FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

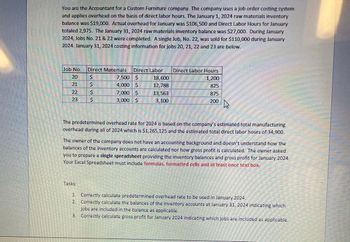

Transcribed Image Text:You are the Accountant for a Custom Furniture company. The company uses a job order costing system

and applies overhead on the basis of direct labor hours. The January 1, 2024 raw materials inventory

balance was $19,000. Actual overhead for January was $106,500 and Direct Labor Hours for January

totaled 2,975. The January 31, 2024 raw materials inventory balance was $27,000. During January

2024, Jobs No. 21 & 22 were completed. A single Job, No. 22, was sold for $110,000 during January

2024. January 31, 2024 costing information for jobs 20, 21, 22 and 23 are below.

Ch

Job No. Direct Materials

21

23

टु

Tasks:

B

VAN DEVALAN

Direct Labor

7,500 $

18,600

4,000 $

12,788

7,000 $

13,563

3,000 $

3,100

13

ܝ .

M

Direct Labor Hours

1,200

825

875

200

4

The predetermined overhead rate for 2024 is based on the company's estimated total manufacturing

overhead during all of 2024 which is $1,265,125 and the estimated total direct labor hours of 34,900.

SE

The owner of the company does not have an accounting background and doesn't understand how the

balances of the inventory accounts are calculated nor how gross profit is calculated. The owner asked

you to prepare a single spreadsheet providing the inventory balances and gross profit for January 2024.

Your Excel Spreadsheet must include formulas, formatted cells and at least once text box.

ETEEN

1. Correctly calculate predetermined overhead rate to be used in January 2024.

2. Correctly calculate the balances of the inventory accounts at January 31, 2024 indicating which

jobs are included in the balance as applicable.

3. Correctly calculate gross profit for January 2024 indicating which jobs are included as applicable.

REDATOR

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Townsend Industries Inc. manufactures recreational vehicles. Townsend uses a job order cost system. The time tickets from November jobs are summarized as follows: Job 201 $4,860 Job 202 2,430 Job 203 1,920 Job 204 3,570 Factory supervision 1,660 Factory overhead is applied to jobs on the basis of a predetermined overhead rate of $28 per direct labor hour. The direct labor rate is $18 per hour. If required, round final answers to the nearest dollar. Question Content Area a. Journalize the entry to record the factory labor costs. If an amount box does not require an entry, leave it blank. blank - Select - - Select - - Select - - Select - - Select - - Select - Question Content Area b. Journalize the entry to apply factory overhead to production for November. If an amount box does not require an entry, leave it blank. blank - Select - - Select - - Select - - Select -arrow_forwardWildhorse Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2022, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $24,400, direct labor $14,640, and manufacturing overhead $19,520. As of January 1, Job 49 had been completed at a cost of $109,800 and was part of finished goods inventory. There was a $18,300 balance in the Raw Materials Inventory account on January 1. During the month of January, Wildhorse Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $148,840 and $192,760, respectively. The following additional events occurred during the month. 1. 2. 3. 4. 5. (a) Purchased additional raw materials of $109,800 on account. Incurred factory labor costs of $85,400. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $14,640; and…arrow_forwardTownsend Industries Inc. manufactures recreational vehicles. Townsend uses a job order cost system. The time tickets from November jobs are summarized as follows: Job 201 $2,270 Job 202 1,140 Job 203 900 Job 204 1,670 Factory supervision 780 Factory overhead is applied to jobs on the basis of a predetermined overhead rate of $28 per direct labor hour. The direct labor rate is $13 per hour. If required, round final answers to the nearest dollar. a. Journalize the entry to record the factory labor costs. If an amount box does not require an entry, leave it blank. Work in Process Factory Overhead Wages Payable v Feedback b. Journalize the entry to apply factory overhead to production for November. If an amount box does not require an entry, leave it blank. Work in Process Factory Overheadarrow_forward

- Lott Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2020, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $23,200, direct labor $13,920, and manufacturing overhead $18,560. As of January 1, Job 49 had been completed at a cost of $104,400 and was part of finished goods inventory. There was a $17,400 balance in the Raw Materials Inventory account. During the month of January, Lott Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were also sold on account during the month for $141,520 and $183,280, respectively. The following additional events occurred during the month. 1. 2. 3. 4. Job No. 50 Purchased additional raw materials of $104,400 on account. Incurred factory labor costs of $81,200. Of this amount $18,560 related to employer payroll taxes. Incurred manufacturing overhead costs as follows: indirect…arrow_forwardDuring the month of January 2020, the job-cost record for Job 123 shows the following: Job 123: Machine Department Assembly Department Manufacturing overhead costs 19 500 7 500 Direct manufacturing labor costs 1 350 1 875 Direct manufacturing labor-hours 30 105 Machine-hours 210 30 Compute the total manufacturing overhead cost allocated to Job 123. Assume that Job 123 produced 450 units, calculate the cost per unit.arrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2020, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $25.000. direct labor $15,000, and manufacturing overhead $20,000. As of January 1, Job 49 had been completed at a cost of $112.500 and was part of finished goods inventory. There was a $18.750 balance in the Raw Materials Inventory account. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were also sold on account during the month for $152,500 and $197.500, respectively. The following additional events occurred during the month. 1 Purchased additional raw materials of $112.500 on account. incurred factory labor costs of $87.500. Of this amount $20,000 related to employer payroll taxes. Incurred manufacturing overhead costs as follows: indirect materials…arrow_forward

- Kapoor Catering Co. uses a job cost system. Its activities in November 2020, the first month of operation, were as follows:arrow_forwardLott Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2020, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $23,200, direct labor $13,920, and manufacturing overhead $18,560. As of January 1, Job 49 had been completed at a cost of $104,400 and was part of finished goods inventory. There was a $17,400 balance in the Raw Materials Inventory account. During the month of January, Lott Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were also sold on account during the month for $141,520 and $183,280, respectively. The following additional events occurred during the month. 1. 2. 3. 4. Job No. 50 Purchased additional raw materials of $104,400 on account. Incurred factory labor costs of $81,200. Of this amount $18,560 related to employer payroll taxes. Incurred manufacturing overhead costs as follows: indirect…arrow_forwardYou are the Accountant for a Custom Furniture company. The company uses a job order costing systemand applies overhead on the basis of direct labor hours. The January 1, 2024 raw materials inventorybalance was $19,000. Actual overhead for January was $106,500 and Direct Labor Hours for Januarytotaled 2,975. The January 31, 2024 raw materials inventory balance was $27,000. During January2024, Jobs No. 21 & 22 were completed. A single Job, No. 22, was sold for $110,000 during January2024. January 31, 2024 costing information for jobs 20, 21, 22 and 23 are below.Job No. Direct Materials Direct Labor Direct Labor Hours20 7,500$ 18,600$ 1,20021 4,000$ 12,788$ 82522 7,000$ 13,563$ 87523 3,000$ 3,100$ 200The predetermined overhead rate for 2024 is based on the company’s estimated total manufacturingoverhead during all of 2024 which is $1,265,125 and the estimated total direct labor hours of 34,900.The owner of the company does not have an accounting background and doesn’t understand how…arrow_forward

- please help mearrow_forwardMorant, Inc. uses a job order costing system and applies overhead on the basis of 125% of direct labor cost. On June 1, 2024, the balance in the work in process inventory account was $197,100. During June, Morant had the following transactions: Raw materials purchased Raw materials used Direct labor costs incurred Actual manufacturing overhead costs incurred Cost of completed jobs $50,200 $50,800 $48,200 $63,700 $87,000 Assume all raw materials are direct materials. What is the balance in Morant's work in process inventory account at June 30? (Hint: The slide with the fire trucks... what affects the work in process account?] 1arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education