Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

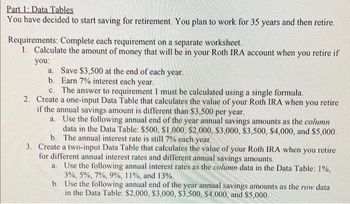

Transcribed Image Text:Part 1: Data Tables

You have decided to start saving for retirement. You plan to work for 35 years and then retire.

Requirements: Complete each requirement on a separate worksheet.

1. Calculate the amount of money that will be in your Roth IRA account when you retire if

you:

a. Save $3,500 at the end of each year.

b.

Earn 7% interest each year.

c. The answer to requirement I must be calculated using a single formula.

2. Create a one-input Data Table that calculates the value of your Roth IRA when you retire

if the annual savings amount is different than $3,500 per year.

a. Use the following annual end of the year annual savings amounts as the column

data in the Data Table: $500, $1,000, $2,000, $3,000, $3,500, $4,000, and $5,000.

b. The annual interest rate is still 7% each year.

3. Create a two-input Data Table that calculates the value of your Roth IRA when you retire

for different annual interest rates and different annual savings amounts.

a. Use the following annual interest rates as the column data in the Data Table: 1%,

3%, 5%, 7%, 9%, 11%, and 13%.

b. Use the following annual end of the year annual savings amounts as the row data

in the Data Table: $2,000, $3,000, $3,500, $4,000, and $5,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Explain the concept of retirement planning

VIEW Step 2: 1. Calculate the amount of money in the IRA when the investor retires.

VIEW Step 3: 2. Create a one-input data table to calculate the future amount at different levels of savings.

VIEW Step 4: 3. Create a 2-input data table to calculate amount at different levels of savings & interest rates.

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- I just need help with part D.arrow_forwardI am not understanding how to use excel to get the answer to this. Please show excel work. Answer should be: $2,704,814arrow_forwardYuli plans to purchase a vehicle, and she is working with two bank offers. . Bank One Loan Offer: $73,800, 6% annual interest, 60 months. . Bank Two Loan Offer: $73,800, 3% annual interest, 84 months. Yuli's ultimate financial goal is to select the loan with the lowest monthly payment regardless of duration. Based on her financial goal, which loan will Yuli choose? O A. Bank One: Loan Offer O B. Bank Two: Loan Offer OC. Both monthly payments are the same. O D. Not enough information given to answer the question.arrow_forward

- Create an Amortization schedule-see amortization video. How much student debt will I bear by the time I graduate? What will my student loan payments be? a. My undergraduate student debt is $32,500. I have secured a 4.08% annual rate (EAR) for a 25-year loan, identify the monthly payment. b. What is the total amount of interest paid on this loan? c. In total (interest plus principle) how much did you pay for this $32,500 loan?arrow_forwardplease answer in the chart formarrow_forwardYou are considering a retirement savings. For this you will need to determine following information. Average starting salary of you major. $73,000 Your annual retirement savings amount. 8% of annual income Your age when you start working. 23 years old Your age when you plan to retire. 58 Retirement account investment vehicle. This will determine the growth rate. ? idk what this is... When I retire I want to open a ice cream shop (this might help answer the question) Create an excel table with your age column, annual contribution, annual account balance. Re-do the calculation with monthly contribution and find your account balance at your retirement. Submit excel table with all your information.arrow_forward

- Shenli would like to plan for retirement. With the help of a financial planner, she estimates that she will need $2,300,000 when she retires 40 years from now. Assume her investments produce returns of 10% per year. How much would Shenli need to save each year if she makes equal end of year deposits for the next 40 years that she works? Click here to access the TVM Factor Table calculator. Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is ±5.arrow_forwardA student wants to save for her retirement. At the end of every year, she deposits 475 in a brokerage account with an expected annual return of 4.3%. How much money will she have in the account in 30 years? Enter your answer as a number with 2 places of precision (i.e. 1.23). Do not include dollar signs or commas.arrow_forwardDeciding between traditional and Roth IRAs. Elijah James is in his early 30s and is thinking about opening an IRA. He can’t decide whether to open a traditional/deductible IRA or a Roth IRA, so he turns to you for help. To support your explanation, you decide to run some comparative numbers on the two types of accounts; for starters, use a 25-year period to show Elijah what contributions of $5,500 per year will amount to (after 25 years) if he can earn, say, 10 percent on his money. Will the type of account he opens have any impact on this amount? Explain. Assuming that Elijah is in the 22 percent tax bracket (and will remain there for the next 25 years), determine the annual and total (over 25 years) tax savings he’ll enjoy from the $5,500-a-year contributions to his IRA. Contrast the (annual and total) tax savings he’d generate from a traditional IRA with those from a Roth IRA. Now, fast-forward 25 years. Given the size of Elijah’s account in 25 years (as computed in part a),…arrow_forward

- You decide to create a savings account for your children's college education, putting $140 permonth into an account paying 6.1% compounded monthly. What will be the value of theaccount in eighteen years? (Please help by using calculator)arrow_forwardshow all excel formulas/ work answering the following: Saving For Retirement You are offered the opportunity to put some money away for retirement. You will receive five annual payments of $25,000 each beginning in 40 years. How much would you be willing to invest today if you desire an interest rate of 12%?arrow_forwardSusan would like to buy a car. She went to the bank and got a loan for $40,000 at the annual interest rate of 4%, for 4 years. Calculate the monthly payment. Calculate the interest on the payment. Calculate the total payment. Make complete amortization schedule on excelarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education