Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

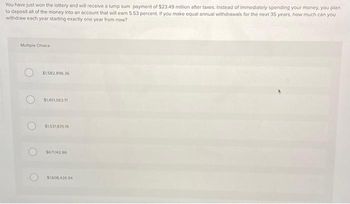

Transcribed Image Text:You have just won the lottery and will receive a lump sum payment of $23.49 million after taxes. Instead of immediately spending your money, you plan

to deposit all of the money into an account that will earn 5.53 percent. If you make equal annual withdrawals for the next 35 years, how much can you

withdraw each year starting exactly one year from now?

Multiple Choice

$1.582.896.36

$1,451,563.71

$1,531,835.19

5671142.86

$1,608.426.94

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You want to retire with $400 000 in the bank and you are able to earn 6% compounded quarterly for the next 25 years. How much money do you have to invest today in order to achieve your goal? Select one: a. $90 251.77 b. $90 201.77 c. $90 001.78 d. $90 251.78 e. $90 001.77arrow_forwardTime to accumulate a given sum Personal Finance Problem Manuel Rios wishes to determine how long it will take an initial deposit of $7,000 to double. a. If Manuel earns 8% annual interest on the deposit, how long will it take for him to double his money? b. How long will it take if he earns only 5% annual interest? c. How long will it take if he can earn 10% annual interest? d. Reviewing your findings in parts a, b, and c, indicate what relationship exists between the interest rate and the amount of time it will take Manuel to double his money. a. If Manuel earns 8% annual interest, the amount of time to double his money is years. (Round to two decimal places.) Carrow_forwardYou plan to invest $5,000 into an account. If you would like to have $10,000 in 15 years, what rate of return must you earn? Question 5 options: 6.02% 5.24% 4.73% 7.55% 7.11%arrow_forward

- Suppose you have $1,000,000 in savings account when you retire. Your plan is to withdraw $6,000 a month as retirement income from this account. You expect to earn annual interest of 5%, compounded monthly, on your money during your retirement. How many months can you be retired until you run out of money? A-210.83 B-262.59 C-220.27 D-285.14arrow_forwardYou would like to give your son $70,000 towards his college education 12 years from now. How much money must you set aside today for this purpose if you can earn 8% on your investments? B. $176.271.91 C. $27.797.96 A. $12.250.00 interest rate, you will triple your money in ately D. $3,688.65 E. $14.211.11arrow_forwardSuppose you invest $25 per week into an account that earns 2% compounded weekly. You make the deposits at the beginning of each week. If you continue to make these deposits for 40 years, how much will you save? Group of answer choices $73,443.56 $79,668.54 $53,040.00 $79,637.91arrow_forward

- YOU ARE SAVING FOR A NEW HOUSE AND YOU PUT $1,000 PER YEAR IN AN ACCOUNT PAYING 25% COMPOUNDED ANNUALLY. THE FIRST PAYMENT IS MADE TODAY. HOW MUCH WILL YOU HAVE AT THE END OF 3 YEARS? Select one: a. 4761.625 b. 4766.625 c. 3025 d. 4765.63arrow_forwardYour bank is offering to finance your new car purchase for 7 years at 14.95%. If you were to borrow $27,000 for the car, what would your payment be? $489 $520 $425 $460 $469arrow_forwardYou have $81,455,75 in a brokerage account, plan to deposit on additional $21,000 and you Dat the end of each future your year until account reaches $500,000, You expect to earn. D9% annually on the account. How long will it take to reach your goal? ΑΑΑΑΑΑΑΑΑΑΑΔΔΑΔ ΔΔΔΔ Δ Δ ΔΔΔΔΔΔΔΔΑ You just received an inheritance worth $200,000. You want to retive in 30 years and you don't plan to make any additional contributions. If you feed $1,000,000 in order to retire, what interest rate must you earn in order to reach your goal? $300 at the end of each of the An investment will раз next 3 years, $150 at the end of Year 4, $500 at the end of Year 5, $100 at the end of Year 6, and 1. require a $400 payment at the end of Year 7. If other investment of equal risk earn 7% annually, what is the present value of the cash flow stream 1 Using the same information from question 5, what is the future value of the cash flow stream?arrow_forward

- Calculate the present value of a retirement fund if you put $1,750 in your savings account at the end of each of each quarter for the next 35 years? Assume that your savings account pays 8% compounded quarterly. O $20,277.13 O$82,030.04 O $83,670.64 O None of the answers are correctarrow_forwardTo pay for your education, you've taken out $24 comma 00024,000 in student loans. If you make monthly payments over 1212 years at 66 percent compounded monthly, how much are your monthly student loan payments? Question content area bottom Part 1 Your monthly student loan payments are $enter your response here. (Round to the nearest cent.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education