ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

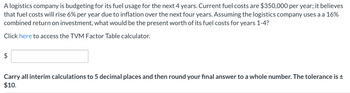

Transcribed Image Text:A logistics company is budgeting for its fuel usage for the next 4 years. Current fuel costs are $350,000 per year; it believes

that fuel costs will rise 6% per year due to inflation over the next four years. Assuming the logistics company uses a a 16%

combined return on investment, what would be the present worth of its fuel costs for years 1-4?

Click here to access the TVM Factor Table calculator.

$

Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is ±

$10.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Q1 A company that makes clutch disks for race cars has the cash flows shown for one department. Take i = 10%, and is = 8% Year Cash Flow, $1000 -65 1 30 2 84 3 - 10 -12 Calculate the internal rate of return. (Use both MIRR and ROIC | approach)arrow_forwardLilly deposits $350 every month into an account that earns 8% annual interest where interest is compounded semiannually. How much would be in the account at the end of 8 years? Click here to access the TVM Factor Table calculator. $ Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is ±20.arrow_forward2arrow_forward

- 6.53 George buys a car every 6 years for $18,000. He trades in his current car to count as the 20% down payment. The rest is financed at a nominal 12% in- terest with monthly payments over 6 years. When the loan is paid off, he trades in the car as the "20%" down payment on the next car, which he finances the same way. Jeanette has similar tastes in cars, and the dealer will count her trade-in vehicle as worth 20%. She has paid cash for old cars in the past, so she now has $14,400 in cash for the other 80% cost of a new car. In 6 years, her vehicle will be worth the "20%" down payment. She wants to make a monthly deposit so that she has the other 80% of the vehicle's cost in 6 years. Her savings account has a nominal annual interest rate of 6% with monthly compounding. What is George's payment? What is Jeanette's deposit? If Jeanette also deposits the difference in a retirement account that pays 9% nominal interest with monthly compounding, what does she have for retirement after 40…arrow_forwardHelp please Exercise 1-How much do you need to invest today in a CD with an ROR of 5.5% if you want to purchase a car 3 years from now for $10,000? Exercise 2 - Your monthly rent and living expenses are $625. How much should be put into your money market amount today, to pay for the next 12 months? Assume your money market is currently paying 5% annually.arrow_forwardTrue Car of Columbia, SC advertised a Ford EcoSport (2019) at $23,178. The EcoSport is a sporty smaller SUV that is perfect for the recent college graduate/young professional. Given that the repayment period is 5 years and the interest on the loan is 3.99%, what are the likely monthly car payments on this loan?arrow_forward

- In 2021 I bought 1/3 of ACO's Sushi House at BAM for 550,000TL. After 3 years I sold half of my shares to Ali for 1,500,000TL. The next year, because of a new virus, the business did poorly and I decided to leave the sushi business but I had to pay mehmet 100,000TL to share our losses. What is the rate of return of my investment?arrow_forwardPlease proceed with this problem In Year 2532, the world is “Exactly” different. Every second, minute, hour counts in comes to interest. Compute the future amount of an investment P 100,000 with an interest of 15% after 74 days, 2 hours, 6 minutes and 20 seconds.arrow_forwardEngineering Economics 2-) We have a five-year contract, compounded quarterly, at a rate of 16% per year. $12 million per quarter. What is the present value of the contract?arrow_forward

- Your mom wants to invest in a project that costs $10,000 today. It will produce a cashflow of $12,000 at the end of the year. Hshe doesn't invest the funds in this project, she could eam 10% per year on the money in the bank. What is the Present Value (NP) of $12,000 received after a year? 2What is the NPV of the $10,000 investment?arrow_forward! Pls answer all ! bartleby 3 max question How much is the exact simple interest of P 6000 from February 28, 2000 to December 31, 2001with an interest rate of 8 %? How long in days should an amount of P 35000 with a 5 % exact simple interest would become P35556?arrow_forwardplz solve both parts within 30-40 mins I'll give you multiple upvotearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education