Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

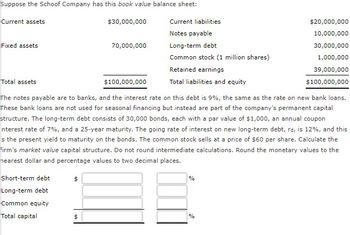

Transcribed Image Text:Suppose the Schoof Company has this book value balance sheet:

$30,000,000

Current assets

Fixed assets

Total assets

Short-term debt

Long-term debt

Common equity

Total capital

$

70,000,000

$

$100,000,000

Current liabilities

Notes payable

The notes payable are to banks, and the interest rate on this debt is 9%, the same as the rate on new bank loans.

These bank loans are not used for seasonal financing but instead are part of the company's permanent capital

structure. The long-term debt consists of 30,000 bonds, each with a par value of $1,000, an annual coupon

nterest rate of 7%, and a 25-year maturity. The going rate of interest on new long-term debt, rd, is 12%, and this

s the present yield to maturity on the bonds. The common stock sells at a price of $60 per share. Calculate the

firm's market value capital structure. Do not round intermediate calculations. Round the monetary values to the

nearest dollar and percentage values to two decimal places.

Long-term debt

Common stock (1 million shares)

Retained earnings

Total liabilities and equity

%

$20,000,000

10,000,000

30,000,000

1,000,000

39,000,000

$100,000,000

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Kingbird, Inc. owns the following assets at December 31, 2020: Cash in bank savings account $47,000 Chequing account balance $30,000 Cash on hand 14,000 Postdated cheque from Blossom Company 440 Refund due (overpayment of income taxes) 30,000 Cash in a foreign bank (CAD equivalent) 88,000 Preferred shares acquired shortly before their fixed maturity date 15,000 Debt instrument with a maturity date of three months from the date acquired 11,000 (a1)If Kingbird follows ASPE and follows a policy of including all possible items in cash and cash equivalent, what amount should be reported as cash and cash equivalents? (Do not leave any answer field blank. Enter 0 for amounts.) Cash and cash equivalents under ASPE $enter Cash and cash equivalents under ASPE in dollars (a2)If Kingbird follows IFRS what amount should be reported as cash and cash equivalents? Cash and cash equivalents under IFRS $enter Cash and cash equivalents…arrow_forwardPB3. 13.2 Starmount Inc. sold bonds with a $50,000 face value, 12% interest, and 10-year term at $48,000. What is the total amount of interest expense over the life of the bonds?arrow_forwardMC Qu. 12-110 Augusta Company reported that its bonds. Augusta Company reported that Its bonds with a face value of $62,000 and a carrylng value of $56,000 are retired for $62,000 cash. The amount to be reported under cash flows from financing activitles is: Multiple Cholce ($68,000) ($6.000) ($62,000) $0; this is an operating activity.arrow_forward

- Hello- Please help me to find the Total debt to equity. Thanks,arrow_forwardIf $457,000 of 8% bonds are issued at 94, what is the amount of cash received from the sale? Select the correct answer. A. $420,440 B. $457,000 C. $429,580 D. $493,560arrow_forwardRequired journal entries Total cash payment = 500000*10%*1/2 = $25, 000 Discount on bonds payable = (10240/64) *4 = $640 My question is the formula of the Total cash payment and Discount on bonds payable.arrow_forward

- If $1,051,000 of 12% bonds are issued at 102 1/2, The amount of cash received from the sale is:arrow_forward5. Federer Corporation issued $540,000 in bonds for $498,600. The bonds had a stated rate of 12% and pay interest quarterly. Premium on Bonds Payable Interest Income Discount on Bonds Payable Interest Expense Cash Bonds Payable PLEASE NOTE: For accounts having similar accounting treatment (DR or CR), you are to record accounts in the same order as shown in the textbook. You must enter the account names exactly as written above and all dollar amounts will be rounded to whole dollars with "$" and commas as needed (i.e. $12,345). What is the journal entry to record the issuance of the bonds? DR DR/CR ? CR What is the journal entry to record the first interest payment? (Note: Do not consider the premium or discount.) DR CRarrow_forwardBank of Charub ($ million)Assets: Liabilities and Net Worth:270 day US Treasury bills $500m 1 year Certificates of Deposit $550m2 year consumer loans Demand Deposits $750mFixed rate, 12% p.a. annually $275m 2 year Bonds $175m7 year commercial loans $350m Fixed rate, 7.5% p.a. annuallyFixed rate, 9% p.a. annually Overnight Fed Funds $350m10 year fixed rate mortgages $675mFixed rate, 6.5% p.a. monthly10 year floating rate mortgages $125m Equity $100mLIBOR+50bp, monthly roll dateNotes: The 1 year Certificates of Deposit pay 1.95% p.a. annually. The demand depositsare non-interest bearing and have a duration of zero. The 7 year commercial loans have aduration of 4.75 years. The fixed rate mortgages have a duration of 8.3 years. All valuesare market values. 5. What is the convexity of the 2 year consumer loans if they yield 6% p.a. witha coupon rate of 12% p.a. paid annually?a. 4.98b. 2.83c. 3.85d. 1.95e. 2.01arrow_forward

- j1arrow_forwardIf $1,000,000 of 8% bonds are issued at 102 3/4, the amount of cash received from the sale isarrow_forwardConsider the following balance sheet for Northern Highland Credit Union (NHCU) before answering parts (i) through (v). Assets ($ million) $ Liabilities ($ million) $ Cash 30 Overnight interbank borrowing (7.00%) 160 T-notes 2 month (7.05%) 60 2-year CD (5%) 20 T-notes 3 months (7.25%) 80 7 year fixed rate Subordinated debt (8.55%) 150 T-notes two-year (7.50%) 60 Equity 25 T-notes 10-year (8.96%) 100 Corporate bonds (>5 years to maturity) 25 Total assets 355 Total liabilities and Equity 355 What is the repricing (funding) gap over the 0-to-6 months maturity bucket?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education