Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

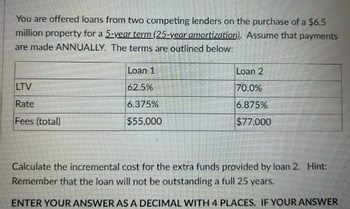

Transcribed Image Text:You are offered loans from two competing lenders on the purchase of a $6.5

million property for a 5-year term (25-year amortization). Assume that payments

are made ANNUALLY. The terms are outlined below:

Loan 1

Loan 2

LTV

62.5%

70.0%

Rate

6.375%

6.875%

Fees (total)

$55,000

$77,000

Calculate the incremental cost for the extra funds provided by loan 2. Hint:

Remember that the loan will not be outstanding a full 25 years.

ENTER YOUR ANSWER AS A DECIMAL WITH 4 PLACES. IF YOUR ANSWER

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The payment necessary to amortize a 5.5% loan of $82,000 compounded annually, with 8 annual payments is $12,944.85. The total of the payments is $103,558.80 with a total interest payment of $21,558.80. The borrower ma larger payments of $13,000.00. Calculate (a) the time needed to pay off the loan, (b) the total amount of the paymen and (c) the amount of interest saved.arrow_forwardComplete an amortization schedule for the following loan. The loan amount is $100,000 at 3. 5 % interest, amortized on a yearly basis over five (5) years. (I have two calculators. A BA2Plus and a Qualifier Plus IIIfx. Please provide the proper key strokes.) Thank you!arrow_forward4. PLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULASBancomer grants loans for the purchase of new automobiles, at 12½ % interest with monthly payments, for 4 years. It requests a minimum down payment of 10% and a maximum of 50% of the initial value of the car, excluding insurance and license plates. Considering the above, calculate the interest cost (effective rate) and the amount of the monthly payments considering the down payments from smallest to largest and varying from 10% to 10%. After a 30% down payment, the rate drops to 11.5%. The list cost of the car is $254,000.00. Very important Note:It is necessary that you make a solution approach and then the result. Above all, to check the procedure and/or the formulas used, especially when you use excel.arrow_forward

- The payment necessary to amortize a 4.9% loan of $86,000 compounded annually, with 4 annual payments is $24,196.70. The total of the payments is $96,786.80 with a total interest payment of $10,786.80. The borrower made larger payments of $25,000.00. Calculate (a) the time needed to pay off the loan, (b) the total amount of the payments, and (c) the amount of interest saved. a. The time needed to pay off the loan with payments of $25,000.00 is _____ years. (Round up to the nearest year.) b. The total amount of the payments is $______ (Round to the nearest cent as needed.) c. The amount of interest saved is $______. (Round to the nearest cent as needed.)arrow_forwardSuppose you borrow $14,000. The interest rate is 11%, and it requires 4 equal end-of-year payments. Set up an amortization schedule that shows the annual payments, interest payments, principal repayments, and beginning and ending loan balances. Round your answers to the nearest cent. If your answer is zero, enter "0". Beginning Repayment Ending Year Balance Payment Interest of Principal Balance 1 $ fill in the blank 60 $ fill in the blank 61 $ fill in the blank 62 $ fill in the blank 63 $ fill in the blank 64 2 $ fill in the blank 65 $ fill in the blank 66 $ fill in the blank 67 $ fill in the blank 68 $ fill in the blank 69 3 $ fill in the blank 70 $ fill in the blank 71 $ fill in the blank 72 $ fill in the blank 73 $ fill in the blank 74 4 $ fill in the blank 75 $ fill in the blank 76 $ fill in the blank 77 $ fill in the blank 78 $ fill in the blank 79arrow_forwardFind the payment necessary to amortize the loan.$2500; 6% compounded annually; 7 annual paymentsarrow_forward

- The payment necessary to amortize a 4.5% loan of $81,000 compounded annually, with 5 annual payments is $18,451.12. The total of the payments is $92,255.60 with a total interest payment of $11,255.60. The borrower made larger payments of $19,000.00. Calculate (a) the time needed to pay off the loan, (b) the total amount of the payments, and (c) the amount of interest saved. Thank you~arrow_forwardPlease no excel. Thanks An 18-year loan of 21,000 may be repaid under the following two methods: amortization method with equal annual payments at an annual effective rate of 6.1% sinking fund method in which the lender receives an annual effective rate of 6.450% and the sinking fund earns an annual effective rate of j. Both methods require payment of X to be made at the end of each year for 18 years. Calculate j. Round your answer to one decimal placearrow_forwardYou recently purchased an office building for $1,950,000 using the following loan terms: 70% LTV, 20-year amortization, 6.25% interest and monthly compounding. Assuming a net operating income of $150,000 in Year 1 and income taxes equal to $11,000, what is the expected ATCF from Operations in Year 1?arrow_forward

- Givens, Hong, and Partners obtained a $8,100 term loan at 9.6% compounded annually for new boardroom furniture. Prepare a complete amortization schedule in which the loan is repaid by equal semiannual payments over three years. (Round your answers to the nearest cent. Do not round the intermediate calculations.) Payment Interest number Payment $ portion $ 0 DLN3 456 1 2 1624.80 1624.80 1624.80 1624.80 1624.80 1624.80 Principal portion $ Principal balance $ 8,100.00arrow_forwardprepare an amortization schedule showing the first four payments for each loan. Large semitrailer trucks cost $110,000 each. Ace Trucking buys such a truck and agrees to pay for it by a loan that will be amortized with 9 semiannual payments at 8% compounded semiannually.arrow_forwardPls help correct thanks . Prepare an amortization schedule for a three-year loan of $102,000. The interest rate is 11 percent per year, and the loan agreement calls for a principal reduction of $34,000 every year. How much total interest is paid over the life of the loan?.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education