Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

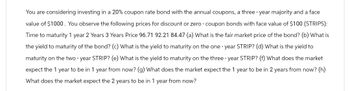

Transcribed Image Text:You are considering investing in a 20% coupon rate bond with the annual coupons, a three-year majority and a face

value of $1000. You observe the following prices for discount or zero - coupon bonds with face value of $100 (STRIPS):

Time to maturity 1 year 2 Years 3 Years Price 96.71 92.21 84.47 (a) What is the fair market price of the bond? (b) What is

the yield to maturity of the bond? (c) What is the yield to maturity on the one-year STRIP? (d) What is the yield to

maturity on the two-year STRIP? (e) What is the yield to maturity on the three-year STRIP? (f) What does the market

expect the 1 year to be in 1 year from now? (g) What does the market expect the 1 year to be in 2 years from now? (h)

What does the market expect the 2 years to be in 1 year from now?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A 30-year maturity bond with a face value of $1,000 making annual coupon payments with a coupon rate of 12% has a duration of 11.54 years and a convexity of 192.4. The bond currently sells at a yield to maturity of 8%. a. What is the current price of this bond? b. What would be the price of the bond if the yield falls to 7%? What price (if y = 7%) would be predicted by the duration rule? d. What price would be predicted by the duration-with-convexity rule? e. What is the percent error for each rule? What do you conclude about the accuracy of the two rules? f. Repeat your analysis if the bond's yield to maturity increases to 9%. Are your conclusions about the accuracy of the two rules consistent with your answers to parts b. to e. above?arrow_forwardConsider a bond with semiannual interest payments that has a Settlement Date of 8/15/2020, a Maturity Date of 2/15/2031, a Coupon Rate of 5.00%, a Market Price of $975, a Face Value of $1,000, and a Required Return of 5.35%. What is the Macaulay Duration using the Duration function on these bonds expressed as a decimal calculated to two decimal places if you purchase them at the current market price? For example, if your answer is 12.345 then enter as 12.35 in the answerarrow_forwardA risk-free, zero-coupon bond with a $1000 face value has 2 years to maturity. The yield to maturity of this bond is 2%? What is the fair price to pay for this bond?arrow_forward

- Suppose that the prices of zero-coupon bonds with various maturities are given in the following table. The face value of each bond is $1,000. Maturity (Years) 1 2 3 4 5 Price $983.78 865.89 797.92 732.00 660.24 Required: a. Calculate the forward rate of interest for each year. b. How could you construct a 1-year forward loan beginning in year 3? c. How could you construct a 1-year forward loan beginning in year 4?arrow_forwardSuppose a ten-year, $1,000 bond with a 8.9% coupon rate and semiannual coupons is trading for$1,035.32. a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? b. If the bond's yield to maturity changes to 9.4% APR, what will be the bond's price? The bond's yield to maturity is ______%. (Round to two decimal places.)arrow_forwardYou find a zero coupon bond with a par value of $10,000 and 19 years to maturity. The yield to maturity on this bond is 4.7 percent. Assume semiannual compounding periods. What is the price of the bond? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forward

- You have a risk-free bond with 2 years to maturity. The bond has a face value of $ 1000 and a coupon rate of 5%. The next coupon will be paid one year from now, and the bond pays annual coupons. a. What is the price of the bond? What is its own yield to maturity? Is it trading at a discount or at a premium? b. Suppose you buy the 2-year bond above, and you sell it after one year. What is the expected return on your investment?Kindly solve the question in 10 mins. It is urgent.arrow_forwardThe YTM on a bond is the interest rate you earn on your investment if interest rates don't change. If you actually sell the bond before it matures, your realized return is known as the holding period yield (HPY) a. Suppose that today you buy an annual coupon bond with a coupon rate of 8 3 percent for $785 The bond has 8 years to maturity and a par value of $1,000. What rate of return do you expect to earn on your investment? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b-1. Two years from now, the YTM on your bond has declined by 1 percent, and you decide to sell. What price will your bond sell for? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b-2. What is the HPY on your investment? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Rate of return b-1. Price % b-2. Holding period…arrow_forwardhelparrow_forward

- Answer this question using the Par Value formula and showing all work. You have been given the following information for an existing bond that provides coupon payments. Par Value: $2000 Coupon rate: 6% Maturity: 4 years Required rate of return: 6%. What is the Present Value (PV) of the bond? If the required rate of return by investors were 11% instead of 6%, what would the Present Value of the bond be? Look at the same Par Value $2,000 Same Coupon rate: 6% Maturity: 10 years Required rate of return: 7% What is the Present Value of the Bond now? Explain how the longer maturities and higher required rate of return by investors affects the bond valuation.arrow_forwardThe current zero-coupon yield curve for risk-free bonds is as follows What is the price per $100 face value of a four-year, zero-coupon, risk-free bond? The price per $100 face value of the four-year, zero-coupon, risk-free bond is $_______(Round to the nearest cent.)arrow_forward(i) Two types of risks faced by bodholders are interest rate risks and default risks? What are interest rate risks and default risks, and why might a bond exhibit more or less of these risks? (ii) You see a bond with the following characteristics: bond matures in 10 years coupon rate = 7% APR compounded semi-annually, paid semi-annually face value = $1000 bond price = $900 What is the yield to maturity (YTM) of this bond, stated as an APR with semi-annual compounding?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education