FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Provide correct answer financial accounting question

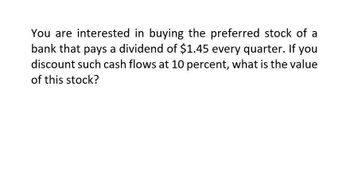

Transcribed Image Text:You are interested in buying the preferred stock of a

bank that pays a dividend of $1.45 every quarter. If you

discount such cash flows at 10 percent, what is the value

of this stock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A stock you purchased for $80 has paid out $2.50 in dividends. The stock is now selling for $100. If you were to sell, what would your capital gains yield be?arrow_forwardA stock you purchased for $50 has paid out $3.50 in dividends. The stock is now selling for $60. If you were to sell, what would your total percentage return be?arrow_forwardA stock is selling today for $50 per share. At the end of the year, it pays a dividend of $3 per share and sells for $59. Required: a. What is the total rate of return on the stock? b. What are the dividend yield and percentage capital gain? c. Now suppose the year-end stock price after the dividend is paid is $44. What are the dividend yield and percentage capital gain in this case?arrow_forward

- A stock is selling today for $50 per share. At the end of the year, it pays a dividend of $3 per share and sells for $56. Required: a. What is the total rate of return on the stock? b. What are the dividend yield and percentage capital gain? c. Now suppose the year-end stock price after the dividend is paid is $48. What are the dividend yield and percentage capital gain in this case? A Required What is the total rate of return for the stock? B Required What is the dividend yield and percentage capital gain? C Required Now suppose the year-end stock price after the dividend is paid is $48. What are the dividend yield and percentage capital gain in this case? (Negative amounts should be indicated by a minus sign. Enter your answers as a whole percent.)arrow_forwardYou buy a share of stock for $100 and a year later the market price is $105 and it pays a dividend of $2. What is the return?arrow_forwardYou expect a share of EconNews.Com to sell for $65 a year from now. If you are willing to pay $65.74 for one share of the stock today, and you assume the share is riskless but require a return of 8 percent, what dividend payment must you expect to receive from the stock?arrow_forward

- Suppose you are thinking of purchasing the SunStar’s common stock today. If you expect SunStar to pay $0.80 dividend at the end of year one and $1.6 dividend at the end of year two and you believe that you can sell the stock for $15 at that time. If you required return on this investment is 10%, how much will you be willing to pay for the stock? a. $13.95 b. $14.44 c. 14.19 d. $15.51arrow_forwardYou buy a share of Damanpour Corporation stock for $21.40. You expect it to pay dividends of $1.07, $1.1149, and $1.2250 in Years 1, 2, and 3 respectively. You also expect to sell the stock at a price of $26.22 at the end of three years. a. Calculate the growth rate in dividends. b. Calculate the expected dividend yield. c. Assuming that the calculated growth rate is expected to continue, you can add the dividend yield to the expected growth rate to determine the expected total rate of return. What is this stock's expected total rate of return?arrow_forwardSuppose you are thinking of purchasing the Luna Co.’s common stock today. If you expect Luna to pay $2.5, $2.625, $2.73, and $2.81 dividends at the end of year one, two, three, and four respectively and you believe that you can sell the stock for $40.97 at the end of year four. If you required return on this investment is 9%, how much will you be willing to pay for the stock today?arrow_forward

- Suppose the current price of a stock is $50 per share. You expected to earn a 10% return on the stock if you buy it at the current market price and hold it for one year (right after you receive the dividend for the year). The stock is expected to pay a dividend of $2.5 per share, what do you expect the stock price to be one year from now? • Suppose the current price of a stock is $50 per share. You expected to earn a 10% return on the stock if you buy it at the current market price and hold it for one year (right after you receive the dividend for the year). The stock one year from now is expected to be $53, how much dividend do you expect to receive during the year .arrow_forwardA stock is selling today for $75 per share. At the end of the year, it pays a dividend of $6 per share and sells for $87. A. What is the total rate of return on the stock? B. What are the dividend yield and percentage capital gain? C. Now suppose the year-end stock price after the dividend is paid is $72. What are the dividend yield and percentage capital gain in this case?arrow_forwardSuppose you are thinking of purchasing the Moore Co.’s common stock today. If you expect Moore to pay $2.5, $2.625, $2.73, and $2.81 dividends at the end of year one, two, three, and four respectively and you believe that you can sell the stock for $40.97 at the end of year four. If you required return on this investment is 9%, how much will you be willing to pay for the stock today?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education