Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

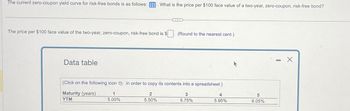

Transcribed Image Text:The current zero-coupon yield curve for risk-free bonds is as follows: What is the price per $100 face value of a two-year, zero-coupon, risk-free bond?

The price per $100 face value of the two-year, zero-coupon, risk-free bond is $

(Round to the nearest cent.)

Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

Maturity (years)

YTM

1

5.00%

2

5.50%

3

5.75%

4

5.95%

5

6.05%

-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Consider a bond that has a price of $1046.76, a coupon rate of 8.8%, a yield to maturity of 8.1%, a face value of $1000, and 10 years to maturity. What is the current yield? Enter your answer as a percentage. Do not include the percentage sign in your answer. Enter your response below. Enter your answer to 2 DECIMAL PLACES. Number %arrow_forwardConsider the following bonds: •Bond A: A 2-year zero-coupon bond with a face value of $100 and 6% YTM. •Bond B: A 2-year par-value bond with a face value of $100 and 6% coupon rate. *Bond C: A 2-year par-value bond with a face value of $100 and 7% coupon rate. Suppose the yield curve shifts upwards by one percent. Which bond among bonds A, B, and C will experience the largest percentage price change? Which will have the lowest percentage price change? O a. Bond A; Bond C O b. Bond A; Bond B O c. Bond B; Bond C O d. Bond C; Bond Barrow_forwardWhat is the market price of a bond if the face value is $1,000 and the yield to maturity is 5.7%? The bond has a 5.15% coupon rate and matures in 14 years. The bond pays interest semiannually. Please express answer as $X.XX or XX.XX and use rounding guideline included in "Course Information" module. Do not round until the final result.arrow_forward

- please don't solve excel version. Please make a classic transactional solution with formulas.arrow_forwardThe YTMs on benchmark one-year, two-year, and three - year annual pay bonds that are priced at par are listed in the table below. Bond Yield 1 - year 1.74 2 - year 3.37 3 - year 3.98 What is the correct no - arbitrage price for a 3 year risk free bond with a 5.35% coupon, per $100 of par value?arrow_forward1) Explain the concept of interest rate risk in bond investment 2) show a numerical example of it by calculating % changes in price for 1 year and 3-year annual coupon bonds. Assume coupon interest rate = 12%, Yield to Maturity = 6%, Face value= 100. Use 2% increase in YTM (i.e., 6% → 8%).arrow_forward

- Please answer all 4 price bonds with explanations thxarrow_forwardShow all workings. Complete the following table and draw a graph showing how bond pricefor each bond changes over time as they move towards their maturitydates. Describe the relationship between bond prices and timeremaining for maturity.YearsreminingtomaturityBOND ACoupon rate = 8% p.a.Market interest rate =6% p.a.BOND BCoupon rate = 6% p.a.Market interest rate =6% p.a.BOND CCoupon rate = 4% p.a.Market interest rate =6% p.a.109876543210arrow_forwardThe current zero-coupon yield curve for risk-free bonds is as follows What is the price per $100 face value of a four-year, zero-coupon, risk-free bond? The price per $100 face value of the four-year, zero-coupon, risk-free bond is $_______(Round to the nearest cent.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education