FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

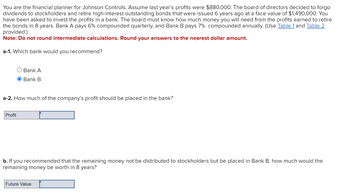

Transcribed Image Text:You are the financial planner for Johnson Controls. Assume last year's profits were $880,000. The board of directors decided to forgo

dividends to stockholders and retire high-interest outstanding bonds that were issued 6 years ago at a face value of $1,490,000. You

have been asked to invest the profits in a bank. The board must know how much money you will need from the profits earned to retire

the bonds in 8 years. Bank A pays 6% compounded quarterly, and Bank B pays 7% compounded annually. (Use Table 1 and Table 2

provided.)

Note: Do not round intermediate calculations. Round your answers to the nearest dollar amount.

a-1. Which bank would you recommend?

Bank A

Bank B

a-2. How much of the company's profit should be placed in the bank?

Profit

b. If you recommended that the remaining money not be distributed to stockholders but be placed in Bank B, how much would the

remaining money be worth in 8 years?

Future Value

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Assume you have just been hired as a business manager of PizzaPalace, a regional pizza restaurant chain. The company’s EBIT was $120 million last year and is not expected to grow. PizzaPalace is in the 25% state-plus-federal tax bracket, the risk-free rate is 6 percent, and the market risk premium is 6 percent. The firm is currently financed with all equity, and it has 10 million shares outstanding. When you took your corporate finance course, your instructor stated that most firms’ owners would be financially better off if the firms used some debt. When you suggested this to your new boss, he encouraged you to pursue the idea. If the company were to recapitalize, then debt would be issued, and the funds received would be used to repurchase stock. As a first step, assume that you obtained from the firm’s investment banker the following estimated costs of debt for the firm at different capital structures: Percent Financed with Debt, Wd Rd 0% 20% 8.0% 30% 8.5% 40% 10.0%…arrow_forwardNeed both answerarrow_forwardYou are very optimistic about the personal computer industry, so you buy 200 shares of Microtech Inc. at $45 per share. You are very pessimistic about the machine tool industry, so you sell short 300 shares of King Tools Corporation at $55. Each transaction requires a 40 percent margin balance. a. What is the initial equity in your account? b. Assume the price of each stock is as follows for the next three months (month-end). Compute the equity balance in your account for each month: Month Microtech Inc. King Tools Corp. October $51 $48 November 39 62 December 37 40arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education