Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

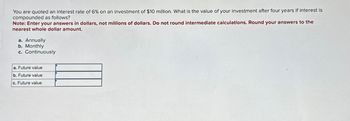

Transcribed Image Text:You are quoted an interest rate of 6% on an investment of $10 million. What is the value of your investment after four years if interest is

compounded as follows?

Note: Enter your answers in dollars, not millions of dollars. Do not round intermediate calculations. Round your answers to the

nearest whole dollar amount.

a. Annually

b. Monthly

c. Continuously

a. Future value

b. Future value

c. Future value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You estimate that by the time you retire in 35 years, you will have accumulated savings of $2.3 million. a. If the interest rate is 9.5% and you live 15 years after retirement, what annual level of expenditure will those savings support? (Do not round intermediate calculations. Enter your answer in whole dollars rounded to 2 decimal places.) Annual expenditure $ Real annual expenditure 293,809.56 b. Unfortunately, inflation will eat into the value of your retirement income. Assume a 4% inflation rate and work out a spending program for your $2.3 million in retirement savings that will allow you to increase your expenditure in line with inflation. What will be your expenditure amount in real terms for each year of your retirement? (Do not round intermediate calculations. Enter your answer in whole dollars rounded to 2 decimal places.)arrow_forwardWhat is the present value of $1,300 due in 14 years at a 7 percent interest rate and 12 percent interest rate? Do not round intermediate calculations. Round your answers to the nearest cent. Present value at 7%: $ Present value at 12%: $ Explain why the present value is lower when the interest rate is higher. I. The less interest you can earn during an investment period, the less you need to invest today to receive a particular amount in the future. II. The more interest you can earn during an investment period, the less you need to invest today to receive a particular amount in the future. III. The more interest you can earn during an investment period, the more you need to invest today to receive a particular amount in the future. -Select- varrow_forwardYou need $25,356 at the end of 9 years, and your only investment outlet is an 9 percent long-term certificate of deposit (compounded annually). With the certificate of deposit, you make an initial investment at the beginning of the first year. Use Appendix B and Appendix C for an approximate answer, but calculate your final answer using the formula and financial calculator methods. a. What single payment could be made at the beginning of the first year to achieve this objective? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) b. What amount could you pay at the end of each year annually for 9 years to achieve this same objective? (Do not round intermediate calculations. Round your final answer to 2 decimal places.)arrow_forward

- Find the accumulated value of an investment of $15,000 for 5 years at an interest rate of 1.45% if the money is a. compounded semiannually; b. compounded quarterly; c. compounded monthly d. compounded continuously. Click the icon to view some finance formulas. c. What is the accumulated value if the money is compounded monthly? $ 16127.15 (Round to the nearest cent as needed.). d. What is the accumulated value if the money is compounded continuously? S (Round to the nearest cent as needed.) ▼ Xarrow_forwardGive typed solution only If you put $200,000 into your investment account now for 10 year at 5% annual interest, what is the difference in interest income between simple interest calculation and compound interest calculation?arrow_forwardConsider the following investment. (Round your answers to the nearest cent.) $5,600 at 6 3/4% compounded quarterly for 8 1/2 years (a) Find the future value of the given amount.$ (b) Interpret the future value of the given amount. After 8 1/2 years, the investment is worth $ .arrow_forward

- Find the accumulated value of an investment of $10,000 for 3 years at an interest rate of 5.5% if the money is a. compounded semiannually; b. compounded quarterly; c. compounded monthly d. compounded continuously. Round answers to the nearest cent. a. What is the accumulated value if the money is compounded semiannually? (Round your answer to the nearest cent.)arrow_forwardSuppose you just bought an annuity with 10 annual payments of $16,500 at a discount rate of 13.75 percent per year. a. What is the value of the investment at the current interest rate of 13.75 percent? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. What happens to the value of your investment if interest rates suddenly drop to 8.75 percent? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. What happens to the value of your investment if interest rates suddenly rise to 18.75 percent? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forwardAn investment will pay you $43,000 in 10 years. If the appropriate discount rate is 7 percent compounded daily, what is the present value? (Use 365 days a year. Do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16))arrow_forward

- You have $68,513 you want to invest. You are offered an investment plan that will pay you 4.58 percent per year for the first 20 years and 6.81 percent per year for the last 21 years. How much will you have (in $) at the end of the two periods? Answer to two decimals. < Previousarrow_forwardAn investment offers to double your money in 30 months (don’t believe it). What rate per six months are you being offered? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.arrow_forwardSuppose you just bought an annuity with 12 annual payments of $15,700 at a discount rate of 11.75 percent per year. a. What is the value of the investment at the current interest rate of 11.75 percent? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. What happens to the value of your investment if interest rates suddenly drop to 6.75 percent? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. What happens to the value of your investment if interest rates suddenly rise to 16.75 percent? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. a. Present value at 11.75 percent b. Present value at 6.75 percent $ 124,187.88 153,795.59 c. Present value at 16.75 percent $ 97,472.81arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education