Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

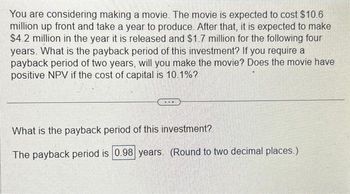

Transcribed Image Text:**Investment Analysis of a Movie Project**

*Scenario Overview*:

You are considering making a movie. The project involves an upfront cost of $10.6 million and will take a year to produce. Upon its release, the movie is expected to generate $4.2 million in the first year and $1.7 million annually for the following four years.

*Key Questions*:

1. **What is the payback period of this investment?**

- The payback period for this investment is calculated to be **0.98 years**. (Rounded to two decimal places.)

2. **If you require a payback period of two years, will you make the movie?**

- The calculated payback period of 0.98 years is less than the required two years, indicating that your criterion is met.

3. **Does the movie have a positive Net Present Value (NPV) if the cost of capital is 10.1%?**

- To determine if the NPV is positive, calculate the present value of future cash flows and compare it to the initial investment using the given cost of capital. This requires a separate NPV calculation not directly provided in the text.

**Conclusion**:

This financial analysis provides insights into the movie’s payback period, guiding you on whether to proceed based on your financial benchmarks. Further NPV analysis is recommended to complete the investment appraisal.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- son.2arrow_forwardAn investor is considering financing a toll highway for $120 million. They expect to get $11 million in toll fees for each of the 30 year period they will manage the facility, but they need to pay $8 million at the end of the period to repave the highway. What is the IRR of this investment? Is is a good idea if the MARR of this company is 10% per year?arrow_forwardYou are considering an investment in a clothes distributer. The company needs $106,000 today and expects to repay you $124,000 in a year from now. What is the IRR of this investment opportunity? Given the riskiness of the investment opportunity, your cost of capital is 15%. What does the IRR rule say about whether you should invest? What is the IRR of this investment opportunity? The IRR of this investment opportunity is %. (Round to two decimal places.)arrow_forward

- You are considering a risk-free investment that costs $4000 and pays $5000 in one year. You can either pay all cash for the investment or you can borrow part and pay cash for the other part. If you borrow $2000, you will be required to pay back $2080 in one year. The risk-free rate is 4%. What is the project’s NPV? Is the NPV affected if you borrow some of the funds?arrow_forwardYou are interested in investing in an office building. You expect the building's net operating income will grow at a constant rate of 4.5% per year during your anticipated holding period. If you are confident that you can earn 10.7% annual return somewhere else on projects of comparable risk, the reasonable cap rate for you to use in evaluating this building should be %? Write your answer without %. E.g. if you answer is 21.5%, just write 21.5arrow_forwardYou run a construction firm. You have just won a contract to build a government office complex. Building it will require an investment of $10.2 million today and $4.7 million in one year. The government will pay you $20.7 million in one year upon the building's completion. Suppose the interest rate is 10.6%. a. What is the NPV of this opportunity? b. How can your firm turn this NPV into cash today? a. What is the NPV of this opportunity? The NPV of the proposal is $million (Round to two decimal places.) CZTEarrow_forward

- You have a potential project for which you want to establish the value of any possible real options. The project will have an initial cost of $86 million, which must be paid at the time of investment. You realize that the project has four possible cash flows starting in year 1 and continuing forever. First, there is a 22% chance of earning $1.02 million per year starting in year 1. Second, there is a 26% chance of earning $6.54 million per year starting in year 1. Third, there is a 20% chance the the project will earn $5.82 million per year. Fourth, there is a chance that the project will earn $3.22. These are the only four possibilities. In 2 year(s), you will be able to improve the quality of your manufacturing process to increase the net CFs from the project if you would like to. The cost of this will be $62 million, and the cash flows will increase beginning immediately when you make this investment (the CFs increase starting the same year that you pay the improvement cost) and…arrow_forwardYou are considering making a movie. The movie is expected to cost 10.6 million up front and take a year to produce. After that, it is expected to make $4.7 million in the year it is released and $1.8 million for the following four years. What is the payback period of this investment? If you require a payback period of two years, will you make the movie? Does the movie have positive NPV if the cost of capital is 10.9% ?arrow_forwardYou are considering making a movie. The movie is expected to cost $10.1 million up front and take a year to produce. After that, it is expected to make $4.1 million in the year it is released and $1.9 million for the following four years. What is the payback period of this investment? If you require a payback period of two years, will you make the movie? Does the movie have positive NPV if the cost of capital is 10.9% 7 What is the payback period of this investment? The payback period is years. (Round to two decimal places)arrow_forward

- Nonearrow_forwardIvy's Ice Cream is looking at an opportunity that would require an investment of $900,000 today. The investment will provide cash flows of $250,000 in the first year, $400,000 in the second year, and $600,000 in the third year. If the interest rate is 8%, what is the NPV of this investment opportunity? Should Ivy's Ice Cream move forward with this investment based on the NPV? (Round your answer to the nearest whole dollar.)arrow_forwardAn investor is considering a project which requires an outlay of 3 million pounds initially (t = 0), and another outlay of one million pounds after one year (t = 1). After two years time (t = 2), when the project ends, they expect an inflow of 4.5 million pounds. What is the internal rate of return (IRR) of this project in percent?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education