Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Remember, the expected value of a probability distribution is a statistical measure of the average (mean) value expected to occur during all possible

circumstances. To compute an asset's expected return under a range of possible circumstances (or states of nature), multiply the anticipated return

expected to result during each state of nature by its probability of occurrence.

Consider the following case:

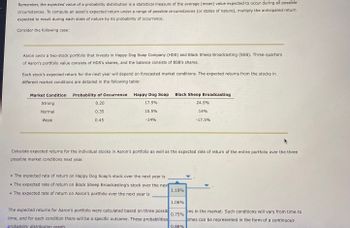

Aaron owns a two-stock portfolio that invests in Happy Dog Soap Company (HDS) and Black Sheep Broadcasting (BSB). Three-quarters

of Aaron's portfolio value consists of HDS's shares, and the balance consists of BSB's shares.

Each stock's expected return for the next year will depend on forecasted market conditions. The expected returns from the stocks in

different market conditions are detailed in the following table:

Market Condition Probability of Occurrence

0.20

0.35

0.45

Strong

Normal

Weak

Happy Dog Soap

17.5%

10.5%

-14%

• The expected rate of return on Happy Dog Soap's stock over the next year is

●

• The expected rate of return on Black Sheep Broadcasting's stock over the next

• The expected rate of return on Aaron's portfolio over the next year is

Black Sheep Broadcasting

The expected returns for Aaron's portfolio were calculated based on three possib

time, and for each condition there will be a specific outcome. These probabilities

probability distribution graph.

Calculate expected returns for the individual stocks in Aaron's portfolio as well as the expected rate of return of the entire portfolio over the three

possible market conditions next year.

1.19%

1.06%

0.75%

24.5%

0.88%

14%

-17.5%

ons in the market. Such conditions will vary from time to

omes can be represented in the form of a continuous

Transcribed Image Text:. The expected rate of return on Aaron's portfolio over the next year is

conditions in the market. Such conditions will vary from time to

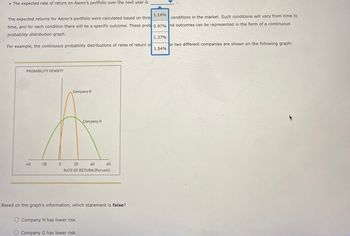

The expected returns for Aaron's portfolio were calculated based on thre

time, and for each condition there will be a specific outcome. These prob 0.97% nd outcomes can be represented in the form of a continuous

probability distribution graph.

For example, the continuous probability distributions of rates of return o

PROBABILITY DENSITY

-40

Company G

Company H

5

20

RATE OF RETURN (Percent)

-20

0

40

O Company H has lower risk.

Company G has lower risk.

60

Based on the graph's information, which statement is false?

1.14%

1.37%

1.54%

or two different companies are shown on the following graph:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Mr. Jones has a 2-stock portfolio with a total value of $540,000. $195,000 is invested in Stock A and the remainder is invested in Stock B. If standard deviation of Stock A is 16.60%, Stock B is 12.40%, and correlation between Stock A and Stock B is –0.40, what would be the expected risk on Mr. Jones’ portfolio (standard deviation of the portfolio return)?arrow_forwardLO some shares of Health Diagnostics, $75 a share. She expects the price of the stock to rise to $115 a share over the next three years. During that time, she also expects to receive annual dividends of $4 per share. Assuming that the investor's expectations (about the future price of the stock and the dividends that it pays) hold up, what rate of return can the investor expect to earn on this investment? (Hint: Use either the approximate yield formula or a financial calculator to solve this problem.) LO3,4 3. Calculating expected return on a stock. The price of Outdoor Designs, Inc. is now $85. The company pays no dividends. Fred Gray expects the price four years from now to be $125 a share. Should Fred buy Outdoor Designs if he wants a 15 percent rate of return? Explain. LO3,4 4. Calculating key stock performance metrics. The Castle Company recently reported net profits after taxes of $15.8 million. It has 2.5 million shares of common stock outstanding and pays preferred dividends of…arrow_forward3. Kelly has one share of a stock. She has two days to sell her stock. At the opening of the stock market on each day, she decides whether to hold or sell the stock. If she decides to sell the stock, she sells it at the opening price. On each day, the stock price is expected to increase by $20 with probability 0.4 and decrease by $16 with probability 0.6 at the closing of the market. Assume that the opening price on the first day is $100. Kelly wants to maximize her wealth. a. Construct a decision tree for Kelly's stock selling problem. b. Find an optimal decision strategy for Kelly using the expected value approach. What is the expected value of the optimal decision strategy? Show the backward pass procedure.arrow_forward

- Ian owns a two-stock portfolio that invests in Blue Llama Mining Company (BLM) and Hungry Whale Electronics (HWE). Three-quarters of Ian's portfolio value consists of BLM's shares, and the balance consists of HWE's shares. Each stock's expected return for the next year will depend on forecasted market conditions. The expected returns from the stocks in different market conditions are detailed in the following table: Market Condition Probability of Occurrence 0.25 0.45 0.30 Strong Normal Weak Blue Llama Mining Hungry Whale Electronics 40% 56% 24% 32% -40% -32% Calculate expected returns for the individual stocks in Ian's portfolio as well as the expected rate of return of the entire portfolio over the three possible market conditions next year. • The expected rate of return on Blue Llama Mining's stock over the next year is • The expected rate of return on Hungry Whale Electronics's stock over the next year is • The expected rate of return on Ian's portfolio over the next year isarrow_forwardTed owns three stocks. The table below summarizes his holdings and the expected return for each stock in the portfolia: STOCK Holding Expected Return DIS 70,000 4% AMZN 72, 000 4% GM 73,000 8% What is the expected return of Ted's portfolio? (Enter your answer as a whole number plus two decimal places. 1. e. 2.25, not 0.0225)arrow_forwardAn individual has $15,000 invested in a stock with a beta of 0.3 and another $65,000 invested in a stock with a beta of 1.7. If these are the only two investments in her portfolio, what is her portfolio's beta? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

- Pls show complete steps and explanation the formula usedarrow_forwardJones Design wishes to estimate the value of its outstanding preferred stock. The preferred issue has a par value of $60 and pays an annual dividend of $5.60 per share. Similar-risk preferred stocks are currently earning an annual rate of return of 7.1%. a. What is the market value of the outstanding preferred stock? b. If an investor purchases the preferred stock at the value calculated in part a, how much does she gain or lose per share if she sells the stock when the required return on similar-risk preferred stocks has risen to 8.6%?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education