Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

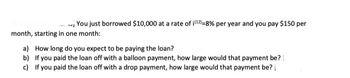

Transcribed Image Text:You just borrowed $10,000 at a rate of i(¹2)=8% per year and you pay $150 per

month, starting in one month:

a) How long do you expect to be paying the loan?

b)

If you paid the loan off with a balloon payment, how large would that payment be?

c) If you paid the loan off with a drop payment, how large would that payment be?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A payday lender might lend you $350 now, and you'll be asked to pay them back when your paycheck comes. Of course, you'll have to pay interest. The median fee charged by these types of lenders is $15 per every 100 borrowed. How much would you have to pay back in ten days?arrow_forwardYou just took out a 15-year traditional fixed-rate mortgage for $300,000 to buy a house. The interest rate is 10.8% (APR) and you have to make payments monthly. a. What is your monthly payment?b. How much of your first monthly payment goes towards paying down the outstanding balance (in $)?c. What is the outstanding balance after 1 year if you have made all 12 payments on time? d.arrow_forwardSuppose you want to borrow $20,000 for a new car. You can borrow 8% per year, compounded 8 monthly (12 = 0.66667% per month. Take a 4 year loan, what is your monthly payment?arrow_forward

- Your business had to borrow 584, 069.18 to cover some urgent experises. The loan carries an annual interest rate of 15%, and the monthly payment is $2000. How many years will it take to pay off this loan? ROUND YOUR ANSWER TO THE NEAREST WHOLE NUMBERarrow_forwardYou can afford a $1300 per month mortgage payment. You've found a 30 year loan at 6% interest.a) How big of a loan can you afford?$b) How much total money will you pay the loan company?$c) How much of that money is interest?arrow_forwardTo repay a $35,000 loan you will make 30 equal annual payments (starting one year from today) of $4,998.10. What is the interest rate on the loan? If you don’t have a financial calculator, you can use the fact that it is one of the following rates. a) 8% b) 10% c) 12% d) 14% e) 16%arrow_forward

- You have just purchased a car and taken out a $50,000 loan. The loan has a five-year term with monthly payments and an APR of 6.0%. a. How much will you pay in interest, and how much will you pay in principal, during the first month, second month, and first year? (Hint: Compute the loan balance after one month, two months, and one year.) b. How much will you pay in interest, and how much will you pay in principal, during the fourth year (i.e., between three and four years from now)? (Note: Be careful not to round any intermediate steps less than six decimal places.) a. How much will you pay in interest, and how much will you pay in principal, during the first month, second month, and first year? (Hint: Compute the loan balance after one month, two months, and one year.) During the first month, you will pay $ in principal. (Round to the nearest cent.)arrow_forwardYour local loan shark offers weekly payday loans: You can borrow $1,000 and pay back $1,050 one week later (or lose a finger or two). a. What is the effective annual rate on the loan? b.arrow_forwardYou took out a loan to buy a new car. The monthly interest rate on the loan is 0.6%. You have to pay $240 every month for 60 months. a. What is the present value of the cash flows if it's an ordinary annuity? b.arrow_forward

- You can afford a $1150 per month mortgage payment. You've found a 30 year loan at 8% interest.a) How big of a loan can you afford?b) How much total money will you pay the loan company?c) How much of that money is interest?arrow_forwardSuppose you take out a 36-month installment loan to finance a delivery van for $26,100. The payments are $987 per month, and the total finance charge is $9,432. After 25 months, you decide to pay off the loan. After calculating the finance charge rebate, find your loan payoff (in $). (Round your answer to the nearest cent.) $ 8938.537arrow_forwardYou've just taken out a student loan with a quoted interest rate of 4.1%. You will have to pay back $1,600 in 19 years, with no intermediate payments necessary. A. How much did you borrow if interest is compounded monthly? B. How much did you borrow if interest is compounded daily?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education