Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Also find

B) The effective annual rate for the loan from your parents is (Round to two decimal places.)

C)The option with the lower effective annual rate is ?

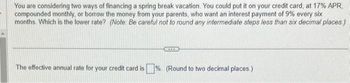

Transcribed Image Text:You are considering two ways of financing a spring break vacation. You could put it on your credit card, at 17% APR,

compounded monthly, or borrow the money from your parents, who want an interest payment of 9% every six

months. Which is the lower rate? (Note: Be careful not to round any intermediate steps less than six decimal places.)

REED

The effective annual rate for your credit card is% (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Buy On Time or Pay Cash Cost of Borrowing 1. 2. 3. 4. 5. 6. 7. 8. Cost of Paying Cash 9. 10. Terms of the loan a. Amount of the loan b. Length of the loan (in years) c. Monthly payment Total loan payments made ($ per month Less: Principal amount of the loan Total interest paid over life of loan Tax considerations: - Is this a home equity loan? - Do you itemize deductions on your federal tax return? What federal tax bracket are you in? Taxes saved due to interest deductions ($ %) Total after-tax interest cost on the loan X months) Annual interest earned on savings (6% X Annual after-tax interest earnings ($ %) X $10,000.00 5 $188.70 no yes 35% $ $ $ 00 00 $arrow_forwardHow do you calculate the rate on an Adjustable Rate Mortgage? Survey the cost of funds an local banks. O Use the amortization formula. With a financial calculator. O Index + Marginarrow_forwardTo account for a down payment, adjust the _____ of the loan by subtracting it from the loan amount. O present value (pv) future value (fv) rate O typearrow_forward

- Which of the following is considered an annuity? OA share of common stock. A conventional fixed payment mortgage. A construction loan with varying costs and payments. A cash payment for a new car. O A savings account with occasional deposits for a newborn child.arrow_forwardThe of the present values of all the payments required to pay off a loan is equal to the original principal of the loan. square root sum economic rate equivalent paymentarrow_forwardTo calculate the withdrawal amount from an account in which you want to maintain a static balance, you use the __________________ formula. Group of answer choices Installment Payment Simple Interest Annuity Compound Interestarrow_forward

- A 5.66% annual coupon, 19-year bond has a yield to maturity of 4.14%. Assuming the par value is $1,000 and the YTM is expected not to change over the next year, what is the expected Current Yield for this bond? Please share your answer as a %.arrow_forwardYou have an opportunity to buy a perpetuity that pays $400 a year forever starting a year from now for $1,500. What interest rate makes this a fair price? Instruction: Round to three decimal places. E.g., if your answer is 0.0106465 or 1.06465%, you should type ONLY the number .011, neither 0.0106465, 0.0106, nor 1.065. Otherwise, Blackboard will treat it as a wrong answer.arrow_forwardAnnuity A and B are exactly the same except that annuity A has an interest rate of 4% and annuity B has an interest rate of 5%, which one has the higher future value? Select one: a. B b. A=B c. Aarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education