Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Good day! I want you to answer only letter (2a).Note that PW, AW, and FW means (Present Worth)(Annual Worth) and (Future Worth)

This is how you answer the problem. Identify first the given. Next identify what is being ask in the problem.Third show me the Formula first before you plug-in the given into it ,i want to study and learn from your solution

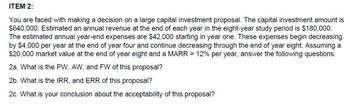

Transcribed Image Text:ITEM 2:

You are faced with making a decision on a large capital investment proposal. The capital investment amount is

$640,000. Estimated an annual revenue at the end of each year in the eight-year study period is $180,000.

The estimated annual year-end expenses are $42,000 starting in year one. These expenses begin decreasing

by $4,000 per year at the end of year four and continue decreasing through the end of year eight. Assuming a

$20,000 market value at the end of year eight and a MARR = 12% per year, answer the following questions.

2a. What is the PW, AW, and FW of this proposal?

2b. What is the IRR, and ERR of this proposal?

2c. What is your conclusion about the acceptability of this proposal?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please help me answer all questions at least 3-5 sentences per question only thanks.arrow_forwardy .22. Write a max one page reflection on machine reasoning from an accounting , tax or audit viewpoint. Cover how you think this technology will change your chosen field. Make sure you cite at least 3 sources. (Must be credible).arrow_forwardWith the Trial balance and the additional data. How can I prepare a Jurnal entrie. I don't understand how to do because there are many amounts of money in the additional Data. Can you show how to do it, thank you.arrow_forward

- Your friends were excited to hear you have chosen accounting for a career. They have several practical questions regarding money and interest (time value of money). Please assist your friends by answering their respective questions. For each question: A. Estimate without using a table, calculator, etc. B. Document the "step-by-step" detail showing them how you solved the question. NOTE: To solve use one of the following: • EXCEL Include all the detail steps for whichever tool you choose. For example, if using EXCEL show all formulas (copy so reader could duplicate your work). If using a business calculator, in detail in proper order show numbers and buttons you input to obtain your answer. C. Provide a one to three sentence written explanation to your friend explaining the basic time value of money concept(s) impacting the solution. Friend #1 – Car Loan – What will by my monthly payment if I purchase a used car for $8,500? The dealer has offered to finance the purchase (car loan) over…arrow_forward(Multiple Choice Question) Which of the following would likely have a Return on Assets of 4%? 1. A website design business 2. A manufacturing company 3. A tutoring service 4. An accounting firmarrow_forwardYour friends were excited to hear you have chosen accounting for a career. They have several practical questions regarding money and interest (time value of money). Please assist your friends by answering their respective questions. For each question: Estimate without using a table, calculator, etc. Document the “step-by-step” detail showing them how you solved the question. NOTE: To solve use one of the following: EXCEL Include all the detail steps for whichever tool you choose. For example, if using EXCEL show all formulas (copy so reader could duplicate your work). If using a business calculator, in detail in proper order show numbers and buttons you input to obtain your answer. Provide a one to three sentence written explanation to your friend explaining the basic time value of money concept(s) impacting the solution. Problems start with “Friend #1” at the top of page 2.arrow_forward

- I just asked this question and it was wrong. Here is what the expert said. Please help with the red fields.arrow_forwardYou have been asked by your manager to review three potential investment opportunities. As part of your investigation, you are asked to provide calculated data for three different methods of comparison. What three methods do you decide to use for your calculations? Explain why you are choosing each of these methods. (Explain your answer in a minimum of 3 complete sentences.)arrow_forwardYou have established your performance materiality for accounts payable and revenue; now you must determine the posting materiality for individual items. The materiality judgement is at 4%. What is the posting materiality? Show your work. Your work should look like: APPROPRIATE AMOUNT x MATERIALITY JUDGEMENT = POSTING MATERIALITYarrow_forward

- For a tutoring center, cash and accounts receivable are two of the assets that they own and will benefit in the future. Please list examples with two assets specifically on the tutoring center.arrow_forwardFor the next problem, I am going to explain a scenario and you need to state True OR False. You will then need a written rationale explaining your choice. Be sure to be specific in rationalizing your answer. You must use your own words. It is a good idea to provide a solved example to reinforce your point. To receive full credit, be sure to give a thorough explanation of why this statement is true or false (approximately 50 words). Michael decided that investing at a higher interest rate for 7 years is a better choice for his $7,500 investment (he got for his birthday). The company he chose offered 3.5% monthly, and the other company offered 3.425% continuously. Michael chose the better option! You will need to submit your work on this problem, giving a detailed explanation of WHY and how much more the better option will produce. O True O Falsearrow_forwardselect a “start-up” company in an industry of your choice and provide a brief summary description of the start-up company you chose and the goods or services it provides. 1. As a start-up company, identify three Credit Risks the company currently faces today or could face in the future. Explain in detail why these risks are a threat to the company. 2. What advice would you give to the CEO of the company to prevent or minimize these credit risks?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education