Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

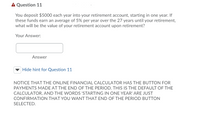

Transcribed Image Text:A Question 11

You deposit $5000 each year into your retirement account, starting in one year. If

these funds earn an average of 5% per year over the 27 years until your retirement,

what will be the value of your retirement account upon retirement?

Your Answer:

Answer

Hide hint for Question 11

NOTICE THAT THE ONLINE FINANCIAL CALCULATOR HAS THE BUTTON FOR

PAYMENTS MADE AT THE END OF THE PERIOD. THIS IS THE DEFAULT OF THE

CALCULATOR, AND THE WORDS 'STARTING IN ONE YEAR' ARE JUST

CONFIRMATION THAT YOU WANT THAT END OF THE PERIOD BUTTON

SELECTED.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume that Social Security promises you $43,000 per year starting when you retire 45 years from today (the first $43,000 will get paid 45 years from now). If your discount rate is 5%, compounded annually, and you plan to live for 17 years after retiring (so that you will receive a total of 18 payments including the first one), what is the value today of Social Security's promise? ... The value today of Social Security's promise is $ the nearest cent.) (Round toarrow_forwardyou want to establish an annuity that will pay $7,500 for the next twenty years (end year) your financial institution will establish such an annuity if you deposit $104,000 today. what is the implied rate that the institution is paying on this annuity?arrow_forwardUse the excel and follow the step Like you did last question and please use excelarrow_forward

- Raghubhaiarrow_forwardYour retirement account has a current balance of $3, 123. What interest rate would need to be earned in order to accumulate a total of $5,000,000 in 24 years by adding $3,123 annually? Is this possible? Why or why not?arrow_forwardYou currently have a balance of $200,000 in your retirement account. You expect to contribute $7,50o to your retirement account at the end of each year for the next 30 years and your employer will match your contributions; thus, the annual end- of-year contributions to your retirement account will be $15,000. If you earn 8% on your retirement account, how much money will you have in your account when you retire in 30 years? You have a 4-year-old daughter and want to have $120,000 in her college fund when she starts college. You expect to earn a 7% return on her college-fund investments. If you want to make 14 equal-sized end-of-year deposits into your daughter's college fund, how much do you need to deposit each year to have $120,000 when she starts college? $ %24 %24arrow_forward

- You have just made your first $5,000 contribution to your retirement account. Assume youearn a return of 10 percent per year and make no additional contributions.a. What will your account be worth when you retire in 45 years?b. What if you wait 10 years before contributing?c. After calculating parts a and b, what is the lesson learned?arrow_forwardif you deposit $190, $250, and $300 in a savings account at the end of the years 2017, 2018, and 2019 respectively how much money will be there in the account at the end of 2019 if you earn an interest of 5.3% per year on your savings?arrow_forwardA rich relative has bequeathed you a growing perpetuity. The first payment will occur in a year and will be $3000 . Each year after that, you will receive a payment on the anniversary of the last payment that is 7% larger than the last payment. This pattern of payments will go on forever. Assume that the interest rate is 9% per year. a. What is today's value of the bequest? b. What is the value of the bequest immediately after the first payment is made?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education