Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

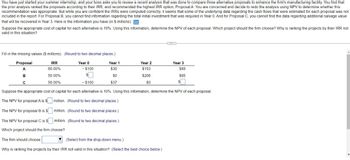

Transcribed Image Text:You have just started your summer internship, and your boss asks you to review a recent analysis that was done to compare three alternative proposals to enhance the firm's manufacturing facility. You find that

the prior analysis ranked the proposals according to their IRR, and recommended the highest IRR option, Proposal A. You are concerned and decide to redo the analysis using NPV to determine whether this

recommendation was appropriate. But while you are confident the IRRS were computed correctly, it seems that some of the underlying data regarding the cash flows that were estimated for each proposal was not

included in the report. For Proposal B, you cannot find information regarding the total initial investment that was required in Year 0. And for Proposal C, you cannot find the data regarding additional salvage value

that will be recovered in Year 3. Here is the information you have (in $ millions): -

Suppose the appropriate cost of capital for each alternative is 10%. Using this information, determine the NPV of each proposal. Which project should the firm choose? Why is ranking the projects by their IRR not

valid in this situation?

Fill in the missing values ($ millions). (Round to two decimal places.)

Proposal

A

IRR

60.00%

Year 0

Year 1

Year 2

Year 3

B

55.00%

-$100

S

$30

$153

$88

$206

с

50.00%

-$100

$37

$0

$95

$

Suppose the appropriate cost of capital for each alternative is 10%. Using this information, determine the NPV of each proposal.

The NPV for proposal A is $ million. (Round to two decimal places.)

The NPV for proposal B is $☐ million. (Round to two decimal places.)

The NPV for proposal C is $ million. (Round to two decimal places.)

Which project should the firm choose?

The firm should choose

(Select from the drop-down menu.)

Why is ranking the projects by their IRR not valid in this situation? (Select the best choice below.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Accountants are counted on to provide management with analyzing data to determine best and worst-case scenarios. As future planning becomes more complex, these what-if analyses can increase in complexity and usefulness. Identify and discuss at least three types of what-if analyses that an accountant should be able to perform to measure a firm’s performance over a periodarrow_forwardBrightenUp Corp. uses a set of quantitative tools to assess employee data such as performance, compensation, designations, and benefits. This is done to arrive at decisions based on accurate findings from analyses that can help the firm achieve its goals. BrightenUp is engaging in the practice of\\n\\nQuestion 1 options:\\n\\ntraining and development.\\n\\njob design.\\n\\nemployee relations.\\n\\ntalent management.\\n\\nworkforce analytics.arrow_forwardOur prior cases have focused in on our client companies ability to cost their own products. Each of the cases mentioned in passing the pricing/costing of the competition. The Tork case dives deeper into the analysis of our client’s competition. As you may have gleaned from the Competition Analysis articles assigned for this module, costing out competitor’s products is done on a regular basis. This process leads to possible opportunities for companies to make strategic and tactical managerial decisions. In the fourth paragraph of the Tork case, we see the strategic dilemma Lerner faces. The case forces you to look deeper than the previous cases. You must consider all the variables available and maybe even some that are not. We have focused on overhead in the last cases, but consider ALL of the costs and compare them between the companies. The Competitive Cost Analysis: Cost-Driver Framework does a great job in explaining the what’s, the why’s, and the how’s of a cost analysis. As for…arrow_forward

- Note:- • Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. • Answer completely. • You will get up vote for sure.arrow_forwardYou are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.5 million for this report, and I am not sure their analysis makes sense. Before we spend the $28 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): 1 2 Sales revenue 29.000 29.000 9 29.000 10 29.000 -Cost of goods sold 17.400 17.400 17.400 17.400 = Gross profit 11.600 11.600 11.600 11.600 - General, sales, and administrative expenses 2.240 2.240 2.240 2.240 - Depreciation 2.800 2.800 2.800 2.800 = Net operating income 6.5600 6.5600 6.5600 6.5600 - Income tax = Net income 2.296 4.264 2.296 2.296 2.296 4.264 4.264 4.264 All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the…arrow_forwardYou are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.9 million for this report, and I am not sure their analysis makes sense. Before we spend the $28 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): 2 9 10 Sales revenue 1 27.000 27.000 16.200 16.200 10.800 10.800 2.240 - Cost of goods sold 27.000 16.200 10.800 27.000 16.200 = Gross profit 10.800 - General, sales, and administrative expenses 2.240 2.240 2.240 - Depreciation 2.800 2.800 2.800 2.800 5.7600 = Net operating income 5.7600 5.7600 5.7600 - Income tax 2.016 2.016 2.016 2.016 = Net income 3.744 3.744 3.744 3.744 All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the…arrow_forward

- You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.1 million for this report, and I am not sure their analysis makes sense. Before we spend the $20 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): Sales revenue - Cost of goods sold = Gross profit - General, sales, and administrative expenses - Depreciation = Net operating income Income tax = Net income 1 26.000 15.600 2 26.000 15.600 10.400 10.400 1.600 1.600 2.000 2.000 6.800 2.38 4.420 6.800 2.38 4.420 ... 9 26.000 15.600 10.400 1.600 2.000 6.800 2.38 4.420 10 26.000 15.600 10.400 1.600 2.000 6.800 2.38 4.420 All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the new…arrow_forwardAn engineer prepares a report to evaluate a project using PW and IRR. Just before submitting the report, he spills coffee on it, making the first digit of the 2-digit IRR unreadable. The second digit is a 2. The PW is negative and MARR is 15 percent. He doesn’t have time to redo the analysis. Can you help him figure out the IRR?arrow_forwardA typical control decision would be best characterised as: Select one: O A. Predicting the cost of offering a new course at a university O B. Identifying how many students should be registered to break even C. Determining why the number of students registered was less than anticipated O D. All of the above.arrow_forward

- Adams Corporation evaluates divisional managers based on Return on Investment (ROI) and has provided the operating results of the Northern DIVislon from last year. The Controller has asked you to compute the ROI and Residual Income based on data from last year and If the alvislon adds a new product line. Use the Information Included in the Excel Simulation and the Excel functions described below to complete the task. • Cell Reference: Allows you to refer to data from another cell in the worksheet. From the Excel Simulation below, if in a blank cell, "=G5" was entered, the formula would output the result from cell G5, or 4.00 In this example. • Basic Math functions: Allows you to use the basic math symbols to perform mathematical functions. You can use the following keys: - (plus sign to add), - (minus sign to subtract). * (asterisk sign to multiply), and (forward slash to divide). From the Excel Simulation below, If in a blank cell "=G5-G6" was entered, the formula would add the values…arrow_forwardYou are a manager at Percolated Fiber, which is considering expanding its operations in synthetic fiber manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.0 million for this report, and I am not sure their analysis makes sense. Before we spend the $25 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): (Click on the following icon in order to copy its contents into a spreadsheet.) Project Year Sales revenue - Cost of goods sold = Gross profit - General, sales, and administrative expenses - Depreciation = Net operating income 1 30.000 18.000 12.000 2.000 2.500 7.500 2 30.000 18.000 12.000 2.000 2.500 7.500 9 30.000 18.000 12.000 2.000 2.500 7.500 10 30.000 18.000 12.000 2.000 2.500 7.500 a. Given the available information, what are the free cash flows in years 0 through 10 that should be…arrow_forward1. Which of the following is an example of qualitative factors that can effect investment decisions? Select one: a. All of the choices b. Over time, how will the quality of goods produced impact the company financially? c. How will any changes affect worker productivity? Will they have any impact on employee morale? d. How will the proposed acquisition or upgrade affect the company’s flexibility?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education