Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

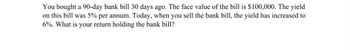

Transcribed Image Text:You bought a 90-day bank bill 30 days ago. The face value of the bill is $100,000. The yield

on this bill was 5% per annum. Today, when you sell the bank bill, the yield has increased to

6%. What is your return holding the bank bill?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose you borrowed $1,000 from the bank and the rate of interest was 5%. What would the simple interest be if the amount is borrowed for 1 year? Suppose you deposit $4,000 at a bank at a simple interest rate of 7.5% per year. How much money will you have in the bank after 10 years? Question 2: The following questions are related to Compounded Interest: You deposit $2000 in an account earning 3% interest compounded monthly. How much will you have in the account in 20 years? How much interest will you earn? How much would you need to deposit in an account now in order to have $6,000 in the account in 8 years? Assume the account earns 6% interest compounded monthly.arrow_forwardSuppose you invest $210,000 in an annuity that returns 6 annual payments, with the first payment one year from now and each subsequent payment growing by 5%. At an interest rate of 8%, how much is the first annual payment you receive? Equivalent problem structure (as a borrower): Suppose you borrow $210,000 to be paid back over 6 years with the first payment one year from now and each subsequent payment growing by 5%. At an interest rate of 8%, how much is the first annual payment? Please round your answer to the nearest hundredth.arrow_forwardYour savings account pays 4% interest on the $40,000 you deposited at time 0. Inflation was 3% for 4 years and then 2% for 6 years. How much is in the account after 10 years in year-10 dollars? How much is that in year-0 dollars? What has been your real rate of return?arrow_forward

- You want to invest $18,000 and are looking for safe investment options. Your bank is offering you a certificate of deposit that pays a nominal rate of 6% that is compounded semiannually. What is the effective rate of return that you will earn from this investment?arrow_forwardYou have the chance to buy a guaranteed promissory note for $850. The note pays $1,000 in 15 months (i.e., exactly 456 days). You have $850 in a bank account that pays a 7% nominal rate compounded daily. Which is a better investment, the note or the bank account? Answer this question using three approaches: (1) compare your future value if you buy the note versus leaving your money in the bank; (2) compare the PV of the note with your current bank balance; and (3) compare the effective rate or return on the note with that of the bank account.arrow_forwardAt the end of each of the next 8 years, you planto put $25,000 of your annual salary in thebank. If the annual interest rate is 3%, what isthe present value of this planned savingsstream? What will the balance in your bankaccount be at the end of the 8 year period?arrow_forward

- How much money do you have to put in the bank today to have $80,000, six years from now if your bank pays 8% interest on savings?arrow_forwardHow much would you be willing to pay today for an investment that will pay you $2,500,000 in 30 years, assuming your discount rate is 14.25%.arrow_forwardYou are buying a house for $290,000.00 with a downpayment of $29,000.00. The loan will be paid back over 20 years with monthly payments of $1,609.25. If the interest rate is 4.2% compounded monthly, what would the unpaid balance be immediately after the eleventh payment? What is the equity after the eleventh payment? The unpaid balance would be $ The equity would be $arrow_forward

- You are buying a house for $200,000.00 with a downpayment of $40,000.00. The loan will be paid back over 15 years with monthly payments of $1,307.33. If the interest rate is 5.5% compounded monthly, what would the unpaid balance be immediately after the twenty-ninth payment? What is the equity after the twenty-ninth payment? The unpaid balance would be $ (Round to 2 decimal places.) The equity would be $ (Round to 2 decimal places.)arrow_forwardI want to accumulate %500,000 in a savings account in 20 years. If the bank pays 6% compounded annually, how much chould I deposit in the account?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education