Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

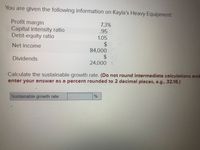

Transcribed Image Text:### Sustainable Growth Rate Calculation for Kayla’s Heavy Equipment

**Provided Information:**

- **Profit Margin:** 7.3%

- **Capital Intensity Ratio:** 0.95

- **Debt-Equity Ratio:** 1.05

- **Net Income:** $84,000

- **Dividends:** $24,000

**Task:**

Calculate the sustainable growth rate. (Do not round intermediate calculations and enter your answer as a percentage rounded to 2 decimal places, e.g., 32.16.)

**Answer:**

Sustainable Growth Rate: __ %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume the following ratios are constant. Total asset turnover Profit margin Equity multiplier Payout ratio = || || || || Sustainable growth rate = = 2.27 5.5% 1.74 What is the sustainable growth rate? Note: Do not round intermediate calculations and enter your answer as a percent 38% %arrow_forwardnote: please you dont use excel.arrow_forwardHii ticher please given correct answer general Accountingarrow_forward

- Given answer accounting questionarrow_forwardin 1. Calculate the Annual rate of return. Solving for Rates - Excel HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Calibri, BIU - A- Alignment Number Conditional Format as Cll Formatting Table Styles 国 Paste Cipboard H. 1. D. E. C. 3. What annual rate of return is earned on a $5,000 investment when it grows to $10,750 in six years? (Do not round intermediate calculations and round your final answer to 2 decimal places. Present value Future value Number of periods 0000 2410,750 Complete the following analysis. Do not hard code values in your calculations. 28 of 40 ere to search %23arrow_forwardPlease solve question 2 with excel function PV, thanksarrow_forward

- How I resolve this problems please give me the detail A firm has the following investment alternatives: Year A B C 1 $400 $--- $---- 2 400 400 ---- 3 400 800 ---- 4 400 800 1,800 Each investment cost of capital is 10 percent a. What is each investment's internal rate of return? b. Should the firm make any of theses investment? C. What is each investemtn's net present value? d. Should the firm make any of these investmentarrow_forwardProfitability index. Given the discount rate and the future cash flow of each project listed in the following table, . use the Pl to determine which projects the company should accept. What is the Pl of project A? i Data Table (Round to two decimal places.) (Click on the following icon o in order to copy its contents into a spreadsheet.) Cash Flow Project A -%241,900,000 $150,000 $350,000 Project B Year 0 $2,300,000 $1,150,000 $950 000 $750,000 $550,000 Year 1 Year 2 Year 3 $550,000 Year 4 $750,000 $950,000 4% Year 5 $350.000 Discount rate 18% Print Donearrow_forwardComplete the following 6 Wk 3 Financial Exercises: Problem Set 1, Part 2 problems: 1. Calculate the net present value (NPV) of the following cash flow stream if the required rate is 12%: Insert your NPV calculation. Year Cash Flow Is this a good project for the business to accept? Explain why or why not. Insert your answer. 2. Calculate the NPV of the following cash flow projections based on a required rate of 10.5%: Insert your NPV calculation. Year Cash Flow Is this a good project for the business to accept? Explain why or why not. Insert your answer. 3. A company needs to decide if it will move forward with 2 new products that it is evaluating. The 2 initiatives have the following cash flow projections: Project A Project B Year Cash Flow Year Cash Flow Based on the risk of each project, the company has a required rate of return of 11% for Project A and 11.5% for Project B. The company has a $1.5 million budget to spend on new projects for the year. Should the company move forward…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning