FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

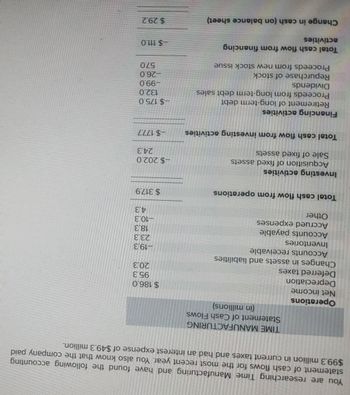

Transcribed Image Text:You are researching Time Manufacturing and have found the following accounting

statement of cash flows for the most recent year. You also know that the company paid

$99.3 million in current taxes and had an interest expense of $49.3 million.

TIME MANUFACTURING

Statement of Cash Flows

(in millions)

Operations

Net income

Depreciation

Deferred taxes

Changes in assets and liabilities

Accounts receivable

Inventories

Accounts payable

Accrued expenses

Other

Total cash flow from operations

Investing activities

Acquisition of fixed assets

Sale of fixed assets

Total cash flow from investing activities

Financing activities

Retirement of long-term debt

Proceeds from long-term debt sales

Dividends

Repurchase of stock

Proceeds from new stock issue

Total cash flow from financing

activities

Change in cash (on balance sheet)

$ 186.0

95.3

20.3

-19.3

23.3

18.3

-10.3

4.3

$317.9

-$202.0

24.3

-$177.7

--$175.0

132.0

-99.0

-26.0

57.0

-$111.0

$29.2

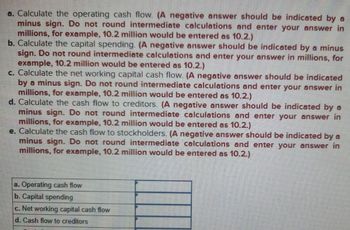

Transcribed Image Text:a. Calculate the operating cash flow. (A negative answer should be indicated by a

minus sign. Do not round intermediate calculations and enter your answer in

millions, for example, 10.2 million would be entered as 10.2.)

b. Calculate the capital spending. (A negative answer should be indicated by a minus

sign. Do not round intermediate calculations and enter your answer in millions, for

example, 10.2 million would be entered as 10.2.)

c. Calculate the net working capital cash flow. (A negative answer should be indicated

by a minus sign. Do not round intermediate calculations and enter your answer in

millions, for example, 10.2 million would be entered as 10.2.)

d. Calculate the cash flow to creditors. (A negative answer should be indicated by a

minus sign. Do not round intermediate calculations and enter your answer in

millions, for example, 10.2 million would be entered as 10.2.)

e. Calculate the cash flow to stockholders. (A negative answer should be indicated by a

minus sign. Do not round intermediate calculations and enter your answer in

millions, for example, 10.2 million would be entered as 10.2.)

a. Operating cash flow

b. Capital spending

c. Net working capital cash flow

d. Cash flow to creditors

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Introduction of operating cash flow, capital spending, and net working capital cash flow

VIEW Step 2: Requirement a - Computation of the operating cash flow

VIEW Step 3: Requirement b - Computation of capital spending

VIEW Step 4: Requirement c - Computation of net working capital cash flow

VIEW Solution

VIEW Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following information to compute net investment cash flow for a firm: Net income for the year is $43,900 Account receivable increased by $10,420 Inventory increased by $1,875 Depreciation expense for the year is $8,000 Account payable decreased by $5,782 Other current liabilities increased by $3,500 Taxes payable decreased by $1,970 Old equipment with a book value of $2,200 was sold for $1,325 Old appliances were sold for $24,000 at a gain of $4,800 A new machine was purchased for $10,000 1,000 shares of common stock were issued at par value of $10 each and sold at pay (for $10 each) Declared and paid dividends of $5,000 Reimbursed $7,000 of an outstanding loan’s capitalarrow_forwardWhat is the operating cash flow? The capital spending? The change is net working capital? The cash flow from asset?arrow_forwardNeed Help.arrow_forward

- Cash Flows from (Used for) Operating Activities The income statement disclosed the following items for the year: Depreciation expense $44,100 Gain on disposal of equipment 25,740 Net income 339,800 The changes in the current asset and liability accounts for the year are as follows: Increase(Decrease) Accounts receivable $6,870 Inventory (3,910) Prepaid insurance (1,470) Accounts payable (4,660) Income taxes payable 1,470 Dividends payable 1,030 Question Content Area a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. blankStatement of Cash Flows (partial) Cash flows from (used for) operating activities: $- Select - Adjustments to reconcile net income to net cash flows from (used for) operating activities: - Select -…arrow_forward) Provide an accurate, full and complete explanation and implication of the information presented in (mathematical forms) by explaining the significance of the cash flow statement The net income reported on the income statement for the current year was $128,000. Depreciation recorded on store equipment for the year amounted to $21,100. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: End of Year Beginning of Year Cash $51,200 $47,100 Accounts receivable (net) 36,710 34,810 Merchandise inventory 50,120 52,990 Prepaid expenses 5,630 4,470 Accounts payable (merchandise creditors) 47,970 44,560 Wages payable 26,210 29,110arrow_forwardSelected data derived from the income statement and balance sheet of National Beverage Co. for a recent year are as follows: Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method for National Beverage Co. Interpret your results in part (a).arrow_forward

- Fitz Company reports the following information. Selected Annual Income Statement Data Net income Depreciation expense Amortization expense Gain on sale of plant assets Cash flows from operating activities Selected Year-End Balance Sheet Data $ 373,000 Accounts receivable decrease 49,400 Inventory decrease 8,300 Prepaid expenses increase 6,700 Accounts payable decrease Salaries payable increase Use the indirect method to prepare the operating activities section of its statement of cash flows for the year ended December 31. Note: Amounts to be deducted should be indicated with a minus sign. Statement of Cash Flows (partial) Changes in current operating assets and liabilities Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash $ 60,400 42,500 6,400 8,800 1,700 $arrow_forward1. What is the cash flow statement using the indirect method? 2. What is the free cash flow for this year?arrow_forwardPlease fill in this chartarrow_forward

- Use the following information to compute net operating cash flow for a firm: Net income for the year is $43,900 Account receivable increased by $10,420 Inventory increased by $1,875 Depreciation expense for the year is $8,000 Account payable decreased by $5,782 Other current liabilities increased by $3,500 Taxes payable decreased by $1,970 Old equipment with a book value of $2,200 was sold for $1,325 Old appliances were sold for $24,000 at a gain of $4,800 A new machine was purchased for $10,000 1,000 shares of common stock were issued at par value of $10 each and sold at pay (for $10 each) Declared and paid dividends of $5,000 Reimbursed $7,000 of an outstanding loan’s capitalarrow_forwardA liquid asset can be converted to cash quickly without significantly impacting the asset’s value. Which of the following asset classes is generally considered to be the most liquid? Accounts receivable Cash Inventories The most recent data from the annual balance sheets of Fitcom Corporation and Zebra Paper Corporation are as follows: Balance Sheet December 31st31st (Millions of dollars) Zebra Paper Corporation Fitcom Corporation Zebra Paper Corporation Fitcom Corporation Assets Liabilities Current assets Current liabilities Cash $2,870 $1,845 Accounts payable $0 $0 Accounts receivable 1,050 675 Accruals 633 0 Inventories 3,080 1,980 Notes payable 3,586 3,375 Total current assets $7,000 $4,500 Total current liabilities $4,219 $3,375 Net fixed assets Long-term bonds 5,156 4,125 Net plant and equipment 5,500 5,500 Total debt $9,375 $7,500 Common equity Common stock $2,031 $1,625…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education