Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Also find

b) The effective annual rate for the loan from your parents is %. (Round to two decimal places.)

C) The option with the lower effective annual rate is

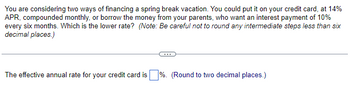

Transcribed Image Text:You are considering two ways of financing a spring break vacation. You could put it on your credit card, at 14%

APR, compounded monthly, or borrow the money from your parents, who want an interest payment of 10%

every six months. Which is the lower rate? (Note: Be careful not to round any intermediate steps less than six

decimal places.)

The effective annual rate for your credit card is%. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Estimate the affordable monthly mortgage payment, the affordable mortgage amount, and the affordable home purchase price for the following situation. Use Exhibit 7-6, Exhibit 7-7. Note: Round your intermediate and final answers to the nearest whole dollar. Monthly gross income $ 4,850 Other debt (monthly payment) $260 20-year loan at 5 percent Down payment to be made (percent of purchase price ) 10 percent Monthly estimate for property taxes and insurance $ 385arrow_forwardEstimate the affordable monthly mortgage payment, the affordable mortgage amount, and the affordable home purchase price for the following situation. (Refer to Exhibit 9.8 and Exhibit 9-9.) Note: Round time value factor to 2 decimal places, Intermediate and final answers to the nearest whole number. Monthly gross income Down payment to be made (percent of purchase price) Other debt (monthly payment) Monthly estimate for property taxes and insurance 30-year loan Affordable monthly mortgage payment Affordable mortgage amount Affordable home purchase price Affordable Amount Mortgage Costs $ 5,150 20 Percent $ 300 $ 400 6.5 Percentarrow_forwardSee Picarrow_forward

- Find the effective yield on a discount loan with the given discount rate r and the time. (Round your answer to two decimal places.) r = 2%, 2 monthsarrow_forwardConsider two loans with a 1-year maturity and identical face values: a(n) 8.3% loan with a 0.99% loan origination fee and a(n) 8.3% loan with a 4.9% (no-interest) compensating balance requirement. Which loan would have the higher effective annual rate (EAR)? Why? The EAR in the first case is %. (Round to one decimal place.)arrow_forwardTo calculate the withdrawal amount from an account in which you want to maintain a static balance, you use the __________________ formula. Group of answer choices Installment Payment Simple Interest Annuity Compound Interestarrow_forward

- You have an opportunity to buy a perpetuity that pays $400 a year forever starting a year from now for $1,500. What interest rate makes this a fair price? Instruction: Round to three decimal places. E.g., if your answer is 0.0106465 or 1.06465%, you should type ONLY the number .011, neither 0.0106465, 0.0106, nor 1.065. Otherwise, Blackboard will treat it as a wrong answer.arrow_forwardAnnuity A and B are exactly the same except that annuity A has an interest rate of 4% and annuity B has an interest rate of 5%, which one has the higher future value? Select one: a. B b. A=B c. Aarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education