Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

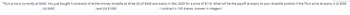

Transcribed Image Text:"TSLA price is currently at $440. You just bought 5 contracts of at-the-money straddle at strike (K) of $440 and expiry in Dec 2020 for a price of $110. What will be the payoff at expiry to your straddle position if the TSLA price at expiry is (i) $200

(ii) $450

and (iii) $1000

. 1 contract is 100 shares. Answer in integers."

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- In January 2023 Apple shares are priced at $200 a share. You believe that they are considerably overvalued and are worth only $120 a share. June 2023 put options on a strike price of $210 a share is currently valued at $18 per share. Each put contract is based on 100 shares. (i) What is the intrinsic value of the put option per share? Explain your reasoning. (ii) What is the time value of the put option per share? (iii) If we arrive at expiry in June and you are proved correct with Apple shares selling for $120, what is your total net dollar profit (+) or loss (-) on a single put option contract in dollars bearing in mind the put option is based on a contract of 100 shares? (iv) What will be the total cash settlement by the option writer if the Apple share price expires at $120 per share in June 2023? (v) What is your net dollar profit (+) or loss (-) as a holder of the put contract (based on a contract size of 100 shares) if we arrive at expiry in June and you are wrong and Apple…arrow_forwardThe stock of Bedrock Solutions is currently trading at $24.50 per share. The 1-month put option with strike price of 13.50 is currently selling for $2.16. What's the intrinsic value of this put option?arrow_forwardMHF believes the price of Amazon is going to fall substantially over the next 8 months. MHF uses an option (use the January 2024 contract with an exercise price of $95) to hedge the risk as it owns 10 million shares of Amazon. It will hedge exactly 50% of its position. Identify the type of option most likely used. Show the total position (please put this in a table) of the spot and derivative at expiration if the price of Amazon at expiration is a) $62; b) $77; c) $93; d) $112; e) $128. Only typed answerarrow_forward

- Google puts with 1 year to expiration and an exercise price of $680 trade for $27. Google calls with 1 year to expiration and an exercise price of $680 trade for $45. The interest rate over 1 year is 1%. Assume all options are European and Google pays no dividends. Using the put-parity condition, the stock price is equal to $691.27. a) In one month, the stock price remains the same as given above. Is the call option value lower, higher, or the same. Explain briefly.arrow_forward1. (7 marks) A stock XYZ is quoted 1015. Two counterparties agree to enter into a forward contract maturing at T = 6 months. Here are the possible values of XYZ, at maturity. XYZ at T=6 months XYZ Forward Long Short 1000 1015 1020 1030 1080 (A) Find the possible values of the payoff for the buyer and for the seller of the forward and sketch a graph of the payoffs. (3.5 marks) (B) We know that spot price at expiration can be duplicated according to Forward + Zero Coupon bond = Spot Price at Maturity. Find the possible values of the zero coupon bond. What can you say about the risk associated with this bond? (3.5 marks)arrow_forward$80. The call premium is $6 and the put premium is $8. To keep thìngs simple, you can assume each contract allows the holder to buy or sell 13) You buy one call contract and also buy one put contract, both with the strike price of one (rather than the typical 100) share of the underlying stock. a. Compute the payoff to your option position if the stock price is $92 when the options expire. b. Compute the profit you made if the stock price is $92 when the options еxpire. c. What would happen to the value of your position if the volatility of returns for the underlying stock increases a day after you bought the call and the put? Please explain your answer for full credit. E FC MacBook Pro I A !!!arrow_forward

- 2. A one year long forward contract on a non-dividend-paying stock is entered into when the stock price is $45 and the risk free rate of interest is 10% per annum with continuous compounding a) What are the forward price and initial value of the forward contract? b) Six month later, the price of the stock is $50 and risk-free interest rate is still 10%. What are the forward price and the value of the forward contract?arrow_forwardConsider a U.S. exchange-traded call option contract to buy 100 shares with a strike price of $37 and maturity in six months. Explain how the terms of the option contract would be revised if the specified change involving the underlying stock were to occur. What would be the revised strike price contract if there were a 5-for 1 stock split? Report your answer rounded to dollars and cents. Answer:arrow_forwardYou buy 1 put contract with a strike price of $60 on a stock which you own 100 shares. What are the expiration total values for this position (100 stock shares plus 1 put contract) for prices of $50 and $60 if the put premium is $1.80?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education