FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

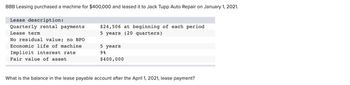

Transcribed Image Text:BBB Leasing purchased a machine for $400,000 and leased it to Jack Tupp Auto Repair on January 1, 2021.

Lease description:

Quarterly rental payments

Lease term

No residual value; no BPO

Economic life of machine

Implicit interest rate

Fair value of asset

$24,506 at beginning of each period

5 years (20 quarters)

5 years

98

$400,000

What is the balance in the lease payable account after the April 1, 2021, lease payment?

Transcribed Image Text:Multiple Choice

$375,494.

$519,493.

$359,437

$391,551.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- (J)arrow_forwardSaved Help Seve & On January 1, 2021, Obermax Corporation agreed to lease a piece of equipment to a customer for 10 years. The lease qualified as a finance/sales-type lease with a 6% implicit interest rate. The customer agreed to make a payment of $8,000 at the beginning of each year, the first payment being made on January 1, 2021. The journal entry Obermax should recognize at the inception of the lease includes: Multiple Choice a debit to lease receivable of $80,000. a debit to lease receivable of S62,414. a credit to interest revenue of $3,265. a debit to lease receivable of $58.881.arrow_forwardPrepare a lease amortization schedule for Larkspur for the 5-year lease term. (Round answers to 2 decimal places, e.g. 5,275.15.) LARKSPUR LEASING COMPANY (Lessor) Lease Amortization Schedule Date 5/1/20 5/1/20 5/1/21 5/1/22 5/1/23 5/1/24 4/30/25 Annual Lease Payment Plus BPO $ 14 15852.19 15852.19 15852.19 15852.19 15852.19 5000 63409 Interest on Lease Receivable 5736.26 i 4623.51 3388.35 2017.33 495,50 13748 LA Recovery of Lease Receivable 15852.19 10115.93 11228.68 12463.84 13834.86 4504.50 49661 OFarrow_forward

- 5. Moose purchased a machine for $420,000 and leased it to Acme on January 1, 2021. Lease description: Quarterly rental payments $25,184 at beginning of each period Lease term 5 years (20 quarters) No residual value; no BPO Economic life of machine 5 years Implicit interest rate 8% Fair value of asset $420,000 What is the balance in the lease payable account after the April 1, 2021, lease payment?arrow_forwardok nt ences A finance lease agreement calls for quarterly lease payments of $7,056 over a 10-year lease term, with the first payment on July 1, the beginning of the lease. The annual interest rate is 12%. Both the present value of the lease payments and the cost of the asset to the lessor are $168,000. Required: a. Prepare a partial amortization table up to the October 1 payment. b. What would be the amount of interest expense (revenue) the lessee (lessor) would record in conjunction with the second quarterly payment on October 1? Complete this question by entering your answers in the tabs below. Required A Required B Prepare a partial amortization table up to the October 1 payment. Note: Enter all amounts as positive values. Round your answers to the nearest whole dollar. Date July 1 July 1 October 1 Lease Payment Effective Interest Decrease in Outstanding balance balance Required B >arrow_forwardThe following facts pertain to a non-cancelable lease agreement between Faldo Leasing Company and Vance Company, a lessee. Commencement date January 1, 2020 Annual lease payment due at the beginning of each year, beginning with January 1, 2020 $113,864 Residual value of equipment at end of lease term, guaranteed by the lessee $50,000 Expected residual value of equipment at end of lease term $45,000 Lease term 6 years Economic life of leased equipment 6 years Fair value of asset at January 1, 2020 $600,000 Lessor's implicit rate 8% Lessee's incremental borrowing rate 8% The asset will revert to the lessor at the end of the lease term. The lessee uses the straight-line amortization for all leased equipment. Instructions a. Prepare an amortization schedule that would be suitable for the lessee for the lease term. b. Prepare all of the journal entries for the lessee for 2020 and 2021 to record the lease agreement, the lease…arrow_forward

- Nonearrow_forwardApplying New Lease Accounting Standards for Operating Leases On January 1 of the current year, CCH Corporation entered into the following lease contract. Based on the facts, CCH Corporation classifies the lease as an operating lease. Details of lease contract Leased asset Office space Lease term 5 years Annual lease payment $115,487 Upfront fees $10,000 Cost of debt capital 5% a. Determine the amount of the lease liability that CCH will add to its balance sheet at the inception of the lease. Amount of lease liability b. What amount will be added to the balance sheet as an asset? Amount added as an asset The rest of the questions are given in pictures below. please answer all parts correctly. i will upvote. thank you!!arrow_forwardThe following facts pertain to a non-cancelable lease agreement between Lennox Leasing Company and Gill Company, a lessee.Inception date: May 1, 2017Annual lease payment due at the beginning of each year, beginning with May 1, 2017: $18,829.49Bargain-purchase option price at end of lease term: $4,000.00Lease term: 5 yearsEconomic life of leased equipment: 10 yearsLessor’s cost: $65,000.00; fair value of asset at May 1, 2017, $81,000.00Lessor’s implicit rate: 10%; lessee’s incremental borrowing rate 10%The lessee assumes responsibility for all executory costs. Instructions(Round all numbers to the nearest cent.)(a) Discuss the nature of this lease to Gill Company.(b) Discuss the nature of this lease to Lennox Company.(c) Prepare a lease amortization schedule for Gill Company for the 5-year lease term.(d) Prepare the journal entries on the lessee’s books to refl ect the signing of the lease agreement and to record the payments and expenses related to this lease for the years 2017 and…arrow_forward

- On January 1, 2021 a company enters a 12-month lease contract for a new laser copier machine. The lease contract legally binds the company to make twelve $2,500 monthly lease payments at the beginning of each month January 1 through December 1, 2021. a. On December 31, 2020 before the lease contract is signed, what is the avoidable cost of leasing the machine for the 2021 production period? What is the economic cost? b. After the lease contract is signed on January 1, what is the avoidable cost of using the machine for the rest of 2021? What is the economic cost? Now suppose the lease agreement is modified by adding a clause that gives the company the right to rent the laser copier to another company during 2021 lease period. The machine can be rented for $1,000 per month. c. What is the amount of the sunk cost on January 1 after the lease is signed? d. What is the amount of the sunk cost on August 1? e. What is the monthly avoidable (and economic) cost of using the laser copier…arrow_forwardOn January 1, 2020, Mountain Inc. leases a machine used in its operations. The annual lease payment is $10,000 due on December 31 of 2020, 2021, and 2022. The fair value of the machine on January 1, 2020 is $26,730. The machine has no residual value. Mountain could borrow on a three-year collateralized loan at 6%. If the lease is accounted for as a finance lease, the total expenses related to this lease contract that Mountain Inc. will report in its income statement for the year ending December 31, 2020 is Select one: a. $10,600 b. $10,514 c. $10,717 d. $10,000arrow_forwardThe following facts pertain to a non-cancelable lease agreement between Cullumber Leasing Company and Crane Company, a lessee. Commencement date Annual lease payment due at the beginning of each year, beginning with January 1, 2025 Residual value of equipment at end of lease term, guaranteed by the lessee January 1, 2025 $125,377 $54,000 Expected residual value of equipment at end of lease term $49,000 Lease term 6 years Economic life of leased equipment 6 years Fair value of asset at January 1, 2025 $660,000 Lessor's implicit rate 8 % Lessee's incremental borrowing rate 8 % The asset will revert to the lessor at the end of the lease term. The lessee uses the straight-line amortization for all leased equipment. Click here to view factor tables. (a) Prepare an amortization schedule that would be suitable for the lessee for the lease term. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to O decimal places e.g. 5,275.) Date 1/1/25 $ 1/1/25…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education