Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

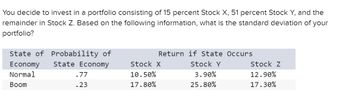

You decide to invest in a portfolio consisting of 15 percent Stock �, 51 percent Stock Y, and the remainder in Stock Z. Based on the following information in the picture, what is the standard deviation of your portfolio? Multiple Choice 8.44% 2.51% 3.35% 7.24% 5.79%

Transcribed Image Text:You decide to invest in a portfolio consisting of 15 percent Stock X, 51 percent Stock Y, and the

remainder in Stock Z. Based on the following information, what is the standard deviation of your

portfolio?

State of Probability of

Economy

Normal

Boom

State Economy

.77

.23

Return if State Occurs

Stock X

Stock Y

Stock Z

10.50%

17.80%

3.90%

25.80%

12.90%

17.30%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- a. Using the data provided in problem 3, determine the return and risk for a portfolio made up of the following three stocks if you want to distribute your investment as follows: 20% in ADRE; 65% in MSFT and 15% in GOOG.b. How would the portfolio be affected if you distributed your investment in the following way: 30% in ADRE; 25% on MSFT and 45% on GOOG?c. Which of the two portfolios would a risk seeking investor prefer and why?arrow_forwardExpected return of a portfolio using beta. The beta of four stocks-P, Q, R, and S-are 0.59, 0.89, 1.05, and 1.31, respectively and the beta of portfolio 1 is 0.96, the beta of portfolio 2 is 0.87, and the beta of portfolio 3 is 1.05. What are the expected returns of each of the four individual assets and the three portfolios if the current SML is plotted with an intercept of 4.5% (risk-free rate) and a market premium of 12.0% (slope of the line)? ..... What is the expected return of stock P? % (Round to two decimal places.)arrow_forwardAa.5arrow_forward

- You own a stock portfolio invested 15 percent in Stock Q, 15 percent in Stock R, 5 percent in Stock S, and 65 percent in Stock T. The betas for these four stocks are 0.43, 0.95, 1.02, and 1.12, respectively. What is the portfolio beta? Multiple Choice 0.99 0.94 0.97 1.04 1.01arrow_forwardYou have a portfolio that is 33 percent invested in Stock R, 17 percent invested in Stock S, with the remainder in Stock T. The expected return on these stocks is 9.4 percent, 10.8 percent, and 13.1 percent, respectively. What is the expected return on the portfolio? Multiple Choice 11.10% 11.29% 11.49% 12.05% 10.18%arrow_forwardYou decide to invest in a portfolio consisting of 25 percent Stock A, 35 percent Stock B, and the remainder in Stock C. Based on the following information, what is the expected return of your portfolio? Probability of State of Economy Return if State Occurs State of Economy Stock A Stock B Stock C 0.4 -12% 4% 1% Bear Normal 0.2 5% 8% 8% Bull 0.4 28% 12% 17% O A. 8.80% O B. 9.16% OC. 7.40% O D.8.17%arrow_forward

- There are three stocks, A, B, and C, with the following expected return, volatility, and correlation data. You are asked to generate a mean-variance portfolio, the expected return of which should be no less than 8%. What’s your optimal allocation (portfolio weights) for those three stocks?arrow_forwardAssume a two-stock portfolio with $50,000 invested in Stock A and $30,000 invested in Stock B. The expected return of Stock A is 12% and the expected return of Stock B is -2%. What's the expected portfolio return? Group of answer choices 7.50% 6.75% 10.0% 6.0%arrow_forwardYour portfolio consists of two stocks: 95 shares of Stock A that sell for $47 per share and 120 shares of Stock B that sell for $25 per share. Required: (a) What is the portfolio weight of Stock A? (Click to select) (b) What is the portfolio weight of Stock B? (Click to select) Varrow_forward

- Donald Gilmore has $100,000 invested in a 2-stock portfolio. $30,000 is invested in Stock X and the remainder is invested in Stock Y. X's beta is 1.50 and Y's beta is 0.70. What is the portfolio's beta? Select the correct answer. a. 0.73 b. 0.80 c. 0.87 d. 1.01 e. 0.94arrow_forwardDonald Gilmore has $100,000 invested in a 2-stock portfolio. $70,000 is invested in Stock X and the remainder is invested in Stock Y. X's beta is 1.50 and Y's beta is 0.70. What is the portfolio's beta? Select the correct answer. a. 1.31 b. 1.36 c. 1.41 d. 1.46 e. 1.26arrow_forwardWhat is the standard deviation of a portfolio formed of shares A and B? Asset (A) E(R₂) = 9% SDA = 4% W₁ = 0.4 Select one: A. 4.99% B. 4.56% C. 3.68% D. 5.16 Asset (B) E(R₂) = 11% SDB = 6% WB = 0.6 COVA, B = 0.0011arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education