ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

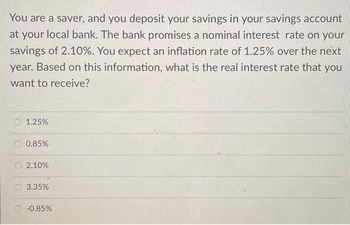

Transcribed Image Text:You are a saver, and you deposit your savings in your savings account

at your local bank. The bank promises a nominal interest rate on your

savings of 2.10%. You expect an inflation rate of 1.25% over the next

year. Based on this information, what is the real interest rate that you

want to receive?

1.25%

0.85%

2.10%

3.35%

-0.85%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Prices for fresh fruit went up 9% last year and 3% this year. What is the average inflation rate percentage for fresh fruit over the 2-year period? Enter your answer as a percentage rounded to the nearest tenth of a percent.arrow_forwardCalculate the inflation-adjusted interest rate when the annualized inflation rate is 7.9% per year and the real interest rate is 3.6% per year. The inflation-adjusted interest rate is %.arrow_forward"You have a $10,000 monthly loan payment. If annual inflation is 5% (compounded monthly), what is the constant dollar amount of this payment in month 49? Recall that since the annual inflation rate is compounded monthly and payments are made monthly, you can calculate the effective monthly inflation rate simply by dividing the annual inflation rate by 12. "arrow_forward

- The nominal interest rate is 10%. The inflation rate is 2%. The real interest rate is equal toarrow_forwardIf the nominal interest rate on a loan was 10 percent and the real interest rate was 8 percent, then the inflation rate during that time must have been: 9% 2% 1.25% 18%arrow_forward10arrow_forward

- Assume you have won a lottery prize of $5,000, which works out great since you want to buy a new gaming PC that costs $5,500. You decide to save the lottery winnings for one year by purchasing a bank CD with one year until maturity. The interest rate on your deposit is 12% and inflation is expected to be 8% over the next year. You plan to work part-time to make up any shortfall in your savings covering the cost of the gaming PC one year from now. a. How much money will you have in your bank account at the end of one year? b. What is the real interest rate you expect to earn on your deposit over the next year? c. Will you have enough money from the savings to buy the PC next year? d. If your answer to c. is no, how many hours of work @ $15/hour will be required to make up the shortfall?arrow_forwardRequired information In wisely planning for your retirement, you invest $18,000 per year for 20 years into a 401K tax-deferred account. Assume you make a real return of 10% per year when the inflation rate averages 2.8% per year. How many future dollars will you have in the account immediately after your last deposit? You will have $ |future dollars in your account immediately after your last deposit.arrow_forwardSuppose that the investment function is I = 3,500 − 100r, where r is the real interest rate (in percent). If the nominal interest rate is 12 percent and the inflation rate is 4 percent, then total investment will be:arrow_forward

- Suppose a person works hard at a job after graduation and after her first year, her effort is rewarded with a 3% raise when the average wage increase in her company is 2%. Later, the government releases its inflation report and says that the inflation rate is 7%. Given this information, which of the following is true regarding her standard of living? Her standard of living has improved because the 3% raise is enough to offset the average rise in prices. Her standard of living did not improve because the purchasing power of her income is less than it was last year. Her standard of living has remained the same because the rate of inflation does not influence purchasing power. Her standard of living has increased by the amount of inflation, namely, 7%.arrow_forwardCalculate what will be the nominal interest rate at any given loan if the inflation is 3.2% and the real interest rate is 0.8 %arrow_forwardThe idea that a regular annual inflation rate of 35 per cent requires CPP adjustments, but a regular annual inflation rate of 25 per cent does not, is quite absurd. Discuss.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education