Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

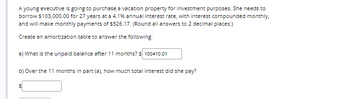

Transcribed Image Text:A young executive is going to purchase a vacation property for investment purposes. She needs to

borrow $103,000.00 for 27 years at a 4.1% annual interest rate, with interest compounded monthly,

and will make monthly payments of $526.17. (Round all answers to 2 decimal places.)

Create an amortization table to answer the following:

a) What is the unpaid balance after 11 months? $ 100410.01

b) Over the 11 months in part (a), how much total interest did she pay?

S

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Vincent received a loan of $28,000 at 4.25% compounded monthly. She had to make payments at the end of every month for a period of 5 years to settle the loan. a. Calculate the size of payments. Round to the nearest cent b. Complete the partial amortization schedule, rounding the answers to the nearest cent. Payment Number Payment K 0 1 2 0 0.00 0 0 Total :: :: $0.00 $0.00 $0.00 $0.00 $0.00 Interest Portion Principal Portion $0.00 $0.00 :: :: $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Principal Balance $28,000.00 $0.00 $0.00 :: $0.00 $0.00 0.00arrow_forwardA young executive is going to purchase a vacation property for investment purposes. She needs to borrow $78,000.00 for 29 years at 4.1% compounded monthly, and will make monthly payments of $383.53. (Round all answers to 2 decimal places.) What is the unpaid balance after 12 months? $ During this time period, how much interest did she pay? $arrow_forwardA young executive is going to purchase a vacation property for investment purposes. She needs to borrow $113,000.00 for 27 years at a 4.1% annual interest rate, with interest compounded monthly, and will make monthly payments of $577.25. (Round all answers to 2 decimal places.) a) What is the unpaid balance after 15 months? b) Over the 15 months in part (a), how much total interest did she pay?arrow_forward

- On January 1, 2022, Anderson Company purchased a machine with a cost of $14,409.50. To complete the purchase, Anderson signs a note specifying monthly payments of $600 beginning one month from the purchase date. The interest rate is 18% compounded monthly. How many payments will Anderson make for this loan? What is the total amount of interest that Anderson will pay over the life of this loan?arrow_forwardA young executive is going to purchase a vacation property for investment purposes. She needs to borrow $112,000.00 for 26 years at 5.9% compounded monthly. (Round all answers to 2 decimal places.) What is the unpaid balance after 16 months?arrow_forwardA property is available for sale that could be financed with a fully amortizing $250,000 loan at 8% with a monthly payment over 30 years. The builder is offering buyers a mortgage that reduces the payment by 20% for first and second year. After the second year, regular payment would be made for the remainder of the loan term. What is the first-year monthly payment for buyer? 1467.53 1657.32 1723.56arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education