FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

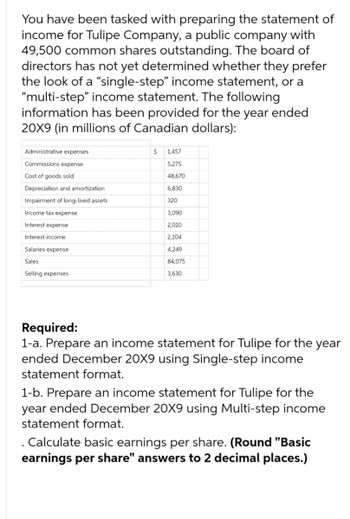

Transcribed Image Text:You have been tasked with preparing the statement of

income for Tulipe Company, a public company with

49,500 common shares outstanding. The board of

directors has not yet determined whether they prefer

the look of a "single-step" income statement, or a

"multi-step" income statement. The following

information has been provided for the year ended

20X9 (in millions of Canadian dollars):

Administrative expenses

Commissions expense

Cost of goods sold

Depreciation and amortization

Impairment of long-lived assets

Income tax expense

Interest expense

Interest income

Salaries expense

Sales

Selling expenses

$

1,457

5,275

48,670

6,830

320

3,090

2,010

2,104

4,249

84,075

3,630

Required:

1-a. Prepare an income statement for Tulipe for the year

ended December 20X9 using Single-step income

statement format.

1-b. Prepare an income statement for Tulipe for the

year ended December 20X9 using Multi-step income

statement format.

. Calculate basic earnings per share. (Round "Basic

earnings per share" answers to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Selected accounts from the year-to-date financial statements for Nowak Company and its wholly owned subsidiary, Shawinigan Ltd., were as follows: Cash Inventory Deferred income tax asset Sales Cost of sales Income tax expense Additional Information . Nowak Shawinigan $ 570 $ 750 210 • The above statements include the only intercompany transaction this year which was a cash sale of $600 by Nowak to Shawinigan at its regular margin of 30% of sales and accrued income tax at its tax rate of 40%. Cash Inventory Deferred income tax asset 9,100 6,370 910 Sales Cost of sales Income tax expense Today, Shawinigan sold $400 of the inventory it had purchased from Nowak to an arm's length party at its regular markup of 30% over cost and accrued income tax at its tax rate of 40%. 180 1,740 90 5,200 4,000 450 Required: Determine the account balance for each account on the three financial statements after the new transaction is recorded. (Input all amounts as positive values. Omit $ sign in your…arrow_forwardMcCorey Corporation recorded the following events last year: Repurchase by the company of its own common stock Sale of long-term investment Interest paid to lenders Dividends paid to the company's shareholders Collection by McCorey of a loan made to another company Payment of taxes to governmental bodies On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities. Based solely on the information above, the net cash provided by (used in) financing activities on the statement of cash flows would be: Multiple Choice O $(156,000) $(83,000) $ 27,000 $ 46,000 $ 8,500 $ 56,000 $ 32,000 $ 18,500 $91,500 $188,000arrow_forwardThe year-end balance sheet of Star Inc. shows total assets of $12,407 million, operating assets of $9,849 million, operating liabilities of $5,291 million, and shareholders’ equity of $5,532 million.The company's year-end net operating assets are: Select one: a. $9,849 million b. $17,698 million c. $15,140 million d. None of these are correct. e. $4,558 millionarrow_forward

- Bostian, Inc. has total assets of $510,000. Its total debt outstanding is $185,000. The Board of Directors has directed the CFO to move towards a debt-to-assets ratio of 55%. How much debt must the company add or subtract to achieve the target debt ratio? Select the correct answer. a. $95,450 b. $95,550 c. $95,601 d. $95,500 e. $95,651arrow_forwarded The Alberta Mining and Export Corporation (AMEC) has operations at several locations throughout the province of Alberta in Western Canada. AMEC reports under IFRS as a publicly traded company. AMEC reported the following financial results (all pre-tax amounts) for the years 20X6 through 20X9: Alberta Mining and Export Corporation: Statement of Profit and Loss (summarized) Revenues Expenses other than depreciation Depreciation expense (straight-line) Pre-tax accounting income 20X6 $118,000 (81,600) (10,400) 20X7 $132,000 (93,600) (10,400) 20X8 $152,000 (96,600) (10,400) 20X9 $172,000 (129,600) $ 26,000 $ 28,000 $ 45,000 (10,400) $ 32,000 Alberta Mining and Export Corporation: Statement of Financial Position (partial) Machine (four-year life, no residual value), at cost Less: Accumulated depreciation AMEC has a tax rate of 40% for each of the relevant years. AMEC claimed the following amounts as CCA on its income tax filings: • 20X6: $17,600 • 20X7: $13,600 20X6 20X7 20X8 $ 41,600 $…arrow_forwardThe year-end balance sheet of Star Inc. shows total assets of $6,617 million, operating assets of $5,253 million, operating liabilities of $2,822 million, and shareholders' equity of $2,950 million.The company's year-end net operating assets are: $9,39 million $5,253 million $2,431 million $8,075 million None of these are correct.arrow_forward

- fill in germano company and gable industriesarrow_forwardOne item is omitted in each of the following summaries of balance sheet and income statement data for four different corporations, AL, CO, KS, and MT. Enter the missing amounts. Beginning of the year: Assets Liabilities End of the year: Assets Liabilities During the year: Additional issue of capital stock Dividends Revenue Expenses AL $308,100 184,900 382,000 166,400 21,600 101,700 55,500 CO $354,300 184,200 496,000 155,900 70,900 21,300 92,100 KS $144,800 115,800 159,300 115,800 14,500 168,000 178,100 MT 169,200 349,600 191,700 56,400 82,700 157,900 180,400arrow_forwardProvide correct answer for this questionarrow_forward

- Income from Continuing Operationsarrow_forwardArizona Corp. had the following account balances at 12/1/19: Receivables: $96,000; Inventory: $240,000; Land: $720,000; Building: $600,000; Liabilities: $480,000; Common stock: $120,000; Additional paid-in capital: $120,000; Retained earnings, 12/1/19: $840,000; Revenues: $360,000; and Expenses: $264,000. Several of Arizona's accounts have fair values that differ from book value. The fair values are: Land — $480,000; Building — $720,000; Inventory — $336,000; and Liabilities — $396,000. Inglewood Inc. acquired all of the outstanding common shares of Arizona by issuing 20,000 shares of common stock having a $6 par value, but a $66 fair value. Stock issuance costs amounted to $12,000. Imagine you are the decision maker at Inglewood Inc. Prepare a fair value allocation and goodwill schedule at the date of the acquisition. Determine in 525- words whether you would encourage acquiring Arizona Corp? Be sure to include your rationaarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education