FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

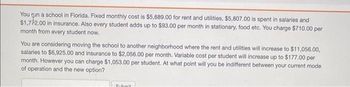

Transcribed Image Text:You run a school in Florida. Fixed monthly cost is $5,689.00 for rent and utilities, $5,807.00 is spent in salaries and

$1,772.00 in insurance. Also every student adds up to $93.00 per month in stationary, food etc. You charge $710.00 per

month from every student now.

You are considering moving the school to another neighborhood where the rent and utilities will increase to $11,056.00,

salaries to $6,925.00 and insurance to $2,056.00 per month. Variable cost per student will increase up to $177.00 per

month. However you can charge $1,053.00 per student. At what point will you be indifferent between your current mode

of operation and the new option?

Submit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You love to go fishing. You are happiest when you are on the water, the sea breeze blowing in your face, as you race to get to your favorite fishing spot before the sun peeks over the horizon. You are interested in purchasing a new fishing boat that costs $35,000. You have found a nearby marina that is offering a special financing rate of 6% APR (0.5% per month) on new boat loans with a tern of 48 months with required monthly payments. Assuming that you do not make a down payment on the boat (meaning you will need to borrow the full purchase price) and you take the marina's special financing deal, then your monthly boat payments would be closest to which of the following? You may assume that your first loan payment will be due one month from the time of purchase. O A. $773. O B. $729. O C. $842. O D. $822. O E. $921. O F. $647. -12 O Time Remaining: 00:27:47 Next etv 11 DD F10 F9 888 F8 F7 F6 F5 F4 F3 esc & # 2$ % 8. @ 7 3 4arrow_forwardYou are considering the purchase of a Condo in downtown Toronto that you hope to operate as an Airbnb. The monthly mortgage expenses will be about $2215. You expect the cleaning cost to vary with the daily occupation, at the rate of $ 41 per day of occupation. Renting the Condo at $299 per night. How many days must your Condo be occupied if you want to make a monthly profit of $ 2221? (Please give your answer to two significant decimal figures)arrow_forwardParents wish to have $160,000 available for a child education. If the child is now eight years old, how much money must be set aside at 7% compounded semi annually to meet their financial goal when the child is 18? The amount that should be set aside is $___ (Round up to the nearest dollar.)arrow_forward

- 1arrow_forwardThe owners of a condominium building wish to save enough money to replace the roof on their building in 10 years. The new roof is projected to cost $55,500. How much must they deposit monthly into an account earning j12-3% in order to have enough money for the new roof? Your Answer:arrow_forwardYou are considering the purchase of new living room furniture that costs $1,140. The store will allow you to make weekly payments of $25.12 for one year to pay off the loan. What is the EAR of this arrangment? Multiple Choice 27.39% 29.41% 32.99% 31.42%arrow_forward

- You want to buy a car. A dealership in town has the SUV you want to buy for $22,510. Your first financing option is to make a down payment of $2500 and finance the rest at 2.99% APR for 72 months. How much will you be financing? $ How much will your monthly payments be under this financing option? (Round to the nearest dollar.) $ How much total money will you pay for the SUV at the end of the 72 months under this financing option? (Don't forget to include your down payment in this total amount.) $arrow_forwardKelly Robins is considering purchasing a usedautomobile. The price including the title and taxes is$15,455. Kelly is able to make a $2,455 down payment. The balance of $13,000 will be borrowed fromher credit union at an interest rate of 9.45% compounded daily. The loan should be paid in 36 equalmonthly payments. Compute the monthly payment.What is the total amount of interest Kelly has to payover the life of the loan?arrow_forwardA high school graduate has to decide between working and going to college. If he works, he will work for the next 50 years of his life. If he goes to college, he will be in college for 5 years, and then work for 45 years. In this model, the rate of discount that equates the lifetime present value of not going to college and going to college is 8.24 percent when the cost of each year of college is $15,000, each year of noncollege work pays $35,000, and each year of postcollege work pays $60,000. For each of the parts below, discuss how the rate of discount that equalizes the two options would change and who would make a different schooling decision based on the change. (Extra credit: Use Excel to show that the rate of return to schooling is 8.24 percent in the above case and solve for the rates of discount associated with each of the parts below.) a. Each year of college still costs $15,000 and each year of postcollege work still pays $60,000, but each year of noncollege work now pays…arrow_forward

- One year ago, the Jenkins Family Fun Center deposited $3,400 into an investment account for the purpose of buying new equipment four years from today. Today, they are adding another $5,200 to this account. They plan on making a final deposit of $7,400 to the account next year. How much will be available when they are ready to buy the equipment, assuming they earn a rate of return of 6 percent? Multiple Choice $18,516.29 $19,019.26 $19,431.85 $19,928.37 $17,421.48arrow_forwardThe Jacksons want to buy a condo in Langley. This will be their first property. Their combined gross annual salary is $108,000. They estimate that the property taxes are $2,400/year, strata fees $200/month and heating costs average $50/month. Banks use the affordability rule: no more than 32% of gross monthly hosehold income can go tawards paying the mortgage, property taxes, heating costs and 50% of the condo fees. What is the maximum monthly mortgage payment they could afford? Your Answer: Answerarrow_forward3. A village has six residents, each of whom has accumulated savings of $100. Each villager can use this money either to buy a government bond that pays 15% per year. Or they can buy a llama, send it onto the commons to graze and then sell it after one year. The price the villager gets for selling the llama depends on quality of fleece it grows. The quality of fleece depends on how many llamas are grazing. At the end of the year the villager will have $115 if they buy the bond or $109-$122 if they buy the llama depending on how many llamas are purchased Number of Llamas 1 2 3 4 5 6 Price per Llama 122 118 116 114 112 109 a. If each villager decides individually how to invest, how many llamas will be sent onto the commons and what will be the net village income? b. What is the socially optimal number of llamas for this village? c. The village committee votes to auction the right to graze the llamas to the highest bidder. How much will the grazing right sell for? What will be the net…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education