Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

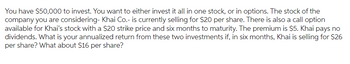

Transcribed Image Text:You have $50,000 to invest. You want to either invest it all in one stock, or in options. The stock of the

company you are considering- Khai Co.- is currently selling for $20 per share. There is also a call option

available for Khai's stock with a $20 strike price and six months to maturity. The premium is $5. Khai pays no

dividends. What is your annualized return from these two investments if, in six months, Khai is selling for $26

per share? What about $16 per share?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You think that there is an arbitrage opportunity on the market. The current stock price of Wesley corp. is $20 per share. A one- year put option on Wesley corp. with a strike price of $18 sells for $3.33, while the identical call sells for $7. The one-year risk- free interest rate is 8%. Assuming that the put option is fairly priced, compute the fair price of the call option and explain what you must do to exploit this arbitrage opportunity and what will be your gain.arrow_forwardRebecca is interested in purchasing a European call on a hot new stock, Up, Inc. The call has a strike price of $98.00 and expires in 95 days. The current price of Up stock is $115.36, and the stock has a standard deviation of 37% per year. The risk-free interest rate is 6.29% per year. Up stock pays no dividends. Use a 365-day year. a. Using the Black-Scholes formula, compute the price of the call. b. Use put-call parity to compute the price of the put with the same strike and expiration date. (Note: Make sure to round all intermediate calculations to at least five decimal places.)arrow_forwardYou are bullish on Telecom stock. The current market price is $110 per share, and you have $22,000 of your own to invest. You borrow an additional $22,000 from your broker at an interest rate of 6.6% per year and invest $44,000 in the stock. a. What will be your rate of return if the price of Telecom stock goes up by 8% during the next year? (Ignore the expected dividend.) (Round your answer to 2 decimal places.) b. How far does the price of Telecom stock have to fall for you to get a margin call if the maintenance margin is 30%? Assume the price fall happens immediate ly. (Round your answer to 2 decimal places.)arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardSuppose you have $28,000 to invest. You're considering Miller-Moore Equine Enterprises (MMEE), which is currently selling for $40 per share. You notice that a put option with a $40 strike is available with a premium of $2.80. Calculate your percentage return on the put option for the six-month holding period if the stock price declines to $36 per share. (Do not round intermediate calculations. Enter your 6-month return as a percent rounded to 2 decimal places. Omit the "%" sign in your response.) Percentage return %arrow_forwardYou think that the stock of Fleetwood Corp is likely to rise within the next six months from its current price ($19.00 bid and $20.00 ask), and you want to maximize the amount of profit from your investment. So, you will use a margin account to borrow on margin in order to buy as many shares as you can. Your initial margin requirement is 45%, and you have $90,000 of your own money to invest in the shares. The minimum (maintenance) margin is 30%, and Fleetwood does not pay dividends. (Ignore interest for this problem.) If you buy Fleetwood on margin with the maximum margin loan, what is the maximum number of shares you can buy? Suppose you bought the maximum number of shares of Fleetwood as in (1). Assume that immediately after your purchase, Fleetwood’s share price drops to $18.00 per share. Calculate your new margin. Will you receive a margin call? How far can the price drop before you will receive a margin call? If the stock price falls to $14.00, you calculate that you would…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education