Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

I need this question completed in 10 minutes

Transcribed Image Text:9

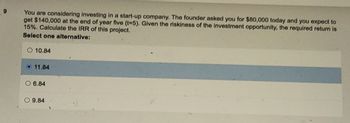

You are considering investing in a start-up company. The founder asked you for $80,000 today and you expect to

get $140,000 at the end of year five (t-5). Given the riskiness of the investment opportunity, the required return is

15%. Calculate the IRR of this project.

Select one alternative:

10.84

11.84

6.84

O9.84

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are responsible to manage an IS project with a 4-year horizon. The annal cost of the project is estimated at $40,000 per year, and a one-time costs of $120,000. The annual monetary benefit of the project is estimated at $96,000 per year with a discount rate of 6 percent. a. Calculate the overall return on investment (ROI) of the project. b. Perform a break-even analysis (BEA). At what year does break-even occur?arrow_forwardI need help on this. It's lengthy and I don't know where to start. The sales department of Donovan Manufacturing, Inc. has completed the following sales forecast for the months of January through March 20X1 for its only two products: 50,000 units of J to be sold at $90 each and 30,000 units of K to be sold at $70 each. The desired unit inventories at March 31, 20X1, are 10% of the next quarter's unit sales forecast, which are 60,000 units of J and 30,000 units of K. The January 1, 20X1, unit inventories were 5,000 units of J and 2,000 units of K. Each unit of J requires 3 pounds of material A and 2 pounds of material B for its manufacture; K requires 2 pounds of A and 4 pounds of B. The purchase cost of A is $9 per pound and the purchase cost of B is $5 per pound. Materials A and B on hand at January 1, 20X1, were 19,000 pounds of A and 7,000 pounds of B. Desired inventories at March 31, 20X1, are 14,000 pounds of A and 8,000 pounds of B. Each unit of J requires 0.5 hours of…arrow_forwardWhich of the following would indicate the BEST Average Collection Period? 30 days 20 days 25 days 15 daysarrow_forward

- Suppose a media planner had a budget of $5,000,000 and the cost per thousand exposures was $10. The planner wanted a frequency of 20. The planner could attain a reach of:arrow_forwardRetail Assistant Chris Johnson Michael Kilby Jessica Freeman Salary (per annum) £24,480 £22,800 £23,520arrow_forwardWe plan to make 20,600 cases of applesauce this month. Move the appropriate raw materials into production. Our standard cost of raw materials is $8.55 per case. Answer the value and places youd record this on cash flow, balance sheet and or income statement.arrow_forward

- Journal entryarrow_forwardTucker Inc. needs 5kg of meat to make its dog treats per unit of product. Management wants materials on hand at the end of each month equal to 10% of the following month's production On March 31, 13,000 kg of material are on hand. Material cost is $0.40 per kg How much raw material needs to be purchased in April given the following production budget April May June July Production 26,000 46, 000 29, 000 101, 000 13, 000 140,000 153, 000 26,000arrow_forwardThe manufacturing process of a new product is very labor intensive. The learning curve percentage (LC) for the process is 90%. It took 30 hours with 15 workers together to produce the first product. The average labor cost including overhead expenses is about $20 per hour. (a) Estimate the labor cost (including overhead expenses) to produce the tenth product? (Hint: 2 steps. How long is T_10? How much is the cost?) (b) A new training program is intended to lower the learning-curve percentage by 10% (minus 10%). If the program is successful, what cost savings will be realized for the tenth unit? (Hint: How long is the new T_10? How much is the new cost? How much is the cost saving?)arrow_forward

- Teletronics is going to introduce a combination phone/tablet product. Design and testing will take 8 months. Teletronics expects to sell 24,000 units during the first 6 months of sales. Sales over the next 12 months are expected to be less robust at 20,000. And, sales in the final 6 months of the expected life cycle are expected to be 9,000. Teletronics is budgeting for this product as follows: LOADING... (Click the icon to view the cost information.) Read the requirements LOADING... . Requirement 1. If Teletronics prices the phone/tablets at $280 each, how much operating income will the company make over the product's life cycle? What is the operating income per unit? Begin by preparing the life cycle income statement in order to determine how much operating income the company will make over the product's life cycle. Projected Life Cycle Income Statement Revenues Variable costs: Months 9-14 Months 15-26…arrow_forwardBlossom's Recording Studio rents studio time to musicians in two-hour blocks. Each session includes the use of the studio facilities, a digital recording of the performance, and a professional music producer/mixer. Anticipated annual volume is 1,000 sessions. The company has invested $1,963,500 in the studio and expects a return on investment of 20%. Budgeted costs for the coming year are as follows: Per Session Total Direct materials (tapes, CDs, etc.) $20 Direct labour. 380 Variable overhead 40 Fixed overhead $925,000 Variable selling and administrative expenses 30 Fixed selling and administrative expenses 475,000arrow_forwardThe creative designer at your company has promised to reduce all design faults by one third over the entire shift cycle from 0800 to 0800. If this initiative is successful, what would be the total number of design faults over the same period of time?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education