Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

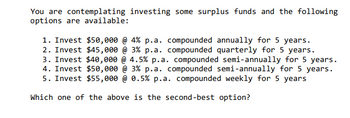

Transcribed Image Text:You are contemplating investing some surplus funds and the following

options are available:

1. Invest $50,000 @ 4% p.a. compounded annually for 5 years.

2. Invest $45,000 @ 3% p.a. compounded quarterly for 5 years.

3. Invest $40,000

4.5% p.a. compounded semi-annually for 5 years.

4. Invest $50,000 @ 3% p.a. compounded semi-annually for 5 years.

5. Invest $55,000 @ 0.5% p.a. compounded weekly for 5 years

Which one of the above is the second-best option?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Problem 1: You can choose between two different investments: (A) an annuity that pays $10,000 each year for the next 6 years; (B) a perpetuity that pays $10,000 forever, starting 11 years from now. 1. Which investment do you choose, A or B, if the interest rate is 5%? What if it is 10%? Explain in words the reason behind your choices.arrow_forwardYou have the ability to invest $100,000 and have a choice between the following investments that return $150,000 over the next 5 years: Year A B C D 1 $10,000 $30,000 $50,000 2 $20,000 $30,000 $40,000 3 $30,000 $30,000 $30,000 4 $40,000 $30,000 $20,000 5 $50,000 $30,000 $10,000 $150,000 Required: a. Based on cash flows given, with no other analysis, which investments would be a good investment? Which would be a bad investment? b. Based on cash flows given, and no other analysis, rank the investments based on preference/ desirability. Rank 1st, 2nd, 3rd, 4th. If ties, please explain why! c. If you analyzed the cash flows, what would you do? Briefly explain NOTE: Each of the above requires a short narrative answer.arrow_forwardSuppose that you have an opportunity to invest in a fund that pays 12% interest compoundedannually. Today, you invest P10,000 into this fund. Three years later, you borrow P5,000 from alocal bank at 10% effective annual interest and invest it in the fund. Two years later, you withdrawenough money from the fund to repay the bank loan and all interest due on it. Three years laterfrom this withdrawal you start taking P2,000 per year for 5 years out of the fund. After 5 years, youhave withdrawn your original P10,000. The amount remaining in the fund is earned interest. Howmuch remains?arrow_forward

- Complete a,b,& c please and thank youarrow_forwardA borrower bought a house for $300,000; he can obtain an 80% loan with a 20-year fully amortizing, 7% interest rate and monthly payment. Alternatively, he could get a 30-year fully amortizing 90% loan at 9% What is the incremental cost of borrowing the additional fund?arrow_forwardAt the beginning of each year, you deposit the following into a growthmutual fund that earns 6 percent per year:Year Deposit1 $ 5,000.002 7,500.003 4,500.004 5,500.005 6,200.00 ======== $28,700.00How much should the fund be worth at the end of 5 years?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education