Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

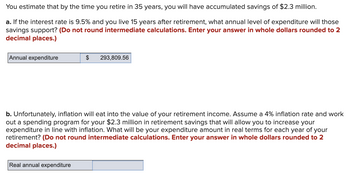

Transcribed Image Text:You estimate that by the time you retire in 35 years, you will have accumulated savings of $2.3 million.

a. If the interest rate is 9.5% and you live 15 years after retirement, what annual level of expenditure will those

savings support? (Do not round intermediate calculations. Enter your answer in whole dollars rounded to 2

decimal places.)

Annual expenditure

$

Real annual expenditure

293,809.56

b. Unfortunately, inflation will eat into the value of your retirement income. Assume a 4% inflation rate and work

out a spending program for your $2.3 million in retirement savings that will allow you to increase your

expenditure in line with inflation. What will be your expenditure amount in real terms for each year of your

retirement? (Do not round intermediate calculations. Enter your answer in whole dollars rounded to 2

decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose the interest rate is 6.9 APR with monthly compounding. What is the present value of an annuity that pays $110 every three months for five years? (Note: Be careful not to round any intermediate steps less than six decimal places.) Question content area bottom Part 1 The present value of the annuity is $ enter your response here. (Round to the nearest cent.)arrow_forwardSuppose that you are planning to buy a boat in in 28 years [cell B3] for $100,000 [cell B2], and you deposit into your account the amount of $26,000 CAD [cell B1]. (a) What average annually compounding rate of return (as a percentage, correct to 2 decimals) should you earn so you can accumulate the lump sum needed to achieve your goal [cell B5]? Use the RATE function.(Note: You might have to modify the format of cell B5 so that it shows 2 decimals.) (b) What is the correct formula (using 18 characters or less) that should be placed in cell B5?Note: There are to be NO numbers in the function call (apart from a 0 if appropriate), only cell references, or negative cell references where appropriate. In excel pls.arrow_forwardYou are contemplating the purchase of a twenty-four year (variable) annuity that promises cash flows in the following pattern, repeating every four years:e 6. 3 21e 22e 23 24 $1,600- $1,500- $1,400- $1,300 $1,600- $1,500 $1,400 $1,300- Suppose you don't like the fluctuations in the amount of your annual benefits. a. What annual rate of return would you use to convert these (end-of-year) cash flows to equal annual (end-of-year) amounts if you required an APR of 14.4%, compounded monthly? b. Without prejudice to your answer in part a, suppose that your required annual rate of return is 15%, what equal annual (beginning-of-year) payments over the twenty-four year period would be equivalent to the cash flow stream depicted above?arrow_forward

- At the moment you don't have any money saved for retirement, but have resolved to start making $425 monthly payments (starting one month from today) into an account expected to earn an effective annual rate of 9.9%. Given that plan, how many years will it take for you to accumulate $2.4 million? (Use excel or a financial calculator)arrow_forwardYou started an investment account 10 years ago with $2100, and it now has grown to $8900. a. What annual rate of return have you earned (you have made no additional contributions to the account)? b. If the investment account earns 11% per year from now on, what will the account's value be ten years from now? a. The annual rate of return is%. (Round to two decimal places.) View an example Get more help - Clear allarrow_forwardThe present value of an annuity is payable for 4 years, with the first payment at the end of 10 years is P 21,264. If money is worth 4.69%, what is the value of annuity? Solve correctly without using Excel .arrow_forward

- Suppose you are going to receive $14,500 per year for five years. The appropriate interest rate is 8 percent. a-1. What is the present value of the payments if they are in the form of an ordinary annuity? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. a-2. What is the present value of the payments if the payments are an annuity due? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b-1. Suppose you plan to invest the payments for five years. What is the future value if the payments are an ordinary annuity? Note: Do not round intermediate..arrow_forwardUsing the "Human Life Value" method, how much life insurance should you purchase if you have 45 years until retirement, an annual income of $65,100 received at the start of each years, and a time value of money of 9%? (Assume 80% income replacement, ignore taxes and inflation.)arrow_forwardWhat is the future value (at the end of 10 years) of an annuity that pays $700 a quarter over 10 years with the payments invested at 6.6% per annum (assume compounding matches payment periods, common assumption for such problems)? (enter your answer in the following format 123456.78) Answer:arrow_forward

- Find the present value PV of the annuity account necessary to fund the withdrawal given. (Assume end-of-period withdrawals and compounding at the same intervals as withdrawals. Round your answer to the nearest cent.) $2,100 per quarter for 15 years, if the account earns 4% per year PV = $ Need Help? Read It Watch Itarrow_forwardSuppose you just bought an annuity with 10 annual payments of $16,500 at a discount rate of 13.75 percent per year. a. What is the value of the investment at the current interest rate of 13.75 percent? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. What happens to the value of your investment if interest rates suddenly drop to 8.75 percent? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. What happens to the value of your investment if interest rates suddenly rise to 18.75 percent? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forwardIn 3 years you are to receive 5,000. If the interest rate were to suddenly increase, the present value of that future amount to you would A. fall B. Rise C. remain unchanged D. cannot be determined without more informationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education