Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

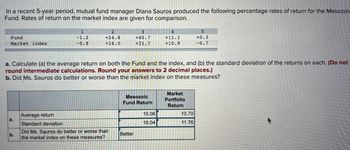

Transcribed Image Text:In a recent 5-year period, mutual fund manager Diana Sauros produced the following percentage rates of return for the Mesozoic

Fund. Rates of return on the market index are given for comparison.

Fund

Market index

a.

1

-1.2

-0.9

b.

2

+24.8

+16.0

a. Calculate (a) the average return on both the Fund and the index, and (b) the standard deviation of the returns on each. (Do not

round intermediate calculations. Round your answers to 2 decimal places.)

b. Did Ms. Sauros do better or worse than the market index on these measures?

Average return

Standard deviation

Did Ms. Sauros do better or worse than

the market index on these measures?

3

+40.7

+31.7

Mesozoic

Fund Return

Better

4

+11.1

+10.9

15.06

16.04

Market

Portfolio

Return

5

+0.3

-0.7

10.70

11.76

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Mr. Abir, after joining in Classic Mutual Fund has been asked to compute the returns. Apart from this, he must have to highlight the other areas of the fund. Consider the following information about the returns on Classic Fund, the market returns, and the T-Bill returns. Year Returns on Classic Fund % Market Index (Nifty Returns) % T-Bills Returns % 2003 15.3 10.5 5.4 2004 14.2 16.5 6.1 2005 -5.0 -7.9 5.9 2006 21.2 18.0 6.2 2007 18.3 15.5 5.5 2008 12.5 10.7 5.4 2009 -9.5 -3.0 5.8 2010 -7.3 4.9 6.1 2011 8.5 -7.5 6.2 2012 -11.4 3.0 5.8 2013 25.2 20.5 5.7 2014 22.0 18.0 5.4 2015 -16.3 4.3 6.0 2016 14.7 12.0 6.2 2017 18.5 15.3 5.8 2018 20.2 18.0 6.0 From the above information calculate all the inputs required for determining the Sharpe’s Ratio Treynor Ratio Jensen Ratioarrow_forwardYou have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is 0.97. 1ITT Market Risk-Free Year Fund 2011 -21.8% -41.5% 3% 2012 25.1 21.2 4 14.1 2013 14.5 8.8 2014 6.4 4 -2.22 2015 -5.2 What are the Sharpe and Treynor ratios for the fund? (Do not round intermediate calculations. Round your answers to 4 decimal places.) Sharpe ratio Treynor ratioarrow_forwardYou have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is 0.97. Year 2011 2012 2013 2014 2015 Fund -15.2% 25.1 12.4 6.2 -1.2 Sharpe ratio Market -24.5% 19.5 9.4 7.6 -2.2 What are the Sharpe and Treynor ratios for the fund? (Do not round intermediate calculations. Round your answers to 4 decimal places.) Treynor ratio X Answer is complete but not entirely correct. Risk-Free 1% 3 2 4 2 0.2273 x 3.4773 Xarrow_forward

- You invested $90,000 in a mutual fund at the beginning of the year when the NAV was $54.3. At the end of the year, the fund paid $.40 in short-term distributions and $.57 in long-term distributions. If the NAV of the fund at the end of the year was $63.94, what was your return for the year? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forwardNonearrow_forwardYou have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is .97. Year 2015 2016 2017 2018 2019 Fund -17.0% Sharpe ratio Treynor ratio 25.1 13.3 6.4 -1.74 Market -33.5% 20.4 12.1 8.0 -3.2 Risk-Free 2% 6 2 5 3 What are the Sharpe and Treynor ratios for the fund? (Do not round intermediate calculations. Round your answers to 4 decimal places.)arrow_forward

- Use the following data to answer the question regarding the performance of Guardian Stock Fund and the market portfolio. The risk- free return during the sample period was 5%. Average return Standard deviation of returns Beta Residual standard deviation Guardian 14% 26% 1.2 0.60 X 4% Calculate the information ratio measure of performance for Guardian Stock Fund. (Round your answer to 2 decimal places. Do not round intermediate calculations.) Answer is complete but not entirely correct. Information ratio Market Portfolio 10% 21% 1 0%arrow_forwardA pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is a money market fund that provides a safe return of 9%. The characteristics of the risky funds are as follows: Stock fund (S) Bond fund (B) Expected Return 19% 12 Standard Deviation 32% 15 The correlation between the fund returns is 0.11. Solve numerically for the proportions of each asset and for the expected return and standard deviation of the optimal risky portfolio. Note: Do not round intermediate calculations. Enter your answers as decimals rounded to 4 places. Portfolio invested in the stock Portfolio invested in the bond Expected return Standard deviationarrow_forwardVijayarrow_forward

- 17. Average Return and Standard Deviation. In a recent five-year period, mutual fund manager Diana Sauros produced the following percentage rates of return for the Mesozoic Fund. Rates of return on the market index are given for comparison. Calculate (a) the average return on both the fund and the index and (b) the standard deviation of the returns on each. Did Ms. Sauros do better or worse than the market index on these measures? (LO11-3) Fund Market index 1 -1.2 -0.9 2 +24.8 +16.0 3 +40.7 +31.7 4 +11.1 +10.9 5 +0.3 -0.7arrow_forwardUse the following data to answer the question regarding the performance of Guardian Stock Fund and the market portfolio. The risk- free return during the sample period was 5%. Average return Standard deviation of returns Beta Residual standard deviation Guardian 14% 26% 1.2 (0.80) 4% X Answer is complete but not entirely correct. Information ratio Market Portfolio Calculate the information ratio measure of performance for Guardian Stock Fund. (Round your answer to 2 decimal places. Do not round intermediate calculations.) 10% 21% 1 0%arrow_forwardanswer must be correct or i will give down votearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education