Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

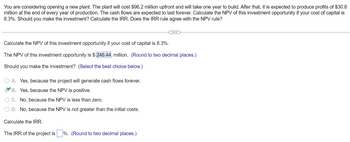

Transcribed Image Text:You are considering opening a new plant. The plant will cost $96.2 million upfront and will take one year to build. After that, it is expected to produce profits of $30.8

million at the end of every year of production. The cash flows are expected to last forever. Calculate the NPV of this investment opportunity if your cost of capital is

8.3%. Should you make the investment? Calculate the IRR. Does the IRR rule agree with the NPV rule?

(...)

Calculate the NPV of this investment opportunity if your cost of capital is 8.3%.

The NPV of this investment opportunity is $ 246.44 million. (Round to two decimal places.)

Should you make the investment? (Select the best choice below.)

O A. Yes, because the project will generate cash flows forever.

B. Yes, because the NPV is positive.

C. No, because the NPV is less than zero.

D. No, because the NPV is not greater than the initial costs.

Calculate the IRR.

The IRR of the project is%. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardCaspian Sea Drinks is considering buying the J - Mix 2000. It will allow them to make and sell more product. The machine cost $1.92 million and create incremental cash flows of $582, 193.00 each year for the next five years. The cost of capital is 9.20 %. What is the profitability index for the J - Mix 2000?arrow_forwardYou are considering making a movie. The movie is expected to cost $10.7 million up front and take a year to produce. After that, it is expected to make $4.6 million in the year it is released and $1.6 million for the following four years. What is the payback period of this investment? If you require a payback period of two years, will you make the movie? Does the movie have positive NPV if the cost of capital is 10.1%? wwwarrow_forward

- Please show detailed steps and correct.arrow_forwardCaspian Sea Drinks is considering buying the J-Mix 2000. It will allow them to make and sell more product. The machine cost $1.54 million and create incremental cash flows of $552,182.00 each year for the next five years. The cost of capital is 11.42%. What is the internal rate of return for the J-Mix 2000?arrow_forwardFastTrack Bikes, Inc. is thinking of developing a new composite road bike. Development will take six years and the cost is $200,000 per year. Once in production, the bike is expected to make $300,000 per year for 10 years. Assume the cost of capital is 10%. a. Calculate the NPV of this investment opportunity, assuming all cash flows occur at the end of each year. Should the company make the investment? b. By how much must the cost of capital estimate deviate to change the decision? (Hint: Use Excel to calculate the IRR.) c. What is the NPV of the investment if the cost of capital is 14%? Note: Assume that all cash flows occur at the end of the appropriate year and that the inflows do not start until year 7.arrow_forward

- A new machine will cost $400,000 and generate after-tax cash inflows of $50,000 for 12 years. Find the NPV if the firm uses a 11% opportunity cost of capital. What is the IRR? What is the payback period? (5’)arrow_forwardYou are considering a risk-free investment that costs $4000 and pays $5000 in one year. You can either pay all cash for the investment or you can borrow part and pay cash for the other part. If you borrow $2000, you will be required to pay back $2080 in one year. The risk-free rate is 4%. What is the project’s NPV? Is the NPV affected if you borrow some of the funds?arrow_forwardYou are interested in investing in an office building. You expect the building's net operating income will grow at a constant rate of 4.5% per year during your anticipated holding period. If you are confident that you can earn 10.7% annual return somewhere else on projects of comparable risk, the reasonable cap rate for you to use in evaluating this building should be %? Write your answer without %. E.g. if you answer is 21.5%, just write 21.5arrow_forward

- An investment of $1,600,000 will return $320,000 per year for 6 years. Should the investment be undertaken if the required rate of return is 5%? Use the appropriate tables in Appendix A to obtain the relevant present value factor and round up your final answer to the nearest dollar. Group of answer choices Yes because the NPV is greater than zero. No, the investment rate of return is not high enough to meet the required rate of return. Can't be determined because given data does not provide all necessary information. Yes because the NPV is less than zero.arrow_forwardYou have a potential project for which you want to establish the value of any possible real options. The project will have an initial cost of $86 million, which must be paid at the time of investment. You realize that the project has four possible cash flows starting in year 1 and continuing forever. First, there is a 22% chance of earning $1.02 million per year starting in year 1. Second, there is a 26% chance of earning $6.54 million per year starting in year 1. Third, there is a 20% chance the the project will earn $5.82 million per year. Fourth, there is a chance that the project will earn $3.22. These are the only four possibilities. In 2 year(s), you will be able to improve the quality of your manufacturing process to increase the net CFs from the project if you would like to. The cost of this will be $62 million, and the cash flows will increase beginning immediately when you make this investment (the CFs increase starting the same year that you pay the improvement cost) and…arrow_forwardYou are considering making a movie. The movie is expected to cost 10.6 million up front and take a year to produce. After that, it is expected to make $4.7 million in the year it is released and $1.8 million for the following four years. What is the payback period of this investment? If you require a payback period of two years, will you make the movie? Does the movie have positive NPV if the cost of capital is 10.9% ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education