Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

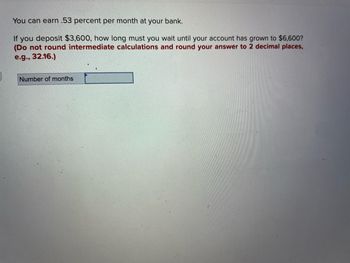

Transcribed Image Text:You can earn .53 percent per month at your bank.

If you deposit $3,600, how long must you wait until your account has grown to $6,600?

(Do not round intermediate calculations and round your answer to 2 decimal places,

e.g., 32.16.)

Number of months

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You want to be able to withdraw $5000 from an account at the end of each year for the next 12 years. How much money should you invest now into an account earning 5.5% interest per year, compounded annually, in order to fund the desired withdrawals? Assume the account is empty after the last withdrawal is made. Give the answer to 2 decimal places, and do not use the $ sign in the answer box. The amount to invest now is Blank 1. Calculate the answer by read surrounding text. dollars.arrow_forwardTen Thousand dollars is deposited into a savings account at 1.8% interest compounded monthly. How many months are required for the balance to reach $10,665.74? After how many months will the balance exceed $11,000? Do not solve by formula ONLY TVM SOLVER. I need to know which numbers to plug into the TVM solver and where.arrow_forwardYou deposit $296 today into a bank account that earns 12% annually. How much will be in your account after 25 years? note: show your answer to the nearest dollar (round to nearest dollar).arrow_forward

- You have a credit card that has a balance of $6400 at an APR of 13.49%. You plan to pay $300 each month in an effort to clear the debt quickly. How many months will it take you to pay off the balance?arrow_forwardIf you earn 5% per year on your bank account, how long will it take an account with $110 to double to $220? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardIf you put $259 into a bank account that pays 3.5% interest, compounded 9 times per year, how much interest will the account pay over 2 years? Round your answer to two decimal places if necessary.arrow_forward

- You are planning to make 18 monthly withdrawals beginning at the end of the sixth month. You plan to withdraw $108 in the sixth month and increase your withdrawals by $15 over the previous month's withdrawal. How much should you deposit now in a bank account that pays 12% per year compounded monthly? Enter the answer with two decimal places. Do not enter the dollararrow_forwardYou have a credit card that has a balance of $8930 at an APR of 16.49%. You plan to pay $400 each month in an effort to clear the debt quickly. How many months will it take you to pay off the balance?arrow_forwardIf you deposit money today in an account that pays 12.5% annual interest, how long will it take to double your money? Round your answer to two decimal places. yearsarrow_forward

- please show me how to enter this into a financial calculator, i cannot use formaulas for these problems.arrow_forwardAnswer the following (up to two decimal points) by showing the working calculation. The rates of the months for 2018 are shown in the table below. There are 28 days in February and assume you withdraw hibah at the end of each month. Any positive or negative increment in the monthly rates shown is based on the basic rate. You open a new wadiah account with a deposit of RM5000 on 28.01.2018. You deposit another RM1000 and RM5500 on 13.02.2018 and 30.03.2018 respectively. Again, you deposit another RM1550 on 31.05.2018. Then, you deposit another RM8500 on 10.06.2018 but withdraw RM5000 on 28.06.2018. On 15.12.2018, you withdraw another RM2000 from the account and then withdraw again another RM3250 on 28.12.2018. What will be your total hibah on 30.12.2018? Table 1: Monthly rates Month Rate (%) Jan 4.00%* Feb +0.00% March +0.10% April -0.10% May +0.10% June +0.20% July -0.10% Aug +0.20% Sept +0.10% Oct +0.20% Nov -0.10% Dec +0.00% * Basic rate 2. Suggest two (2) financial instruments or…arrow_forwardYou deposit $2,400 each year in an account bearing 4.2% annual interest, with the first deposit made upon opening the account. What will your balance be after 11 total deposits, that is, after 10 years? (Round your answer to the nearest cent; no labels please!) $4arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education