FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

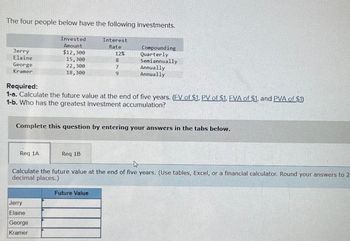

Transcribed Image Text:The four people below have the following investments.

Invested

Amount

Interest

Rate

Compounding

Jerry

Elaine

$12,300

12%

Quarterly

15,300

8

Semiannually

George

22,300

7

Annually

Kramer

18,300

9

Annually

Required:

1-a. Calculate the future value at the end of five years. (EV of $1, PV of $1, FVA of $1, and PVA of $1)

1-b. Who has the greatest investment accumulation?

Complete this question by entering your answers in the tabs below.

Req 1A

Req 1B

Calculate the future value at the end of five years. (Use tables, Excel, or a financial calculator. Round your answers to 2

decimal places.)

Jerry

Elaine

George

Kramer

Future Value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Classify the financial problem. Assume a 9% interest rate compounded annually. What annual deposit is necessary to give $10,000 in 6 years? A.future valueB.amortization C.sinking fundD.present valueE.ordinary annuity Answer the question. (Round your answer to the nearest cent.)arrow_forwardCalculate the future value in five years of $4,000 received today if your investments pay for the following interest rates. (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) 6 percent compounded annually b. 8 percent compounded annually a. C. 10 percent compounded annually d. 10 percent compounded semiannually 10 percent compounded quarterly e. Future Valuearrow_forward1 Which formula property calculates the future value of monthly deposits of $800 left on 2 deposit for 10 years at an annual return of 8%? Assume an initial deposit of $20,000. Your formula must return a positive value. 4 Number of years 5 Payments per year 6 Monthly deposit 7 Annual return 8 Initial deposit 10 12 $800 8% $20,000 Multiple Choice =FV(B7/B5,B4 B5,B6,B8) =-FV(B7/85,84-85,B6,B8) -FV(B7.85,84-85,B6) =-FVB7.84-85.B6.B8)arrow_forward

- You have been depositing money into an account yearly based on the following investment amounts, rates and times, what is the value of that investment account at the end of that period? (Click here to see present value and future value tables) Amounts ofInvestment Rate Times Value at the Endof the Period $9,000 20% 16 years $fill in the blank 1 $13,000 15% 11 years $fill in the blank 2 $16,000 12% 6 years $fill in the blank 3 $35,000 10% 4 years $fill in the blank 4arrow_forwardWhat is the future value of an annuity due of $800 paid semi-annually for the next 7 years, with a yield of 5% p.a. compounded semi-annually? Select one: a. $13,215.16 b. $6,923.22 c. $11,200.00 d. $13,545.54arrow_forwardhe future value of an ordinary annuity with $200 annual deposits into an account paying 6% interest over the next 10 years will be a. $1,987.56 b. $2,636.16 c. $2,794.37 d. $2,120arrow_forward

- Which investment will give you the higher future value in 5 years? Investment 1: You deposit $100 every month into an investment savings account that has an interest rate of 2.5% compounded daily. Investment 2: You deposit $300 every three months into an investment savings account that has an interest rate of 2.6% compounded semi-annually.arrow_forwardCalculate the future value in six years of $8,000 received today if your investments pay for the following interest rates. (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) Future Value 5 percent compounded annually b. 7 percent compounded annually c. 9 percent compounded annually d. 9 percent compounded semiannually 9 percent compounded quarterly а. $ 6,268.21 е.arrow_forwardCompound Interest Table Complete the following schedule for investments a through f by indicating the relevant factor from the present value or future value table and the final present or future value amount. Investment Compounding a. Annuity b. Annuity Annually Semiannually Semiannually Annually c. Annuity d. Single Payment e. Single Payment Semiannually f. Single Payment Semiannually Factor Answer $ a. $ Annual Interest Rate Amount 5% $2,000 4% 1,000 6% 14,000 •Note: Round your answers to the nearest whole dollar. •Note: Do not use a negative sign (-) with your answers. b. 5% 9,000 6% 16,000 4% 9,600 $ C. Investment $ Period d. $ Payment at Beg. or End e. of Period 2 years End 3 years Beginning 4 years Beginning 6 years n/a 5 years n/a 4 years n/a $ f. Future Value or Present Value Future Present Future Present Future Presentarrow_forward

- Please answer ASAP for an upvote. Thank you. Interest Rate=5% compounded annuallyarrow_forwardd. How much do you have to invest today and every six months thereafter for the next 10 years if you want to accumulate a total of $400,000, 10 years from today in an investment paying 10% semiannually? Do not answer in image formatarrow_forwardConsider the following investment. (Round your answers to the nearest cent.) $5,200 at 7 3 4 % compounded quarterly for 8 1 2 years (a) Find the future value of the given amount.$ (b) Interpret the future value of the given amount. After 8 1 2 years, the investment is worth $ .arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education