Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:es

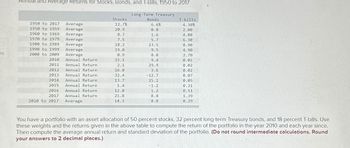

Annual and Average Returns for Stocks, Bonds, and T-Bills, 1950 to 2017

1950 to 2017 Average

1950 to 1959

1960 to 1969

1970 to 1979

Average

Average

Average

Average

1980 to 1989

1990 to 1999

Average

Average

2000 to 2009

Annual Return

Annual Return

2010

2011

2012 Annual Return

2013 Annual Return

2014 Annual Return

2015 Annual Return

2016 Annual Return

2017 Annual Return

2010 to 2017 Average

Stocks

12.7%

20.9

8.7

7.5

18.2

19.0

0.9

15.1

2.1

16.0

32.4

13.7

1.4

12.0

21.8

14.3

Long-Term Treasury

Bonds

6.6%

0.0

1.6

5.7

13.5

9.5

8.0

9.4

29.9

3.6

-12.7

25.1

-1.2

1.2

8.4

8.0

T-bills

4.30%

2.00

4.00

6.30

8.90

4.90

2.70

0.01

0.02

0.02

0.07

0.05

0.21

0.51

1.39

0.29

You have a portfolio with an asset allocation of 50 percent stocks, 32 percent long-term Treasury bonds, and 18 percent T-bills. Use

these weights and the returns given in the above table to compute the return of the portfolio in the year 2010 and each year since.

Then compute the average annual return and standard deviation of the portfolio. (Do not round intermediate calculations. Round

your answers to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are considering an investment in either individual stocks or a portfolio of stocks. The two stocks you are researching, Stock A and Stock B, have the following historical returns: Year rA rB 2014 -20.00% -5.00% 2016 42.00 15.00 2017 20.00 -13.00 2018 -8.00 50.00 2019 25.00 12.00 a. Calculate the average rate of return for each stock during the 5-year period. b. Suppose you had held a portfolio consisting of 50% of Stock A and 50% of Stock B. What would have been the realized rate of return on the portfolio in each year? What would have been the average return on the portfolio during this period? c. Calculate the standard deviation of returns for each stock and for the portfolio. d. Suppose you are a risk-averse investor. Assuming Stocks A and B are your only choices, would you prefer to hold Stock A, Stock B, or the portfolio? Why?arrow_forwardA portrollo consists of assets with the following expected returns: Technology stocks Pharmaceutical stocks Utility stocks Savings account a. What is the expected return on the portfolio if the investor spends an equal amount on each asset? Round your answer to two decimal places. % 26% 16 9 4 b. What is the expected return on the portfolio if the investor puts 53 percent of available funds in technology stocks, 15 percent in pharmaceutical stocks, 14 percent in utility stocks, and 18 percent in the savings account? Round your answer to two decimal places. %arrow_forwardYou are given the following returns on "the market" and Stock F during the last three years. We could calculate beta using data for Years 1 and 2 and then, after Year 3, calculate a new beta for Years 2 and 3. How different are those two betas, i.e., what's the value of beta 2 - beta 1? (Hint: You can find betas using the Rise-Over-Run method, or using your calculator's regression function.) Year Market Stock F 1 6.10% 19.50% 2 12.90% −3.70% 3 16.20% 21.71% A. 10.96 B. 10.91 C. 11.06 D. 11.01 E. 11.11 Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- uppose the average return on Asset A is 7.1 percent and the standard deviation is 8.3 percent, and the average return and standard deviation on Asset B are 4.2 percent and 3.6 percent, respectively. Further assume that the returns are normally distributed. Use the NORMDIST function in Excel® to answer the following questions. a. What is the probability that in any given year, the return on Asset A will be greater than 12 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the probability that in any given year, the return on Asset B will be greater than 12 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-1. In a particular year, the return on Asset A was −4.38 percent. How likely is it that such a low return will recur at some point in the future? (Do not round…arrow_forwardYou own a portfolio that has $2,045 invested in Stock A and $4,096 invested in Stock B. If the expected returns on these stocks are 14 percent and 8 percent, respectively, what is the expected return (in percent) on the portfolio? Answer to two decimals.arrow_forwardYou are constructing a portfolio of two assets, Asset A and Asset B. The expected returns of the assets are 12 percent and 16 percent. respectively. The standard deviations of the assets are 29 percent and 37 percent, respectively. The correlation between the two assets is 41 and the risk-free rate is 3.4 percent. What is the optimal Sharpe ratio in a portfolio of the two assets? What is the smallest expected loss for this portfolio over the coming year with a probability of 2.5 percent? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your Sharpe ratio answer to 4 decimal places and the z-score value to 3 decimal places when calculating your answer. Enter your smallest expected loss as a percent rounded to 2 decimal places.) Sharpe ratio Smallest expected loss %arrow_forward

- Consider the following historical performance data for two different portfolios, the Standard and Poor's 500, and the 90-day T-bill presented below. What is the Fama diversification measure for the Globex Fund? Assume the T-bill rate as the risk- free rate and the S&P return as the market average return. Use at least four decimal places in your calculations, but report your answer in percentage terms rounded to two decimal places. (Ex..12345 should be entered as "12.35") Investment Vehicle Globex Fund World Fund S&P500 90-day T-bill Answer: Average Rate of Return% 25.2 13.92 15.52 7.10 Standard Deviation 21.33 14 12.8 0.3 Beta 1.05 0.95 R² 0.756 0.741arrow_forwardWhat is portfolio A's CAPM beta based on your analysis? Round off your answer to three digits after the decimal points. State your answer as a percentage point as 1.234. Compute the Treynor measure for portfolio B. Round off your answer to three digits after the decimal point. State your answer as 1.234arrow_forwardConsider three investments. You are given thefollowing means, standard deviations, and correlations for the annual return on these three investments.The means are 0.12, 0.15, and 0.20. The standarddeviations are 0.20, 0.30, and 0.40. The correlationbetween stocks 1 and 2 is 0.65, between stocks 1 and3 is 0.75, and between stocks 2 and 3 is 0.41. Youhave $10,000 to invest and can invest no more thanhalf of your money in any single stock. Determine theminimum-variance portfolio that yields a mean annualreturn of at least 0.14arrow_forward

- You own a portfolio that is 25% invested in Stock X, 40% in Stock Y, and 35% in Stock Z. The expected returns on these three stocks are 10%, 13%, and 15%, respectively. What is the expected return on the portfolio? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Expected returnarrow_forwardYou own a portfolio that has $1,600 invested in Stock A and $2,700 invested in Stock B. Assume the expected returns on these stocks are 11 percent and 17 percent, respectively. What is the expected return on the portfolio? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardUSE THE FOLLOWING DATA FOR QUESTIONS 4-6: A portfolio is equally invested in Stock A, Stock B, Stock C, and Treasury Bills (25% each). The expected returns of each of these holdings is 4.8%, 11.2%, 18.6%, and 3.0%, respectively. The Betas for each of the stocks is as follows: A 0.4, B 1.8, and C 2.6. Q6: Based on your answers to questions 4 and 5, assuming an expected return of the market of 8.5%, should you invest in this portfolio from a risk/reward perspective? Multiple Choice O O Yes Noarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education