ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

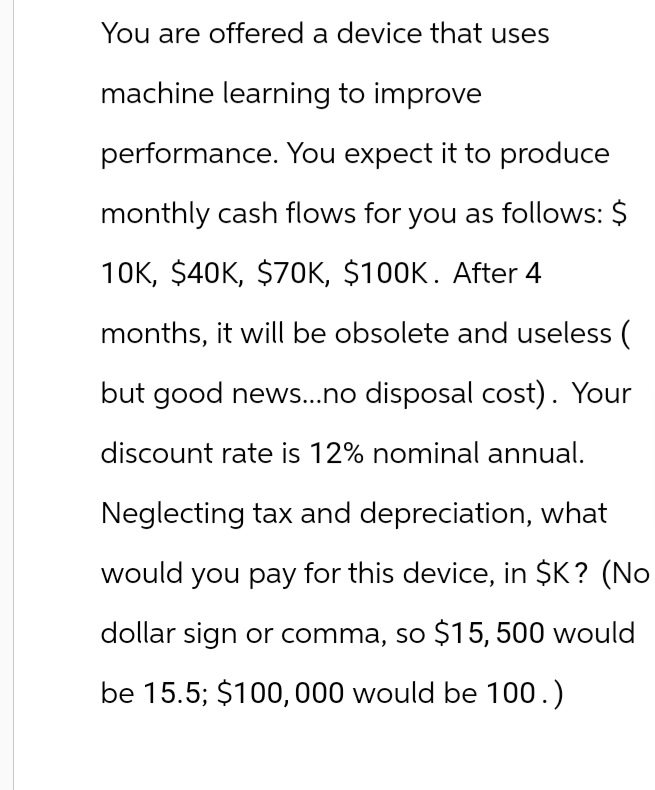

Transcribed Image Text:You are offered a device that uses

machine learning to improve

performance. You expect it to produce

monthly cash flows for you as follows: $

10K, $40K, $70K, $100K. After 4

months, it will be obsolete and useless (

but good news...no disposal cost). Your

discount rate is 12% nominal annual.

Neglecting tax and depreciation, what

would you pay for this device, in $K? (No

dollar sign or comma, so $15,500 would

be 15.5; $100,000 would be 100.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardHome Furniture paid $65 for a lamp. Expenses are 14% of selling price and the required profit is 21% of selling price. Round ALL answers to the nearest cent if applicable. 1) What is the regular selling price? $ 2) What is the break-even selling price? 3) During an inventory sale, the lamp was marked down 30% on the regular selling price. What is the sale price? 4) What is the operating profit or loss during the inventory sale (use a negative sign (-) for a loss)? $arrow_forwardff2arrow_forward

- 1-25 Zoe Garcia is the manager of a small office-support business that supplies copying, binding, and other services for local companies. Zoe must replace a worn-out copy machine that is used for black-and-white copying. Two machines are being considered, and each of these has a monthly lease cost plus a cost for each page that is copied. Machine 1 has a monthly lease cost of $600, and there is a cost of $0.010 per page copied. Machine 2 has a monthly lease cost of $400, and there is a cost of $0.015 per page copied. Customers are charged $0.05 per page for copies. (a) What is the break-even point for each machine? (b) If Zoe expects to make 10,000 copies per month, what would be the cost for each machine?arrow_forwardAli needs to work on a project in Australia for 5 years and he needs a car. He has the choice between buying one and leasing one. After some research, he finds out the following: If he decides to buy the car, it would cost him 300,000 AED and after five years, he could sell it for 30A AED. If he decides to lease the car, he would have to pay 50,000 AED per year. Assuming an MARR of S perform an evaluation and decide if he should lease or buy the car.arrow_forward1-25 Zoe Garcia is the manager of a small office-support business that supplies copying, binding, and other services for local companies. Zoe must replace a worn-out copy machine that is used for black-and-white copying. Two machines are being considered, and each of these has a monthly lease cost plus a cost for each page that is copied. Machine 1 has a monthly lease cost of $600, and there is a cost of $0.010 per page copied. Machine 2 has a monthly lease cost of $400, and there is a cost of $0.015 per page copied. Customers are charged $0.05 per page for copies. (c) If Zoe expects to make 30,000 copies per month, what would be the cost for each machine? (d) At what volume (the number of copies) would the two machines have the same monthly cost? What would the total revenue be for this number of copies?arrow_forward

- Problem 1: An equipment costs 7X,000 QAR and has an estimated salvage value of IX,000 QAR at the end of 5 years of useful life. Calculate: (a) The book value at the end of year 3 by the straight-line method. (b) The book value at the end of year 3 by DDB method.arrow_forwardConsider the revenues and costs in 2019 for Spruce Decor Inc, an Alberta-based furniture company entirely owned by Mr Harold Buford $645,000 a. What would accountants determine Spruce Decor's profits to be in 20197 Spruce Decor's profits in 2019 equal $471000 Furniture Sales Catalogue Sales Labour Costs Materials Costs Advertising Costs Debt-Service Costs $13,500 $350,000 $148,000 $28,000 $30,000arrow_forwardFink Co. is interested in purchasing a new business vehicle. The vehicle costs $50,000 and will generate constant-dollar delivery revenue of $20,000 (year O dollars) for each of the next 6 years. At the end of the 6 years, the vehicle will have a salvage value of $5,000. The tax rate is 21%, and annual inflation is 3%. Assuming that the vehicle is depreciated using MACRS (5-year property class) and that Fink Co. uses an after-tax real interest MARR of 8%, compute the PW, and determine whether Fink Co. should purchase the new business vehicle. Click here to access the TVM Factor Table calculator. Click here to access the MACRS-GDS Property Classes. Click here to access the MACRS-GDS percentages page. Click here to access the MACRS-GDS percentages for 27.5-year residential rental property. LAarrow_forward

- Show the correct answer to this problem. Please not that in excel type of calculation I need a detailed solution with formulas and computations on it. Thank you.arrow_forwardQw0004.arrow_forwardYou as a businessperson have one million dollars to invest. One option is to invest your money. in a saving account that gives you 8% annual interest rate. But you decide to open a book store instead. You need to rent a place for $7900 per month and hire two workers and pay them each $6000 monthly. The other expenses such as purchases and overhead are $6500 per month. Your store generates $395,000 sales per year. How much is your economic profit? Which business do you choose? explainarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education