ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

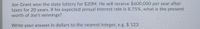

Transcribed Image Text:Joe Grant won the state lottery for $20M. He will receive $600,000 per year after

taxes for 20 years. If his expected annual interest rate is 8.75%, what is the present

worth of Joe's winnings?

Write your answer in dollars to the nearest integer, e.g. $ 123

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- please answerarrow_forward6. Ms. Cruz can buy a piece of property for P6.500.000 cash or P4,000.000 down payment and P4,200,000 in five (5) years. If she has money earning 8%, converted quarterly, which is a better purchased plan and by how much?arrow_forward7. What is the future worth of $2,000 at the end of each month for 10 years at 10% compounded monthly?arrow_forward

- A $1000 face-value coupon bond has a current yield of 5.75% and a market price of $1060. What is the bond’s coupon rate?arrow_forwardA car dealership offers you no money down on a new car. You may pay for the car for 3 years by equal monthly end-of-the-month payments of $735 each, with the first payment to be made one month from today, If the discount annual rate is 17.45 percent compounded monthly, what is the present value of the car payments? Round the answer to two decimal places.arrow_forwardSabrina has $657 in 2022 and pays an annual interest rate of 22%. How much money will she have at the end of 2027?arrow_forward

- Question 1 Due to health reasons, Dave is considering early retirement. He currently has $700,000 in a self- managed retirement fund. He thinks he will need S40,000 per year during retirement. He intends to invest his retirement in a low-risk mutual fund which return 1.5% per year. How many years can he live off this retirement fund without the need to look for a job?arrow_forwardFive years ago you invested $18,242. What is the current value of that investment if you use a 5% market interest rate?arrow_forward1. Assume you graduate with a student loan total of $28,000. You are going to pay off this loan with monthly payments for the next 8 years. The monthly interest rate is 0.25%. What is your monthly payment amount? (Answer is not 3,539.49)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education