ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

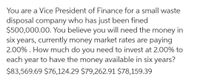

Transcribed Image Text:You are a Vice President of Finance for a small waste

disposal company who has just been fined

$500,000.00. You believe you will need the money in

six years, currently money market rates are paying

2.00% . How much do you need to invest at 2.00% to

each year to have the money available in six years?

$83,569.69 $76,124.29 $79,262.91 $78,159.39

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- On Juan's twenty-sixth birthday, he invested $7,500 in a retirement account. Each year thereafter, he deposited 8 percent more than the previous deposit. The account paid annual compound interest of 5 percent. If Juan decided to wait 8 years before investing for retirement, how much would he have to invest at Round entry that time to have the same account balance on his sixtieth birthday? $ to the nearest dollar.arrow_forward•If you deposit $100 now (n = 0) || and $200 two years from now (n = 2) in || a savings account that pays 10% interest, how much would you have at the end of year 10?arrow_forwardIf Phil borrows $25,000 from a loan company at an interest rate of 3.5% per year compounded weekly, and plans to make a payment of $850 per quarter, how may years will it take him to pay off the loan?If Phil borrows $25,000 from a loan company at an interest rate of 3.5% per year compounded weekly, and plans to make a payment of $850 per quarter, how may years will it take him to pay off the loan?arrow_forward

- A company has issued a 20 year bonds, with a face value of $50,000 interest at 8% is paid quarterly. If an investor desires to earn 12% compounded quarterly, what would be the purchase price of the bond? $12, 654.40 $42, 563 $35, 062.60 $ 34, 900.80arrow_forwardPLEASE ANSWER ASAP AND NEAT ONLY IF 100% CORRECT!arrow_forwardYou just accepted an offer from XYZ Petrochemical Company in Louisiana. As a sign up bonus, the XYZ will deposit $10,000 in a retirement account for you which generates 12% return annually. In addition, the company deposits $5,000 every year in the same account, if you stays with XYZ. How much money will be accumulated in this account if you decide to retire 40 years from now?arrow_forward

- Please answer very soon will give rating surelyarrow_forwardYou have a bank deposit now worth $4500.How long will it take for your deposit to be worth more than $8600 if: The account pays 6 percent actual interest every half-year and is compounded every half-year?arrow_forwardUsing the formula, not the tablearrow_forward

- Don’t use excel Use formula or factorarrow_forwardQuestion 1 transcript How much must be invested now to grow to $30,000 in 7 years with an interest rate of 4% compounded annually? Question 2 transcript How much must be invested now to grow to $30,000 in 7 years with an interest rate of 4% compounded semiannually? Question 3 transcript How much must be invested now to grow to $30,000 in 7 years with an interest rate of 4% compounded monthly? Question 4 transcript Calculate the unknown value of the cashflow diagram shown. Time is in years and interest is compounded annually. $25 $25 $25 $25 $25 O 1 2 i = 6% F=? 3 4 5arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education