FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

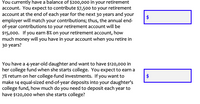

Transcribed Image Text:You currently have a balance of $200,000 in your retirement

account. You expect to contribute $7,50o to your retirement

account at the end of each year for the next 30 years and your

employer will match your contributions; thus, the annual end-

of-year contributions to your retirement account will be

$15,000. If you earn 8% on your retirement account, how

much money will you have in your account when you retire in

30 years?

You have a 4-year-old daughter and want to have $120,000 in

her college fund when she starts college. You expect to earn a

7% return on her college-fund investments. If you want to

make 14 equal-sized end-of-year deposits into your daughter's

college fund, how much do you need to deposit each year to

have $120,000 when she starts college?

$

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- After one year of employment, Hasan has joined his company's pensionplan. He estimates he will retire in 35 years, and will be retired for a total of 25 years. During his retirement, he will need S50, 000 at the beginning of each year. At a discount rate of 4%, compounded quarterly, what should be his savings goal? a. S807, 655b. S963, 258c. S2, 184,431d . S3, 878, 614arrow_forwardJane wants to retire with $2,000,000 in her retirement account exactly 35 years from today. If she thinks she can earn an interest rate of 10. percent compounded monthly, how much must she deposit each month to fund her retirement? $432.83 O $493,32 O $526.78 $582.32arrow_forwardA retiree invests $8,000 in a savings plan that pays 6% per year. What will the account balance be at the end of the first year?arrow_forward

- ANSWER ASAP THE SUBQUESTIONSarrow_forwardYou have just made your first $4,500 contribution to your individual retirement account. Assume you earn an annual return of 11.3 percent and make no additional contributions. What will your account be worth when you retire in 39 years?arrow_forwardYour employer automatically puts 5 percent of your salary into a 401(k) retirement account each year. The account earns 8% interest. Suppose you just got the job, your starting salary is $50000, and you expect to receive a 3% raise each year. For simplicity, assume that interest earned and your raises are given as nominal rates and compound continuously. Find the value of your retirement account after 35 years Value = $arrow_forward

- Your company’s pension plan earns 4.3 % interest per year, compounded quarterly. a) You would like to receive payments of $40,000 quarterly while retired. If you would like these payments paid out over 25 years, what amount of money will you need in your pension fund at the beginning of your retirement years? Give the answer correctly to 2 decimal places, and do not use the $ sign in the answer box. The money you will need at the beginning of your retirement years is Blank 1. Calculate the answer by read surrounding text. dollars. b) Use your answer from part a to help you to determine how much you should put into your pension fund quarterly during your working years to reach your retirement goals. Assume you are planning to work for 30 years. Give the answer correctly to 2 decimal places, and do not use the $ sign in the answer box. The amount you should deposit quarterly during your working years is Blank 2. Calculate the answer by read surrounding text.…arrow_forwardAnnie would like a retirement income of $4,000 per month (beginning of month payments) for 23 years once she retires. How much must she have in her retirement account on the day she retires if the account can earn 4% compounded semi-annually? Your Answer: Answerarrow_forwardWhen you retire at 65, you wish to be able to have $3,000 each month for 25 years. How much would you have to deposit into an account each month, starting when you are 23, if the account earns 7.6% compounded monthly?arrow_forward

- Jeni has decided that she needs to start saving for her retirement. She can afford $100 a month deducted automatically from her paycheck. She deposits it into an account that earns 4.5% interest compounded monthly. How much will she have in her account when she retires 42 years later? A. $ 14,922.70 B.$ 50,400.00 C. $132,213.00 D. $149,226.96arrow_forwardYou have just made your first $4,500 contribution to your individual retirement account. Assume you earn an annual return of 10.85 percent and make no additional contributions. a. What will your account be worth when you retire in 43 years? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. What if you wait 10 years before contributing? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. a. Account value if you start now b. Account value if you wait 10 yearsarrow_forwardCatherine Dohanyos plans to retire in 20 years. She will make 20 years of monthly contributions to her retirement account. One month after her last contribution, she will begin the first of 10 years of withdrawals. She wants to withdraw $2400 per month. How large must her monthly contributions be in order to accomplish her goal if the account earns interest of 7.3% compounded monthly for the duration of her contributions and the 120 months of withdrawals? Question content area bottom Part 1 The amount of her monthly contributions must be Senter your response here. (Round to the nearest cent as needed.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education