FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

1. What is the

2. What is the

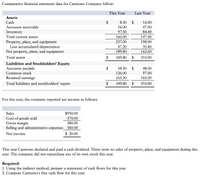

Transcribed Image Text:Comparative financial statement data for Carmono Company follow:

This Year

Last Year

Assets

Cash

$

8.50 $

16.00

Accounts receivable

54.00

47.00

Inventory

97.50

84.40

Total current assets

160.00

147.40

Property, plant, and equipment

Less accumulated depreciation

Net property, plant, and equipment

237.00

198.00

47.20

35.40

189.80

162.60

Total assets

$

349.80 $

310.00

Liabilities and Stockholders' Equity

Accounts payable

$

58.50

48.00

Common stock

126.00

97.00

Retained earnings

165.30

165.00

Total liabilities and stockholders' equity

$

349.80

$

310.00

For this year, the company reported net income as follows:

Sales

$950.00

Cost of goods sold

Gross margin

Selling and administrative expenses_ 360.00

570.00

380.00

Net income

$ 20.00

This year Carmono declared and paid a cash dividend. There were no sales of property, plant, and equipment during this

year. The company did not repurchase any of its own stock this year.

Required:

1. Using the indirect method, prepare a statement of cash flows for this year.

2. Compute Carmono's free cash flow for this year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How do you take the present value of a stream of cash flows. How does it work for annual payments, weekly payments, quarterly payments, and monthly payments? Provide examples of eacharrow_forwardWhat is the payback period for the following set of cash flows? (Round your answer to 2 decimal places, e.g., 32.16.) Year Cash Flow 0 –$ 4,700 1 1,200 2 1,400 3 1,800 4 1,300arrow_forwardWhat is the payback period for the following set of cash flows? Year Cash Flow -$ 0 3,600 1 2,800 2 2,100 3 2,900 4 2,800arrow_forward

- Can you please write the calculations step by step including the formulas. How did you calculate the Cash flow in order to calculate the cumulative cash flow after that?arrow_forwardWhy, in most cases, accrual-basis net income provides a better measure of perfomance than net operating cash flow?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education