Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

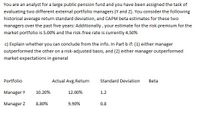

Transcribed Image Text:You are an analyst for a large public pension fund and you have been assigned the task of

evaluating two different external portfolio managers (Y and Z). You consider the following

historical average return standard deviation, and CAPM beta estimates for these two

managers over the past five years: Additionally, your estimate for the risk premium for the

market portfolio is 5.00% and the risk-free rate is currently 4.50%

c) Explain whether you can conclude from the info. In Part b if: (1) either manager

outperformed the other on a risk-adjusted basis, and (2) either manager outperformed

market expectations in general

Portfolio

Actual Avg.Return

Standard Deviation

Beta

Manager Y

10.20%

12.00%

1.2

Manager Z

8.80%

9.90%

0.8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Use the following data to answer the question regarding the performance of Guardian Stock Fund and the market portfolio. The risk- free return during the sample period was 5%. Average return Standard deviation of returns Beta Residual standard deviation Guardian 14% 26% 1.2 0.60 X 4% Calculate the information ratio measure of performance for Guardian Stock Fund. (Round your answer to 2 decimal places. Do not round intermediate calculations.) Answer is complete but not entirely correct. Information ratio Market Portfolio 10% 21% 1 0%arrow_forwardYou already submitted an Investment Proposal. The second part of your Investment Project is a follow-up of your Investment Proposal, with a short reflection essay about the securities you recommended in your Investment proposal. You have to provide an updated Table showing your portfolio. Make sure to include the gain or losses of each individual securities, your total holding-period return, and the effective annual rate (EAR). You should include in the analysis at least one of the securities you recommended to buy in your first report. How did it go? Did it go as planned? Why do you think it did not go as planned? You may also analyze some of your winners and losers in your portfolio (they could be others than the ones you justified in the first report). Any regrets? What would you have done differently after what you have learned in this course? There is no unique way to do a reflection essay. What are in your opinion the essential lessons from this course? The length of the…arrow_forwardConsider a client with a 10% return objective. A financial adviser creates a policy statement for that client, identifies relevant financial securities that fit the risk return profile for this client, and drafts an optimal asset allocation using specialized optimization techniques. After one year, the financial adviser's recommendations produce a return of 10%. Question: Is this client satisfied with the performance of the portfolio?arrow_forward

- Use the following data to answer the question regarding the performance of Guardian Stock Fund and the market portfolio. The risk- free return during the sample period was 5%. Average return Standard deviation of returns Beta Residual standard deviation Guardian 14% 26% 1.2 (0.80) 4% X Answer is complete but not entirely correct. Information ratio Market Portfolio Calculate the information ratio measure of performance for Guardian Stock Fund. (Round your answer to 2 decimal places. Do not round intermediate calculations.) 10% 21% 1 0%arrow_forwardConsider the following historical performance data for two different portfolios, the Standard and Poor's 500, and the 90-day T-bill presented below. What is the Fama diversification measure for the Globex Fund? Assume the T-bill rate as the risk- free rate and the S&P return as the market average return. Use at least four decimal places in your calculations, but report your answer in percentage terms rounded to two decimal places. (Ex..12345 should be entered as "12.35") Investment Vehicle Globex Fund World Fund S&P500 90-day T-bill Answer: Average Rate of Return% 25.2 13.92 15.52 7.10 Standard Deviation 21.33 14 12.8 0.3 Beta 1.05 0.95 R² 0.756 0.741arrow_forwardAn insurance fund is analysing the performance of three different fund managers A, B and C. Each manager invests in one third of all asset classes to maintain a well diversified portfolio. The following information is available: A B C Market portfolio Average net return (%) 5 8 9 9 Volatility (%) 18 24 21 20 Beta 0.8 1.1 1.3 A risk free rate is established to be 2%. Calculate for each of the fund managers the expected return using CAPM, ex post Sharpe Ratio, Treynor Ratio, M2 alpha and Jensen’s alpha. Interpret your results.arrow_forward

- You have estimated the single index model (SIM) fund B and found that its alpha and beta are 0.035 and 1.1 respectively. The standard deviation of Fund B's excess returns is 30% and the market portfolio excess returns have a standard deviation of 20%. What's the information ratio of Fund B?arrow_forwardThe historical returns for two investments-A and B-are summarized in the following table for the period 2016 to 2020, Use the data to answer the questions that follow. a. On the basis of a review of the return data, which investment appears to be more risky? Why? b. Calculate the standard deviation for each investment's returns. c. On the basis of your calculations in part b, which investment is more risky? Compare this conclusion to your observation in part a. a. On the basis of a review of the return data, which investment appears to be more risky? Why? (Choose the best answer below.) A. The riskier investment appears to be investment B, with returns that vary widely from the average relative to investment A, whose returns show less deviation from the average. B. Investment A and investment B have equal risk because the average returns are the same. C. The riskier investment appears to be investment A, with returns that vary widely from the average relative to investment B, whose…arrow_forwardA portfolio analyst has been asked to allocate investment funds among three different stocks. The relevant data for the stocks is shown in the following table. If the goal is to maximize return while maintaining risk within acceptable bounds (in this case, a portfolio standard deviation of no more than 20%), find the proper allocation of the funds to each stock. Return Risk (Standard Deviation Stock (R) A 20% to S) 25% Pair of Stocks Joint Risk (Covariance) A to B 0.05 B 10% 12% A to C 0.075 C 15% 10% B to C -0.05 ces What proportion of the portfolio should be allocated to stock]B?arrow_forward

- A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is a money market fund that provides a safe return of 8%. The characteristics of the risky funds are as follows: Stock fund (S) Bond fund (B) The correlation between the fund returns is 0.11. Expected Return 19% 12 Required: a-1. What are the investment proportions in the minimum-variance portfolio of the two risky funds? a-2. What are the expected value and standard deviation of the minimum-variance portfolio rate of return? Req A1 Complete this question by entering your answers in the tabs below. Reg A2 What are the investment proportions in the minimum-variance portfolio of the two risky funds? Note: Do not round intermediate calculations. Enter your answers as decimals rounded to 4 places. Portfolio invested in the stock Portfolio invested in the bond Standard Deviation 32% 15 Req A1 A pension fund manager is considering three mutual funds. The…arrow_forwardThe historical returns for two investments A and B—are summarized in the following table for the period 2016 to 2020, Use the data to answer the questions that follow. a. On the basis of a review of the return data, which investment appears to be more risky? Why? b. Calculate the standard deviation for each investment's returns. c. On the basis of your calculations in part b, which investment is more risky? Compare this conclusion to your observation in part a. a. On the basis of a review of the return data, which investment appears to be more risky? Why? (Choose the best answer below.) A. The riskier investment appears to be investment B, with returns that vary widely from the average relative to investment A, whose returns show less deviation from the average. B. The riskier investment appears to be investment A, with returns that vary widely from the average relative to investment B, whose returns show less deviation from the average. C. Investment A and investment B have equal risk…arrow_forwardSolve this practice problem in the 2 pictures belowarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education