Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

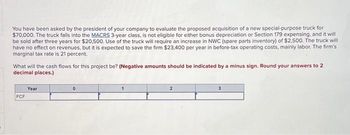

Transcribed Image Text:You have been asked by the president of your company to evaluate the proposed acquisition of a new special-purpose truck for

$70,000. The truck falls into the MACRS 3-year class, is not eligible for either bonus depreciation or Section 179 expensing, and it will

be sold after three years for $20,500. Use of the truck will require an increase in NWC (spare parts inventory) of $2,500. The truck will

have no effect on revenues, but it is expected to save the firm $23,400 per year in before-tax operating costs, mainly labor. The firm's

marginal tax rate is 21 percent.

What will the cash flows for this project be? (Negative amounts should be indicated by a minus sign. Round your answers to 2

decimal places.)

FCF

Year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Dazzle Company purchased a new car for use in its business on January 1, 2020. It paid $28,000 for the car. Dazzle expects the car to have a useful life of four years with an estimated residual value of zero. Dazzle expects to drive the car 10,000 miles during 2020, 15,000 miles during 2021, 30,000 miles in 2022, and 105,000 miles in 2023, for total expected miles of 160,000 Read the requirements: (Complete all input fields. Enter a O for any zero values) Year Start 2020 2021 2022 2023 Units-of-production method Annual Depreciation Accumulated Expense Depreciation Book Valuearrow_forwardYou have been asked by the president of your company to evaluate the proposed acquisition of a new special-purpose truck for $50,000. The truck falls into the MACRS 3-year class, is not eligible for either bonus depreciation or Section 179 expensing, and it will be sold after three years for $20,700. Use of the truck will require an increase in NWC (spare parts inventory) of $2,700. The truck will have no effect on revenues, but it is expected to save the firm $16,700 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 21 percent. What will the cash flows for this project be? (Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places.) FCF Year 0 1 2 3arrow_forwardYou have been asked by the president of your company to evaluate the proposed acquisition of a new special-purpose truck for $60,000. The truck falls into the MACRS 3-year class, is not eligible for either bonus depreciation or Section 179 expensing, and it will be sold after three years for $20,000. Use of the truck will require an increase in NWC (spare parts inventory) of $2,000. The truck will have no effect on revenues, but it is expected to save the firm $20,000 per year in before-tax operating costs, mainly labor. The firm’s marginal tax rate is 21 percent. What will the cash flows for this project be? Note: Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places.arrow_forward

- Buch Corporation purchased Machine Z at the beginning of Year 1 at a cost of $100,000. The machine is used in the production of Product X. The machine is expected to have a useful life of 10 years and no residual value. The straightline method of depreciation is used. Adverse economic conditions develop in Year 3 that result in a significant decline in demand for Product X. At December 31, Year 3, the company develops the following estimates related to Machine Z: Expected future cash flow $75,000 Present value of expected future cash flows $55,000 Selling price $70,000 Costs of disposal $7,000 At the end of Year 5, Buch’s management determines that there has been a substantial improvement in economic conditions resulting in a strengthening of demand for Product X. The following estimates related to Machine Z are developed at December 31, Year 5: Expected future cash flow $70,000 Present value of expected future cash flows $53,000 Selling…arrow_forwardOn January 1, Mitzu Company pays a lump-sum amount of $2,650,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $750,000, with a useful life of 20 years and a $75,000 salvage value. Land Improvements 1 is valued at $360,000 and is expected to last another 12 years with no salvage value. The land is valued at $1,890,000. The company also incurs the following additional costs. Cost to demolish Building 1 Cost of additional land grading Cost to construct Building 3, having a useful life of 25 years and a $402,000 salvage value Cost of new Land Improvements 2, having a 20-year useful life and no salvage value Required: 1. Allocate the costs incurred by Mitzu to the appropriate columns and total each column. Allocation of Purchase Price Land Building 2 Land Improvements 1 Totals Purchase Price Demolition Land grading New building (Construction cost) New improvements Totals Appraised…arrow_forwardYou have been asked by the president of your company to evaluate the proposed acquisition of a new special-purpose truck for $70,000. The truck falls into the MACRS 3-year class, is not eligible for either bonus depreciation or Section 179 expensing, and it will be sold after three years for $19,000. Use of the truck will require an increase in NWC (spare parts inventory) of $1,000. The truck will have no effect on revenues, but it is expected to save the firm $24,000 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 21 percent. What will the cash flows for this project be? Note: Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places. FCF Year 0 2 3arrow_forward

- You have been asked by the president of your company to evaluate the proposed acquisition of a new special-purpose truck for $50,000. The truck falls into the MACRS 3-year class, is not eligible for either bonus depreciation or Section 179 expensing, and it will be sold after three years for $19,100. Use of the truck will require an increase in NWC (spare parts inventory) of $1,100. The truck will have no effect on revenues, but it is expected to save the firm $17,200 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 21 percent. What will the cash flows for this project be? (Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places.) Year 1 2 3 FCFarrow_forwardCrane Company purchases an oil tanker depot on January 1, 2020, at a cost of $639,700. Crane expects to operate the depot for 10 years, at which time it is legally required to dismantle the depot and remove the underground storage tanks. It is estimated that it will cost $69,980 to dismantle the depot and remove the tanks at the end of the depot's useful life. (a) Prepare the journal entries to record the depot and the asset retirement obligation for the depot on January 1, 2020. Based on an effective-interest rate of 6%, the present value of the asset retirement obligation on January 1, 2020, is $39,076. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit January 1, 2020 (To record the depot) January 1, 2020 (To record the asset retirement obligation) eTextbook and Mediaarrow_forwardPull Company is considering the disposal of equipment that is no longer needed for operations. The equipment originally cost $600,000, and accumulated depreciation to date totals $460,000. An offer has been received to lease the machine for its remaining useful life for a total of $300,000, after which the equipment will have no salvage value. The repair, insurance, and property tax expenses during the period of the lease are estimated at $75,800. Alternatively, the equipment can be sold through a broker for $230,000 less a 10% commission. Prepare a differential analysis report, dated June 15 of the current year, on whether the equipment should be leased or sold. Pull Company Proposal to Lease or Sell Equipment June 15, 20XX Net revenue from leasing: Revenue from lease Costs associated with the lease X Net revenue from lease X Net revenue from selling: Sales price X Commission expense on sale X Net revenue from selling Net advantage of lease alternative diarrow_forward

- Keating Co. is considering disposing of equipment with a cost of $62,000 and accumulated depreciation of $43,400. Keating Co. can sell the equipment through a broker for $28,000, less a 9% broker commission. Alternatively, Gunner Co. has offered to lease the equipment for five years for a total of $47,000. Keating will incur repair, insurance, and property tax expenses estimated at $12,000 over the five-year period. At lease-end, the equipment is expected to have no residual value. The net differential income from the lease alternative is Oa. $6,664 Ob. $11,424 Oc. $14,280 Ⓒd. $9,520arrow_forward.On January 1, 2020, Dan Company purchased a new machine for P4,000,000. The new machine has an estimated useful life of eight years and a residual value of 10% of the purchase price. Depreciation was computed using the double decline balance method. At the start of 2021, due to obsolescence and physical damage, the machinery is found to be impaired. Dan Company determined the following information with respect to the machinery at year end of 2020. Fair value less cost of disposal P 2,800,000 Value in use 2,650,000 Required: a) Prepare journal entries for the years 2020 and 2021. b) What amount of depreciation expense would be shown in the Income Statement ending December 31, 2021?arrow_forwardOn January 1, the Matthews Band pays $66,600 for sound equipment. The band estimates it will use this equipment for five years and after five years it can sell the equipment for $2,000. Matthews Band uses straight-line depreciation but realizes at the start of the second year that this equipment will last only a total of three years. The salvage value is not changed. Compute the revised depreciation for both the second and third years.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education