Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Raghubhai

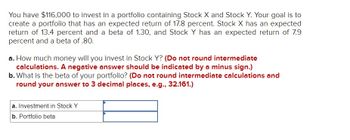

Transcribed Image Text:You have $116,000 to invest in a portfolio containing Stock X and Stock Y. Your goal is to

create a portfolio that has an expected return of 17.8 percent. Stock X has an expected

return of 13.4 percent and a beta of 1.30, and Stock Y has an expected return of 7.9

percent and a beta of .80.

a. How much money will you invest in Stock Y? (Do not round intermediate

calculations. A negative answer should be indicated by a minus sign.)

b. What is the beta of your portfolio? (Do not round intermediate calculations and

round your answer to 3 decimal places, e.g., 32.161.)

a. Investment in Stock Y

b. Portfolio beta

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You have $122,000 to invest in a portfolio containing Stock X and Stock Y. Your goal is to create a portfolio that has an expected return of 17.6 percent. Stock X has an expected return of 14.0 percent and a beta of 1.26, and Stock Y has an expected return of 9.5 percent and a beta of 1.00. a. How much money will you invest in Stock Y? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. What is the beta of your portfolio?arrow_forwardYou have $18,000 to invest in a stock portfolio. Your choices are Stock X with an expected return of 14 percent and Stock Y with an expected return of 11 percent. Assume your goal is to create a portfolio with an expected return of 12.45 percent. How much money will you invest in Stock X and Stock Y? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.arrow_forwardYou have $19,000 to invest in a stock portfolio. Your choices are Stock X with an expected return of 15 percent and Stock Y with an expected return of 10 percent. Assume your goal is to create a portfolio with an expected return of 13.15 percent. How much money will you invest in Stock X and Stock Y? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Investment in Stock X Investment in Stock Yarrow_forward

- You have $10,000 to invest in a stock portfolio. Your choices are Stock X with an expected return of 12.4 percent and Stock Y with an expected return of 10.1 percent. If your goal is to create a portfolio with an expected return of 10.85 percent, how much money will you invest in Stock X and Stock Y? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Stock X Stock Yarrow_forwardYou have $19,256 to invest in a stock portfolio. Your choices are Stock X with an expected return of 13.08 percent and Stock Y with an expected return of 10.37 percent. If your goal is to create a portfolio with an expected return of 12.06 percent, how much money (in $) will you invest in Stock X? Answer to two decimals, carry intermediate calcs. to four decimals.arrow_forwardYou have $261,000 to invest in a stock portfolio. Your choices are Stock H, with an expected return of 14.1 percent, and Stock L, with an expected return of 11.2 percent. If your goal is to create a portfolio with an expected return of 12.55 percent, how much money will you invest in Stock H and in Stock L? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Investment in Stock H Investment in Stock Larrow_forward

- You have $24,000 to invest in a stock portfolio. Your choices are Stock X with an expected return of 13 percent and Stock Y with an expected return of 12 percent. If your goal is to create a portfolio with an expected return of 12.65 percent, how much money will you invest in Stock X and Stock Y? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.)arrow_forwardYou have $21,600 to invest in a stock portfolio. Your choices are Stock X with an expected return of 14.3 percent and Stock Y with an expected return of 8.1 percent. Your goal is to create a portfolio with an expected return of 12.5 percent. All money must be invested. How much will you invest in Stock X? O $15,800 O $18,273 O $14,600 O $15,329 A Moving to another question will save this response. Question 6 of 30> >arrow_forwardYou want to create a portfolio equally as risky as the market, and you have $500,000 to invest. Information about the possible investments is given below: Asset Investment Beta Stock A $ 147,000 .92 Stock B $ 133,000 1.37 Stock C 1.52 Risk - free asset How much will you invest in Stock C? How much will you invest in the risk - free asset? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.arrow_forward

- You own a portfolio that has $3,00o0 invested in Stock A and $4,100 invested in Stock B. Assume the expected returns on these stocks are 10 percent and 16 percent, respectively. What is the expected return on the portfolio? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Expected return %arrow_forwardYou have $37,000 to invest in a stock portfolio. Your choices are Stock X with an expected return of 14.7 percent and Stock Y with an expected return of 7.1 percent. Your goal is to create a portfolio with an expected return of 13 percent. All money must be invested. How much will you invest in Stock X? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardYou want your portfolio beta to be 1.30. Currently, your portfolio consists of $100 invested in stock A with a beta of 1.4 and $300 in stock B with a beta of .6. You have another $400 to invest and want to divide it between an asset with a beta of 1.8 and a risk-free asset. How much should you invest in the risk-free asset?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning