FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

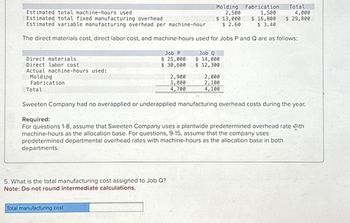

Transcribed Image Text:Direct materials

Direct labor cost

Actual machine-hours used:

Molding

Fabrication

Total

Estimated total machine-hours used

Estimated total fixed manufacturing overhead

Estimated variable manufacturing overhead per machine-hour

The direct materials cost, direct labor cost, and machine-hours used for Jobs P and Q are as follows:

Job P

$ 25,000

$ 30,600

Molding

2,500

$ 13,000

$ 2.60

2,900

1,800

4,700

5. What is the total manufacturing cost assigned to Job Q?

Note: Do not round intermediate calculations.

Total manufacturing cost

Job Q

$ 14,000

$ 12,300

Fabrication

1,500

$ 16,800

$ 3.40

2,000

2,100

4,100

Total

Sweeten Company had no overapplied or underapplied manufacturing overhead costs during the year.

4,000

$ 29,800

Required:

For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with

machine-hours as the allocation base. For questions, 9-15, assume that the company uses

predetermined departmental overhead rates with machine-hours as the allocation base in both

departments.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Computing Total Job Costs and Unit Product Costs Using a Plantwide Predetermined Overhead Rate Mickley Company’s plantwide predetermined overhead rate is $14.00 per direct labor-hour and its direct labor wage rate is $ 17.00 per hour. The following information pertains to Job A-500: Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 40 units, what is the unit product cost for this job?arrow_forwardPlease help mearrow_forwardnkj.1arrow_forward

- Milburn Motors received a P 75 telephone bill that is due next month. Which of the following reflects the proper journal entry for this transaction? A. Debit Telephone Expense P 75; credit Accounts Receivable P 75 B. Debit Accounts Payable P 75; credit Telephone Expense P 75 C. Debit Accounts Payable P 75; credit Cash P 75 D. Debit Telephone Expense P 75; credit Accounts Payable P 75arrow_forwardPredetermined Factory Overhead Rate Turbo Shop uses job order costing to determine the cost of performing engine repair work. Estimated costs and expenses for the coming period are as follows: Engine parts $400,000 Shop direct labor 1,992,000 Shop and repair equipment depreciation 64,220 Shop supervisor salaries 210,000 Shop property taxes 57,390 Shop supplies 14,500 32,000 230,000 12,000 $3,012,110 Advertising expense Administrative office salaries Administrative office depreciation expense Total costs and expenses The average shop direct labor rate is $40.00 per hour. Determine the predetermined shop overhead rate per direct labor hour. Round the answer to nearest whole cent.arrow_forwardCost of Units Completed and in Process The charges to Work in Process-Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department Bal., 6,400 units, 40% completed Direct materials, 116,000 units @ $6.25 45,760 To Finished Goods, 119,400 units 725,000 145,160 90,020 Direct labor Factory overhead Bal. 2 units, 25% completed a. Based on the above data, determine the different costs listed below. 1. Cost of beginning work in process inventory completed this period. 2. Cost of units transferred to finished goods during the period. 3. Cost of ending work in process inventory. 4. Cost per unit of the completed beginning work in process inventory, rounded to the nearest cent. b. Did the production costs change from the preceding period? 0000 ? c. Assuming that the direct materials cost per unit did not change from the preceding period, did the…arrow_forward

- Fickel Company has two manufacturing departments-Assembly and Testing & Packaging. The predetermined overhead rates in Assembly and Testing & Packaging are $22.00 per direct labor-hour and $18.00 per direct labor-hour, respectively. The company's direct labor wage rate is $24.00 per hour. The following information pertains to Job N-60: Direct materials Direct labor Assembly $ 390 $ 228 1. Total manufacturing cost 2. Unit product cost Testing & Packaging Required: 1. What is the total manufacturing cost assigned to Job N-60? (Do not round intermediate calculations.) 2. If Job N-60 consists of 10 units, what is the unit product cost for this job? (Do not round intermediate calculations. Round your answer to 2 decimal places.) $45 $ 132 Answer is complete but not entirely correct. $ $ 971 X 97.10 X per unitarrow_forwardces Mickley Company's plantwide predetermined overhead rate is $20.00 per direct labor-hour and its direct labor wage rate is $15.00 per hour. The following information pertains to Job A-500: Direct materials Direct labor $ 230 $ 75 Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 40 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.) 1. Total manufacturing cost 2. Unit product cost per unitarrow_forward6arrow_forward

- Use the following information to answer the question. Estimated manufacturing overhead $180,000 Actual manufacturing overhead $240,000 Estimated direct labour hours 15,000 Actual direct labour hours worked 16,000 The predetermined overhead rate for applying manufacturing overhead would be:arrow_forwardHelp mearrow_forwardDirect materials $ 41,000 Direct labor-hours 680 labor-hours Direct labor wage rate $ 13 per labor-hour Machine-hours 370 machine-hours Number of units completed 3,500 units The company applies manufacturing overhead on the basis of machine-hours. The predetermined overhead rate is $12 per machine-hour. Compute the unit product cost that would appear on the job cost sheet for this job.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education