Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

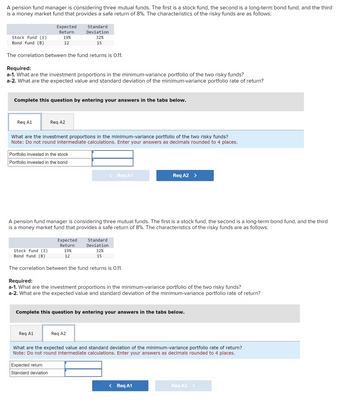

Transcribed Image Text:A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third

is a money market fund that provides a safe return of 8%. The characteristics of the risky funds are as follows:

Stock fund (S)

Bond fund (B)

The correlation between the fund returns is 0.11.

Expected

Return

19%

12

Required:

a-1. What are the investment proportions in the minimum-variance portfolio of the two risky funds?

a-2. What are the expected value and standard deviation of the minimum-variance portfolio rate of return?

Req A1

Complete this question by entering your answers in the tabs below.

Reg A2

What are the investment proportions in the minimum-variance portfolio of the two risky funds?

Note: Do not round intermediate calculations. Enter your answers as decimals rounded to 4 places.

Portfolio invested in the stock

Portfolio invested in the bond

Standard

Deviation

32%

15

Req A1

A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third

is a money market fund that provides a safe return of 8%. The characteristics of the risky funds are as follows:

Expected

Return

19%

12

Expected return

Standard deviation

Stock fund (S)

Bond fund (B)

The correlation between the fund returns is 0.11.

< Req A1

Standard

Deviation

32%

15

Required:

a-1. What are the investment proportions in the minimum-variance portfolio of the two risky funds?

a-2. What are the expected value and standard deviation of the minimum-variance portfolio rate of return?

Req A2

Complete this question by entering your answers in the tabs below.

Req A2 >

What are the expected value and standard deviation of the minimum-variance portfolio rate of return?

Note: Do not round intermediate calculations. Enter your answers as decimals rounded to 4 places.

< Req A1

Req A2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- For a market timer, the ________ will be higher when the market risk premium is higher Select one: a. portfolio’s idiosyncratic risk b. portfolio’s standard deviation c. portfolio’s beta d. security selection component of the portfolio e. portfolio’s alphaarrow_forward2) Calculate the envelope set (frontier) for the following four assets and show that the individual assets all lie within this envelope set. 123456 A B E A FOUR-ASSET PORTFOLIO PROBLEM C Variance-covariance 0.01 0.30 0.06 -0.04 0.10 0.01 0.03 0.05 0.03 0.06 0.40 0.02 D 0.05 -0.04 0.02 0.50 F Mean returns 6% 8% 10% 15%arrow_forwardWhich of the following portfolios achieves the highest Sharpe ratio? (check all that applies) Any portfolio created with a combination of mvp and risk free rate Any portfolio created with a combination of tangency portfolio and risk free rate Any portfolio created with a combination of mvp and tangency portfolioarrow_forward

- Question No. 1: Explain the following Financial Terminology and then determined the relationship between its. portfolio efficient Beta Coefficient frontier efficient Diversification Diversifiable Risk Systematic Riskarrow_forwardi need the answer quicklyarrow_forwardDraw the profit diagram of the portfolio just drawn (and clearly state any assumptions you make). The profit is equal to the difference between the payoff of the portfolio at expiry (maturity) date and the cost of the portfolio. Is the cost of the portfolio positive?arrow_forward

- 10.3 Refer to Exhibit 10.2. a. Construct an equal-weighted (50/50) portfolio of investments B and C. What are the expected rate of return and standard deviation of the portfolio? Explain your results. b. Construct an equal-weighted (50/50) portfolio of investments B and D. What are the expected rate of return and standard deviation of the portfolio? Explain your results.arrow_forwardIs the portfolio risk the weighted average of the variance or covariance?arrow_forwardHow does standard deviation and variance affect portfolio risk, more so than expected return?arrow_forward

- Explain well all question with proper answer. And type the answer step by step.arrow_forwardExplain the meaning and differences between the correlation coefficients “p” in the traditional portfolio and the beta “B” coefficients in the capital asset pricing model (CMPL) approacharrow_forwarda. What are the expected return and standard deviation of your client's portfolio?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education