FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

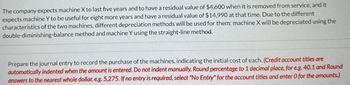

Transcribed Image Text:The company expects machine X to last five years and to have a residual value of $4,600 when it is removed from service, and it

expects machine Y to be useful for eight more years and have a residual value of $14,990 at that time. Due to the different

characteristics of the two machines, different depreciation methods will be used for them: machine X will be depreciated using the

double-diminishing-balance method and machine Y using the straight-line method.

Prepare the journal entry to record the purchase of the machines, indicating the initial cost of each. (Credit account titles are

automatically indented when the amount is entered. Do not indent manually. Round percentage to 1 decimal place, for e.g. 40.1 and Round

answers to the nearest whole dollar, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which method of depreciation, from parts 1-3, would result in the largest net income in the first year for Watkins Production? Explain your reasoning? Which method of depreciation, from part 1-3, would results in the largest net income over the entire 5 years? Explain your reasoning ?arrow_forwardDelaney Company is considering replacing equipment that originally cost $532,000 and has accumulated depreciation of $372,400 to date. A new machine will cost $891,000. what is the the sunk cost in this situation?arrow_forwardI cant compute the math correctly for this. I know you have to determine the double-declining balance rate and then the double-declining depreciation but every answer I input it says its wrongarrow_forward

- I have the answer and question below but I just needf to know how to work it out Solve the problem. Round unit depreciation to nearest cent when making the schedule, and round final results to the nearest cent. A construction company purchased a piece of equipment for $1,710. The expected life is 7,000 hours, after which it will have a salvage value of $280. Find the amount of depreciation for the first year if the piece of equipment was used for 1,600 hours. Use the units-of-production method of depreciation. Answer: ($320)arrow_forwardAn automated assembly robot that cost $352,000 has a depreciable life of 5 years with a $85,000 salvage value. The MACRS (Modified Accelerated Cost Recovery System) depreciation rates for years 1, 2, 3, and 6 are 20.00%, 32.00%, 19.20%, and 5.76%, respectively. What is the book value at the end of year 3? Year 5? Year 6? The book value at the end of year 3 is $ . The book value at the end of year 5 is $ . The book value at the end of year 6 is $ .arrow_forwardThe Darlington Equipment Company purchased a machine 5 years ago at a cost of $85,000. The machine had an expected life of 10 years at the time of purchase, and it is being depreciated by the straight-line method by $8,500 per year. If the machine is not replaced, it can be sold for $5,000 at the end of its useful life. A new machine can be purchased for $170,000, including installation costs. During its 5-year life, it will reduce cash operating expenses by $45,000 per year. Sales are not expected to change. At the end of its useful life, the machine is estimated to be worthless. The new machine is eligible for 100% bonus depreciation at the time of purchase. The old machine can be sold today for $50,000. The firm's tax rate is 25%. The appropriate WACC is 9%. If the new machine is purchased, what is the amount of the initial cash flow at Year 0 after bonus depreciation is considered? Cash outflow should be indicated by a minus sign. Round your answer to the nearest dollar.$…arrow_forward

- An old machine that originally cost $9,500 thus far has accumulated depreciation of$1,900. The remaining useful life is four years, with no salvage value at the end of itsuseful life. A new machine is now available that costs $8,500, with a useful life of fiveyears and no residual value. The old machine could be sold now for $1,400. The annualcash operating costs for the old machine are $5,000, but for the new machine theywould be only $2,500. Gross revenue from the products would be $12,000 annually foreither machine. The company shouldA) keep the old machine to avoid a $6,200 loss on its disposal.B) replace the old machine.C) keep the old machine to avoid an $8,500 decrease in cash.D) keep the old machine to avoid a $1,400 loss on its disposal.arrow_forwardABC company is considering replacing their old manual loading machine with an automatic loading machine. The manual machine cost $300,000 three years ago, and is being depreciated over 10 years straight line depreciation, with no salvage value. If ABC replaces the manual machine, the new automatic machine will cost $400,000 and have a useful life of 10 years. This will also be depreciated on a straight line basis to zero. As a result of this new machine, there will be pretax savings of $130,000 in labour costs and $25,000 in other cash expenses annually. If the automatic machine is purchased, the old machine will immediately be sold at a price of $280,000. The company has already spent $15,000 researching the costs associated with this decision. The company's tax rate is 40% and no inflation is expected. The company's cost of capital is 7%. Calculate the net present value of this decision using a financial calulatorarrow_forwardBramble Corp. is contemplating the replacement of an old machine with a new one. The following information has been gathered: Old Machine New Machine Price $420000 $840000 Accumulated Depreciation 126000 -0- Remaining useful life 10 years -0- Useful life -0- 10 years Annual operating costs $335000 $252000 If the old machine is replaced, it can be sold for $33600. The company uses straight-line depreciation with a zero salvage value for all of its assets.The net advantage (disadvantage) of replacing the old machine is $(8400) $33500 $(84000) $23600arrow_forward

- A machine with a cost of $57,300 has an estimated residual value of $3,956 and an estimated life of 5 years or 20,000 hours. What is the amount of depreciation for the second full year, using the double-declining-balance method?arrow_forwardDaily Enterprises is purchasing a $9.6 million machine. It will cost $46,000 to transport and install the machine. The machine has a depreciable life of five years and will have no salvage value. If Daily uses straight-line depreciation, what are the depreciation expenses associated with this machine? The yearly depreciation expenses are $___________ (Round to the nearest dollar.)arrow_forwardA machine with a cost of $120,000 has an estimated residual value of $15,000 and an estimated life of 5 years or 15,000 hours. It is to be depreciated by the units-of-activity method. What is the amount of depreciation for the second full year, during which the machine was used 5,000 hours?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education