Costing details to use for the assignment, all are Canadian dollars-

- You are a Toronto based tour operator with a series of flights starting up from Vancouver to Montego Bay, Jamaica.

- The charter will operate every Sunday and the duration of your package is 7 nights. The aircraft has 179 seats and the anticipated load factor is 81%.

- The first rotation is Nov 06, 2022, and the last flight rotation is on April 30, 2023.

- Operating costs are $100,000 for each live/live and $85,000 for rotations with a ferry portion.

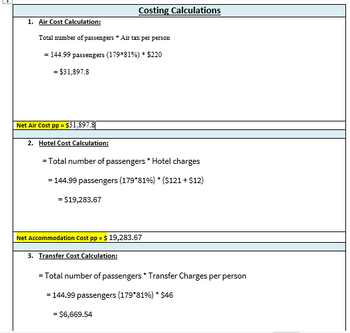

- Air taxes per person are $220.

- The hotel has a rate of $121 per person per night plus $12 per person per night for hotel taxes, charges and service fees.

- Transfer (airport to hotel return) per person is $46.

- Credit card fees are high, so we need to cost them in at $6. 00 per person “below the line” (non-commissionable).

- Travel Agent commission is 8%.

Find:-

1) a. Air Cost Calculation

b Hotel Cost Calculation

c. Transfer Cost Calculation

d. Margin Calculation (Net Margin amount pp = Add PP net costs and margin to get - Final Net Selling Price PP = $ )

e. Retail (Travel Agent) Commission Calculation ( Commission amount pp = Add Final Net Selling Price PP to get - Final Gross Selling Price PP )

f. Tax and Service Charges Calculation(Final Gross Selling Price PP = ? Final T&SC PP = ?

Note:-

All Answers Needed in Soft Form & Don*T Copy From others.

|

4. Margin Calculation:

|

|

Net Margin amount pp = $ Final Net Selling Price PP = $ |

|

|

|

5. Retail (Travel Agent) Commission Calculation:

|

|

Commission amount pp = $ Final Gross Selling Price PP $ |

|

|

|

6. Tax and Service Charges Calculation:

|

|

Final Tax, fees and service charges total Amount PP= $ |

|

|

|

Final Gross Selling Price PP = $ Final T&SC PP = $ |

NOTE:

NEED PART 4,5 & 6 ONLY ,I uploaded part a,b,c solved for Refrences

Step by stepSolved in 2 steps

Final T&SC PP = $ ? where answer for this.?

Final T&SC PP = $ ? where answer for this.?

- You are a Toronto based tour operator with a series of flights starting up from Vancouver to Montego Bay, Jamaica. The charter will operate every Sunday and the duration of your package is 7 nights. The aircraft has 179 seats and the anticipated load factor is 81%. The first rotation is Nov 06, 2022, and the last flight rotation is on April 30, 2023. Operating costs are $100,000 for each live/live and $85,000 for rotations with a ferry portion. Air taxes per person are $220.…arrow_forwardFranklin Camps, Incorporated leases the land on which it builds camp sites. Franklin is considering opening a new site on land that requires $2,450 of rental payment per month. The variable cost of providing service is expected to be $6 per camper. The following chart shows the number of campers Franklin expects for the first year of operation of the new site: January February March 150 260 210 February August April 210 Price May 330 June 510 Required Assuming that Franklin wants to earn $7 per camper, determine the price it should charge for a camp site in February and August. Note: Do not round intermediate calculations. July August September October November December Total 660 660 360 390 150 310 4,200arrow_forwardDomesticarrow_forward

- Mountain Camps, Incorporated, leases the land on which it builds camp sites. Mountain is considering opening a new site on land that requires $2,500 of rental payment per month. The variable cost of providing service is expected to be $6 per camper. The following chart shows the number of campers Mountain expects for the first year of operation of the new site: January February March April May June July August September October November December Total 120 250 200 200 300 500 650 650 350 380 100 300 4,000 Required Assuming that Mountain wants to earn $5.50 per camper, determine the price it should charge for a camp site in February and August. Note: Do not round intermediate calculations.arrow_forwardDETERMINING DAILY COST OF HOLDING A shipment of new connectors for semiconductors needs to go from San Jose to Singapore for assembly.The value of the connectors is $1,750, and holding cost is 40% per year. One airfreight carrier can ship theconnectors 1 day faster than its competitor, at an extra cost of $20.00. Which carrier should be selected?APPROACH c First we determine the daily holding cost and then compare the daily holding cost withthe cost of faster shipment.arrow_forwardNorthampton City Tours (NCT) offers personalized historical and architectural tours in a large midwestern city and the local suburbs. NCT charges $350.00 per trip to or from the airport. The variable cost for a tour totals $42.00 for fuel, driver, and so on. The monthly fixed cost for NCT is $13,860. Required: a. How many tours must NCT sell every month to break even? b. NCT's owners believe that 50 tours is a reasonable forecast of the average monthly demand. What is the margin of safety in terms of the number of tours?arrow_forward

- Adams Furniture receives a special order for 10 sofas for a special price of $5,200. The direct materials and direct labor for each sofa are $100. In addition, supervision and other fixed overhead costs average $120 per sofa. Required: a1. What is the impact on operating income from accepting the special order? a2. Based solely on a short-term financial analysis, should Adams accept the special order? b1. If Adams is currently operating at full capacity, what would be the opportunity cost per unit for lost sales to regular customers if the special sales order is accepted and the selling price per unit on regular sales equals $700? b2. Based solely on a short-term financial analysis, should Adams accept the special order if it is currently operating at full capacity? Complete this question by entering your answers in the tabs below. Req al Req a2 Answer is complete but not entirely correct. Req bl Req b2 If Adams is currently operating at full capacity, what would be the opportunity…arrow_forwardAdams Furniture receives a special order for 10 sofas for a special price of $6,000. The direct materials and direct labor for each sofa are $140. In addition, supervision and other fixed overhead costs average $160 per sofa. Required: a1. What is the impact on operating income from accepting the special order? a2. Based solely on a short-term financial analysis, should Adams accept the special order? b1. If Adams is currently operating at full capacity, what would be the opportunity cost per unit for lost sales to regular customers if the special sales order is accepted and the selling price per unit on regular sales equals $900? b2. Based solely on a short-term financial analysis, should Adams accept the special order if it is currently operating at full capacity?arrow_forwardGlobal Air is considerng a new flight between Atlanta and Los Angeles. The avaerage fare per seat for the flight is $760.The cost associated with the flight are as follows: Fixed cost for the flight Crew Salaries $5,000 Operating Costs 50,000 Aircraft Depreciation 25,000 Total: $80,000 Variable cost per passenger Passenger check-in $20 Operating Costs: 100 Total: $120 The airline estimates that the flight will sell 175 seats. a. determine the break-even number of passengers per flight b. Based on answer in (a), should the airline add this flight to it's schedule? c. How much profit should each flight produce? d. What additionl issues might the airline consider in this decision?arrow_forward

- Can u please help with Problemarrow_forwardAdams Furniture receives a special order for 10 sofas for a special price of $6,000. The direct materials and direct labor for each sofa are $140. In addition, supervision and other fixed overhead costs average $160 per sofa. a1. What is the impact on operating income from accepting the special order? a2. Based solely on a short-term financial analysis, should Adams accept the special order? b1. If Adams is currently operating at full capacity, what would be the opportunity cost per unit for lost sales to regular customers if the special sales order is accepted and the selling price per unit on regular sales equals $900? b2. Based solely on a short-term financial analysis, should Adams accept the special order if it is currently operating at full capacity? Complete this question by entering your answers in the tabs below. Req A1 Show Transcribed Text Req A1 What is the impact on operating income from accepting the special order? Operating income would per sofa. Yes ONO Reg A2 Req A1…arrow_forwardGive me answer within 30 min I will give you immediate upvotes its very urgent ....thankyou.....arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College